A) convertible bonds.

B) bonds with a loan covenant.

C) callable bonds.

D) senior bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company sells $50,000 of bonds for an issue price of $52,000. Which of the following statements is correct?

A) The bond sold at a price of 52, implying a premium of $2,000.

B) The bond sold at a price of 104, implying a discount of $2,000.

C) The bond sold at a price of 52, implying a discount of $2,000.

D) The bond sold at a price of 104, implying a premium of $2,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using straight-line amortization, when a bond is sold at a discount:

A) bonds payable declines by a constant amount each year.

B) interest expense declines by a constant amount each year.

C) bonds payable, net of discount, declines by a constant amount each year.

D) interest expense is a constant amount each year.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Callable bonds

A) can be converted into stock.

B) mature in series of payments.

C) can be redeemed by the issuer at any time at a specified price.

D) mature in total on a specified future date.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When bonds are retired at their maturity date, the balance in the Bonds Payable account is equal to the bond's

A) face value minus any premium amortized.

B) face value plus interest to be paid.

C) face value plus any discount amortized.

D) face value.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Callable bonds can be converted to stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the effective-interest method of amortization is used, what happens to interest expense as a bond moves toward maturity?

A) Interest expense falls for bonds sold at either a discount or a premium.

B) Interest expense rises for bonds sold at a discount and falls for bonds sold at a premium.

C) Interest expense rises for bonds sold at either a discount or a premium.

D) Interest expense falls for bonds sold at a discount and rises for bonds sold at a premium.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has current assets of $5 million and net income of $10 million. Current liabilities total $2.5 million, interest expense is $2 million, and income tax expense is $3 million. The times interest earned ratio for this company is:

A) 0.5.

B) 7.5.

C) 0.3.

D) 2.0.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record a bond retirement at maturity usually involves

A) no gain or loss.

B) a credit to Gain on Bond Retirement.

C) a debit to Loss on Bond Retirement.

D) a credit to Bonds Payable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The method of bond amortization that results in varying amounts of amortization each period is the straight-line amortization method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company issues $500,000 in bonds at an issue price of 98. The company will record:

A) a debit of $490,000 to cash, a debit of $10,000 to a contra-liability account to reflect the discount, and a credit of $500,000 to bonds payable.

B) a debit of $490,000 to cash, a debit of $10,000 to a contra-asset account to reflect the discount, and a credit of $500,000 to bonds payable.

C) a debit of $500,000 to bonds payable, a credit of $10,000 to a contra-liability account to reflect the discount, and a credit to cash of $490,000.

D) a debit of $490,000 to bonds payable, a debit of $10,000 to a contra-asset account to reflect the discount, and

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A typical balance sheet provides no information regarding which of the following questions?

A) To whom does the company owe money?

B) For what does the company owe money?

C) How much does the company owe?

D) What proportion of the company's debts will be paid in the short-term?

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issued 10-year, 8% bonds with a face value of $200,000. Interest is paid annually. The market rate on the issue date was 7.5% and the company received $206,948 in cash proceeds. Which of the following statements is true?

A) The company must pay $184,000 at maturity plus $16,000 in interest each year for 10 years..

B) The company must pay $206,948 at maturity plus $15,000 in interest each year for 10 years.

C) The company must pay $200,000 at maturity plus $16,000 in interest each year for 10 years.

D) The company must pay $200,000 at maturity plus $15,000 in interest each year for 10 years.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

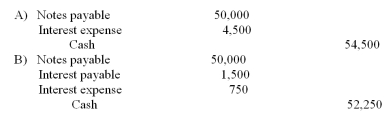

What is the entry to record the payment at the maturity date of the note?

A) Option: A

B) Option: B

C) Option: C

D) Option: D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because interest rates have fallen, a company retires bonds which had been issued at their face value of $200,000. The company bought the bonds back at 97. This retirement would be recorded with a:

A) debit of $200,000 to Bonds Payable, a credit of $6,000 to Gain on Bonds Retired, and a credit of $194,000 to Cash.

B) debit of $200,000 to Bonds Payable and a credit of $200,000 to Cash.

C) debit of $200,000 to Bonds Payable, a credit of $6,000 to Interest Expense, and a credit of $194,000 to Cash.

D) debit of $194,000 to Bonds Payable and a credit of $194,000 to Cash.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are due:

A) but not receivable for more than one year or the current operating cycle, whichever is longer.

B) but not payable for more than one year or the current operating cylce, whichever is longer.

C) and receivable within the current operating cycle or one year, whichever is longer.

D) and payable within the current operating cycle or one year, whichever is longer.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The issuance price of a bond does not depend on the method used to amortize the bond discount or premium.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The net amount of a bond liability that appears on the balance sheet is equal to the face value of the bond plus any related discount or minus any related premium.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased equipment by issuing a $200,000, one-year, 8% note payable. The transaction would be recorded in the accounting records with a credit to

A) Notes payable for $200,000.

B) Notes payable for $216,000.

C) Notes payable for $184,000.

D) Notes payable for $208,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

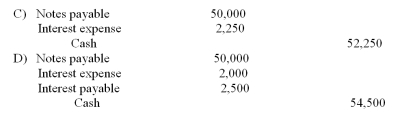

What journal entry will Backyard make when paying off the note and interest at maturity if the company's year-end is June 30? (Hint: Backyard's records were adjusted on June 30) .

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 133

Related Exams