A) adding changes in prepaid expenses and accrued liabilities to other expenses.

B) subtracting increases in prepaid expenses and subtracting decreases in accrued liabilities from other expenses.

C) adding increases in prepaid expenses and adding decreases in accrued liabilities to other expenses.

D) subtracting changes in prepaid expenses and accrued liabilities from other expenses.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brighton, Inc. uses the indirect method to determine its cash flow from operations. During the course of the year, Brighton, Inc.'s Accounts Receivable increased by $10,000 and its Accounts Payable decreased by $5,000. As a result of these two items, the net addition (or subtraction) to convert net income to cash flow from operations equals:

A) $5,000.

B) ($5,000) .

C) $15,000.

D) ($15,000) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about cash flows from investing activities is correct?

A) The proceeds from sales of investments are reported as cash inflows from investing activities.

B) Cash flows from investing activities are calculated by making adjustments to net income.

C) Cash paid to acquire long-lived assets is reported as a cash inflow from investing activities.

D) Cash received from issuing a long-term payable is reported as a cash inflow from investing activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year, Todd Electronics had $610,000 in cash sales and $2,220,000 in credit sales. The Accounts Receivable balance was $530,000 at the beginning of the year and $425,000 at the end of the year. What was the total cash collected from customers during the year?

A) $2,935,000

B) $2,830,000

C) $2,725,000

D) $2,325,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

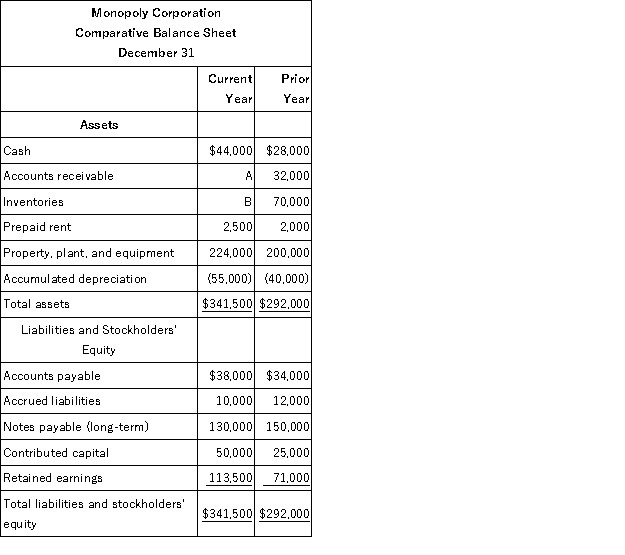

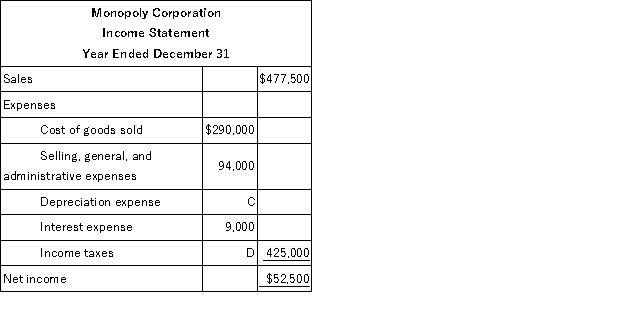

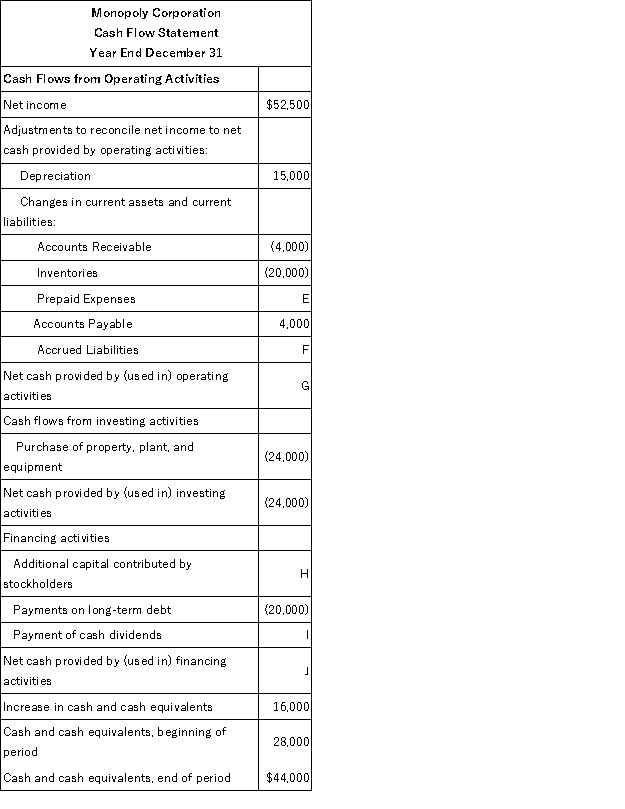

Condensed financial data of Monopoly Corporation appear below:

A cash dividend was declared and paid in full to stockholders during the year.

Required:

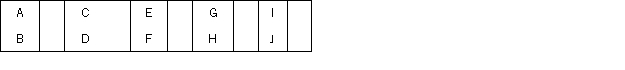

Solve for the missing numbers and summarize your answers in the table below. Be sure to indicate in parentheses ( ) if the missing number is negative (that is, a cash outflow).

A cash dividend was declared and paid in full to stockholders during the year.

Required:

Solve for the missing numbers and summarize your answers in the table below. Be sure to indicate in parentheses ( ) if the missing number is negative (that is, a cash outflow).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of preparing the operating activities section of the statement of cash flows consists of a summary of each component of operating transactions that result in either a debit or a credit to cash?

