B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard costs and actual costs for direct labor in the manufacture of 2,500 units of product are as follows: Standard Costs Direct labor 7,500 hours @ $11.80 Actual Costs Direct labor 7,400 hours @ $11.40 The direct labor time variance is

A) $1,180 favorable

B) $1,140 unfavorable

C) $1,180 unfavorable

D) $1,140 favorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of the variable factory overhead controllable variance is

A) $2,000 unfavorable

B) $3,000 favorable

C) $0

D) $3,000 unfavorable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The following information is for the standard and actual costs for the Happy Corporation: Standard Costs: Budgeted units of production - 16,000 [80% or normal) capacity] Standard labor hours per unit - 4 Standard labor rate - $26 per hour Standard material per unit - 8 lbs. Standard material cost - $12 per pound Standard variable overhead rate - $15 per labor hour Budgeted fixed overhead - $640,000 Fixed overhead rate is based on budgeted labor hours at 80% or normal) capacity. Actual Cost: Actual production - 16,500 units Actual material purchased and used - 130,000 pounds Actual total material cost - $1,600,000 Actual labor - 65,000 hours Actual total labor costs - $1,700,000 Actual variable overhead - $1,000,000 Actual fixed overhead - $640,000 Determine: a) the direct materials quantity variance, price variance, and total cost variance; b) the direct labor time variance, rate variance, and total cost variance; and c) the factory overhead volume variance, controllable variance, and total factory overhead cost variance. Note: If following text formulas, do not round interim calculations.)

Correct Answer

verified

Correct Answer

verified

True/False

A variable cost system is an accounting system where standards are set for each manufacturing cost element.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Variances from standard costs are reported to

A) suppliers

B) stockholders

C) management

D) creditors

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Standard and actual costs for direct labor for the manufacture of 1,000 units of product were as follows: Actual costs 950 hours at $37 Standard costs 975 hours at $36 Determine the direct labor a) time variance, b) rate variance, and c) total direct labor cost variance.

Correct Answer

verified

Correct Answer

verified

True/False

Changes in technology, machinery, or production methods may make past cost data irrelevant when setting standards.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Hint: Determine units produced at normal capacity.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Myers Corporation has the following data related to direct materials costs for November: actual costs for 5,000 pounds of material, $4.50; And standard costs for 4,800 pounds of material at $5.10 per pound. What is the direct materials price variance?

A) $3,000 favorable

B) $3,000 unfavorable

C) $2,880 favorable

D) $2,880 unfavorable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the wage rate paid per hour differs from the standard wage rate per hour for direct labor, the variance is a

A) variable variance

B) rate variance

C) quantity variance

D) volume variance

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the standard to produce a given amount of product is 600 direct labor hours at $15 and the actual was 500 hours at $17, the time variance was $1,700 unfavorable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

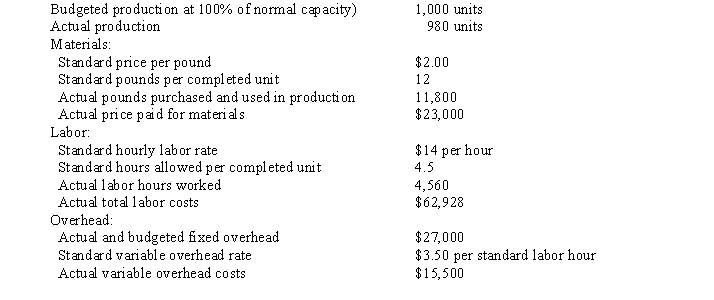

The following data is given for the Bahia Company:  Overhead is applied on standard labor hours. The fixed factory overhead volume variance is

Overhead is applied on standard labor hours. The fixed factory overhead volume variance is

A) $65 unfavorable

B) $65favorable

C) $540 unfavorable

D) $540 favorable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the direct labor time variance.

A) $2,362.50 favorable

B) $2,362.50 unfavorable

C) $6,540.00 favorable

D) $6,540.00 unfavorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Standard and actual costs for direct materials for the manufacture of 1,000 units of product were as follows: Actual costs 1,550 lbs. at $9.10 Standard costs 1,600 lbs. at $9.00 Determine the direct materials a) quantity variance, b) price variance, and c) total cost variance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unfavorable volume variance may be due to all of the following factors except

A) failure to maintain an even flow of work

B) machine breakdowns

C) unexpected increases in the cost of utilities

D) failure to obtain enough sales orders

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Normally, standard costs should be revised when labor rates change to incorporate new union contracts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because accountants have financial expertise, they are the only ones that are able to set standard costs for the production area.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The labor rate variance is

A) $4,920 unfavorable

B) $4,920 favorable

C) $4,560 favorable

D) $4,560 unfavorable

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard costs are used in companies for a variety of reasons. Which of the following is not one of the benefits for using standard costs?

A) used to indicate where changes in technology and machinery need to be made

B) used to estimate cost of inventory

C) used to plan direct materials, direct labor, and variable factory overhead

D) used to control costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 175

Related Exams