A) 12 million shares.

B) 20 million shares.

C) 9 million shares.

D) 17 million shares.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company sells stock to the public for the first time,the sale is called a(n) :

A) initial public offering (IPO) .

B) first time issue (FTI) .

C) seasoned new issue (SNI) .

D) initial stock offering (ISO) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

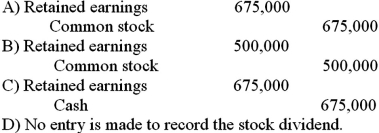

A corporation had 50,000 shares of $20 par value common stock outstanding.The board of directors declared and issued a 50% stock dividend.The market value of the stock was $27 per share.What is the journal entry to record this stock dividend?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has outstanding 9 million shares of $2 par value common stock and 1 million shares of $4 par value preferred stock.The preferred stock has an 8% dividend rate.The company declares $600,000 in total dividends for the year.Which of the following is true if dividends in arrears are $30,000?

A) Preferred stockholders will receive $350,000.Common stockholders will receive $250,000.

B) Preferred stockholders will receive $60,000.Common stockholders will receive $540,000.

C) Preferred stockholders will receive $320,000.Common stockholders will receive $280,000.

D) Preferred stockholders will receive $90,000.Common stockholders will receive $510,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All other things being equal,the higher the return on equity ratio,the better the financial performance of the company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issued 600 shares of $50 par value stock for $45,000.The total amount of contributed capital is:

A) $30,000.

B) $15,000.

C) $45,000.

D) $50.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The combined effect of the declaration and payment of a cash dividend on a company's financial statements is to:

A) increase total liabilities and decrease stockholders' equity.

B) increase total expenses and decrease assets.

C) increase total assets and increase stockholders' equity.

D) decrease total assets and decrease stockholders' equity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Dividends in arrears are reported as liabilities on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

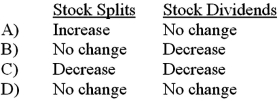

Stock splits and stock dividends have the following effects on retained earnings:

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which number is potentially the largest?

A) The number of shares authorized.

B) The number of shares issued.

C) The number of shares outstanding.

D) The number of shares certified.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues 100,000 shares of preferred stock for $40 a share.The stock has a fixed dividend rate of 5% and a par value of $3 per share.The company records the issuance with a:

A) debit of $4 million to Cash and a credit of $4 million to Preferred Stock.

B) debit of $300,000 to Cash and a credit of $300,000 to Preferred Stock.

C) debit of $4 million to Cash,a credit of $300,000 to Preferred Stock,and a credit of $3.7 million to Additional Paid-in Capital.

D) debit of $300,000 to Cash,a debit of $3.7 million to Long-term Investments,a credit of $300,000 to Preferred Stock,and a credit of $3.7 million to Additional Paid-in Capital.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has 110,000 shares authorized,50,000 shares issued,and 5,000 shares of treasury stock.How many shares are outstanding?

A) 45,000

B) 155,000

C) 55,000

D) 145,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding treasury stock is true?

A) When a company reissues treasury stock for more than it originally paid for the stock,it does not report a gain.

B) When a company purchases treasury stock or pays a dividend,it increases total stockholders' equity.

C) Treasury stock is reported as an asset on the balance sheet.

D) Treasury stock is reported as issued and outstanding stock.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock dividend transfers:

A) contributed capital to retained earnings.

B) retained earnings to assets.

C) contributed capital to assets.

D) retained earnings to contributed capital.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The patent on a major drug produced by a pharmaceutical company will soon expire.Sales of the drug contribute 10% to the company's net income.Which of the following statements is most likely to be true in these circumstances?

A) The P/E ratio will probably fall because the stock price will fall and earnings will rise.

B) The P/E ratio will probably rise because the stock price will rise and the earnings will fall.

C) The P/E ratio will probably fall as investors factor in the future drop in net income.

D) The P/E ratio will probably rise because the stock price will fall and the earnings fall.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit balance in retained earnings is called a(n)

A) discount.

B) accumulated deficit.

C) net loss.

D) It is impossible to have a debit balance in retained earnings.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true about when cash dividends can be paid?

A) The retained earnings account must have an accumulated balance sufficient to cover the amount of the dividends to be paid.

B) The cash account must have a balance sufficient to pay the dividends.

C) The board of directors must have declared the dividend before it can be paid.

D) Loan covenants do not restrict the payment of dividends.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you own 200,000 shares of stock in a company with 8 million shares outstanding and the company issues an additional 2 million shares to its employees through a stock purchase plan,your ownership percentage:

A) remains the same because the company now has more assets.

B) falls from 2.5% to 2%.

C) remains the same because the company now has fewer liabilities.

D) increases because the company now has more stock outstanding.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of debt financing?

A) It does not have to be repaid.

B) Interest is discretionary.

C) Interest is tax deductible.

D) It reduces stockholder control.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation's charter establishes the number of shares of stock to be issued.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 146

Related Exams