B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The de minimis fringe benefit:

A) Exclusion applies only to property received by the employee.

B) Can be provided on a discriminatory basis.

C) Exclusion is limited to $250 per year.

D) Exclusion applies to employee discounts.

E) None of these.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The employees of Mauve Accounting Services are permitted to use the copy machine for personal purposes, provided the privilege is not abused.Ed is the president of a civic organization and uses the copier to make several copies of the organization's agenda for its meetings.The copies made during the year would have cost $150 at a local office supply.

A) Ed must include $150 in his gross income.

B) Ed may exclude the cost of the copies as a no-additional cost fringe benefit.

C) Ed may exclude the cost of the copies only if the organization is a client of Mauve.

D) Ed may exclude the cost of the copies as a de minimis fringe benefit.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer who uses the automatic mileage method to compute auto expenses can also deduct the business portion of tolls and parking.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A worker may prefer to be treated as an independent contractor rather than an employee) for which of the following reasons:

A) Avoids the overall limitation 50%) as to business meals.

B) All of the self-employment tax is deductible for income tax purposes.

C) Work-related expenses of an independent contractor are deductible for AGI.

D) A Schedule C does not have to be filed.

E) None of these.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An education expense deduction may be allowed even if the education results in a promotion or pay raise for the employee.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The services are performed at Sue's premises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ellie a single taxpayer) is the owner of ABC, LLC.The LLC a sole proprietorship) reports QBI of $900,000 and is not a "specified services" business.ABC paid total W-2 wages of $300,000, and the total unadjusted basis of property held by ABC is $30,000.Ellie's taxable income before the QBI deduction is $740,000 this is also her modified taxable income) .What is Ellie's QBI deduction for 2018?

A) $75,750.

B) $148,000.

C) $150,000.

D) $180,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Under the automatic mileage method, depreciation is not taken into account in the mileage rate allowed.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Mauve Company permits employees to occasionally use the copying machine for personal purposes.The copying machine is located in the office where the higher paid executives work, so they occasionally use the machine.However, the machine is not convenient for use by the lower paid warehouse employees and, thus, they never use the copier.The use of the copy machine may not be excluded from gross income because the benefit is discriminatory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Meg's employer carries insurance on its employees that will pay an employee his or her regular salary while the employee is away from work due to illness.The premiums for Meg's coverage were $1,800.Meg was absent from work for two months as a result of a kidney infection.Meg's employer's insurance company paid Meg's regular salary of $8,000 while she was away from work.Meg also collected $2,000 on a wage continuation policy she had purchased.Meg must include $11,800 in her gross income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Employees of a CPA firm located in Maryland may exclude from gross income the meals and lodging provided by the employer while they were on an audit in Delaware.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Louise works in a foreign branch of her employer's business.She earned $5,000 per month throughout the relevant period.Which of the following is correct:

A) If Louise worked in the foreign branch from May 1, 2017 until October 31, 2018, she may exclude $40,000 from gross income in 2017 and exclude $50,000 in 2018.

B) If Louise worked in the foreign branch from May 1, 2017 until October 31, 2018, she cannot exclude anything from gross income because she was not present in the country for 330 days in either year.

C) If Louise began work in the foreign country on May 1, 2017, she must work through November 30, 2018 in order to exclude $55,000 from gross income in 2018 but none in 2017.

D) Louise will not be allowed to exclude any foreign earned income because she made less than $103,900.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Code § 199A permits an individual to deduct 25 percent of the qualified business income generated through a sole proprietorship, a partnership, or an S corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a medical reimbursement plan for officers that covers all costs that the insurer will not pay.However, for all employees who are not officers, the medical reimbursement plan applies only after the employee has paid $1,000 from his or her own funds.An officer incurred $1,500 in medical expenses and was reimbursed for that amount.An hourly worker also incurred $1,500 in medical expense and was reimbursed $500.

A) Both employees must include all benefits received in gross income.

B) The officer must include $500 in gross income.

C) The officer must include $1,500 in gross income.

D) The hourly employee must include $1,000 in gross income.

E) None of these.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A self-employed taxpayer who uses the automatic mileage method to compute auto expenses can also deduct the business portion of automobile club dues.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Qualified business income includes the "reasonable compensation" paid to the taxpayer by a qualified trade or business and guaranteed payments made to a partner for services rendered.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

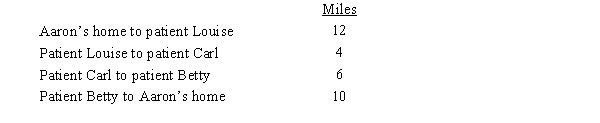

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

A) 10 miles.

B) 12 miles.

C) 20 miles.

D) 22 miles.

E) 32 miles.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If an employer pays for the employee's long-term care insurance premiums, the employee can exclude from gross income the premiums but all of the benefits collected must be included in gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peggy is an executive for the Tan Furniture Manufacturing Company.Peggy purchased furniture from the company for $9,500, the price Tan ordinarily would charge a wholesaler for the same items.The retail price of the furniture was $12,500, and Tan's cost was $9,000.The company also paid for Peggy's parking space in a garage near the office.The parking fee was $600 for the year.All employees are allowed to buy furniture at a discounted price comparable to that charged to Peggy.However, the company does not pay other employees' parking fees.Peggy's gross income from the above is:

A) $0.

B) $600.

C) $3,500.

D) $4,100.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 131

Related Exams