A) Direct

B) Indirect

C) Accrual

D) Cash

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is considered to be a cash equivalent?

A) An investment in a U. S. bond due in two years

B) A one-year certificate of deposit due in six weeks

C) A one-month Treasury bill due in two weeks

D) A promissory note due from a customer in 7 months

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which phrase below best describes the direct method for reporting operating cash flows?

A) A method that incorporates financing and investing activities into cash flows from operations.

B) A method employing accrual-based accounting to convert cash flows to GAAP Net Income.

C) A summary of operating transactions resulting in either a debit or credit to cash.

D) A series of adjustments to Net Income to arrive at operating cash flows.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the direct method to prepare its statement of cash flows. If the company's Accounts Receivable increase during the accounting period, the change in Accounts Receivable is:

A) added to the change in the Cash account to calculate cash collected from customers.

B) subtracted from Sales Revenue to calculate the cash collected from customers.

C) added to Sales Revenue to calculate the cash collected from customers.

D) subtracted from the change in the Cash account to calculate cash collected from customers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following might be used to evaluate cash flow performance, except:

A) the absolute amount of cash flow.

B) whether cash flow is positive or negative.

C) the relationship between net income and cash flow.

D) the trend in sales and operating expenses.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows. Why is a decrease in Accounts Receivable decrease added to sales revenue when computing cash collected from customers?

A) There were more cash sales than credit sales during the year.

B) There were more collections of Accounts Receivable than sales on account during the year.

C) There were more credit sales than cash sales during the year.

D) There were more sales on account than collections of Accounts Receivable during the year.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the financing activities on a statement of cash flows?

A) Changes in accounts payable

B) Purchases of equipment

C) Paying interest to lenders

D) Cash dividends paid

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company uses the direct method to determine the cash flows from operating activities, cash flows from operating activities will:

A) be identical to the amount reported using the indirect method.

B) be larger if there is a net cash inflow and smaller if there is a net cash outflow compared to the amount reported using the indirect method.

C) always be larger than the amount reported using the indirect method.

D) be larger if there is a net cash outflow and smaller if there is a net cash inflow compared to the amount reported using the indirect methoD.

The direct method and the indirect method produce the same result for net cash provided by or used in operating activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

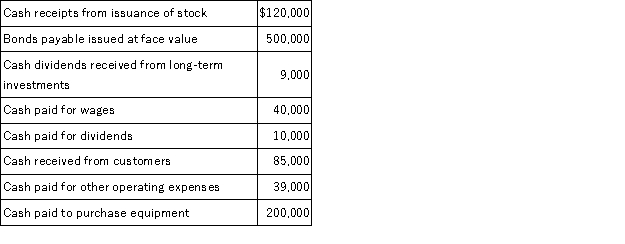

Flynn Corporation had the following cash flows for the current year. The company uses the direct method in preparing the statement of cash flows.  What is the net cash provided by (used in) investing activities?

What is the net cash provided by (used in) investing activities?

A) ($200,000)

B) $420,000

C) $410,000

D) ($190,000)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following journal entries has an effect on cash provided by (used in) operating activities?

A) Bad debts expense

B) Depreciation expense

C) Sale of an investment

D) Payment of interest on long-term notes payable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

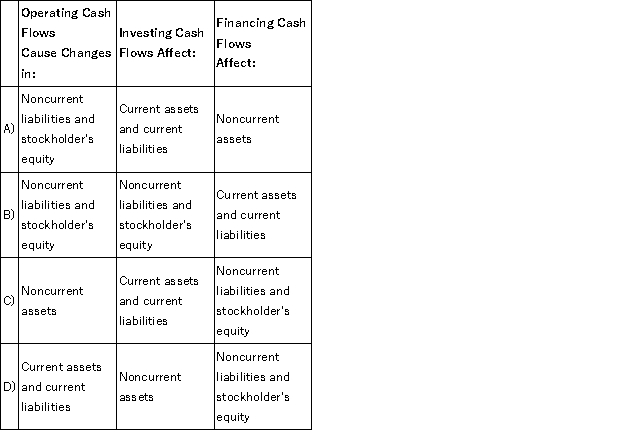

A general rule for the relationship between operating, investing, and financing cash flows and the financial statements is:

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The reporting of financing activities is identical under the indirect and direct methods for the statement of cash flows on the statement of cash flows

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash flow statement should be evaluated by examining the cash flow pattern suggested by the:

A) subtotals of each of the three main sections.

B) operating activities section since this section details the day to day operations of the business.

C) change in cash regardless of which section had the biggest impact on the change.

D) financing section since this section details how much debt the company has incurreD.

Unlike the income statement, which summarizes its detailed information in one number (net income) , the statement of cash flows does not provide a summary measure of cash flow performance. Instead, it must be evaluated in terms of the cash flow pattern suggested by the subtotals of each of the three main sections.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from financing activities:

A) includes all cash inflows and outflows associated with a company's lending activities.

B) includes all cash inflows and outflows between a company and its stockholders.

C) are always negative because of the payments of cash dividends as well as interest and principal on debt.

D) are always positive unless the company is experiencing serious financial trouble.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchases a $300,000 building, paying $200,000 in cash and signing a $100,000 promissory note. What will be reported on the statement of cash flows as a result of this transaction?

A) A $300,000 cash outflow from investing activities

B) A $200,000 cash outflow from investing activities and a $100,000 cash inflow from financing activities

C) A $200,000 cash outflow from investing activities and a $100,000 noncash transaction

D) A $300,000 cash outflow from investing activities and a $100,000 cash inflow from financing activities

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 208

Related Exams