A) Direct materials price variance

B) Direct labor rate variance

C) Direct labor time variance

D) Direct materials quantity variance

E) Budgeted variable factory overhead

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following formulas or descriptions with the term (a-e) it defines. -Standard variable overhead for actual units produced

A) Direct materials price variance

B) Direct labor rate variance

C) Direct labor time variance

D) Direct materials quantity variance

E) Budgeted variable factory overhead

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that the standard fixed overhead rate is based on full capacity, the cost of available but unused productive capacity is indicated by the

A) fixed factory overhead volume variance

B) direct labor time variance

C) direct labor rate variance

D) variable factory overhead controllable variance

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Rosser Company produces a container that requires 4 yards of material per unit. The standard price of one yard of material is $4.50. During the month, 9,500 chairs were manufactured using 37,300 yards of material.Journalize the entry to record the standard direct materials used in production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

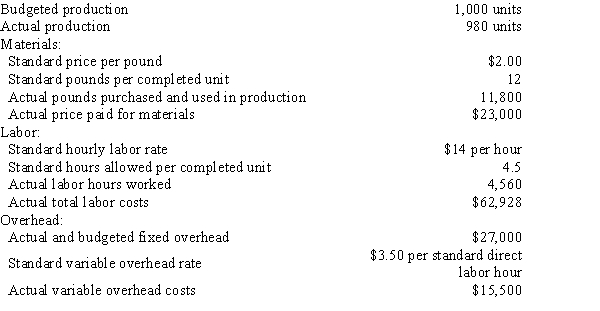

The following data are given for Bahia Company:  Overhead is applied on standard labor hours.The variable factory overhead controllable variance is

Overhead is applied on standard labor hours.The variable factory overhead controllable variance is

A) $65 unfavorable

B) $65 favorable

C) $540 unfavorable

D) $540 favorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

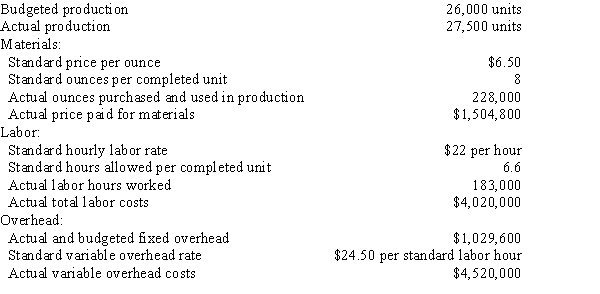

Use this information for Stringer Company to answer the questions that follow.

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

-The direct materials quantity variance is

Overhead is applied on standard labor hours.

-The direct materials quantity variance is

A) $63,000 favorable

B) $63,000 unfavorable

C) $59,400 favorable

D) $59,400 unfavorable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

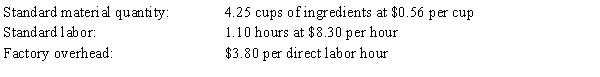

Essay

Sally's Chocolate Company makes gourmet cupcakes that are sold by the dozen. Compute the standard cost for one dozen cupcakes, based on the following standards:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula to compute the direct labor rate variance is to calculate the difference between

A) Actual Costs + (Actual Hours × Standard Rate)

B) Actual Costs - Standard Costs

C) (Actual Hours × Standard Rate) - Standard Costs

D) Actual Costs - (Actual Hours × Standard Rate)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard costs and actual costs for direct labor for the manufacture of 2,500 actual units of product are as follows:Standard CostsDirect labor7,500 hours @ $11.80Actual CostsDirect labor7,400 hours @ $11.40The direct labor rate variance is

A) $2,960 unfavorable

B) $4,500 favorable

C) $2,960 favorable

D) $4,500 unfavorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

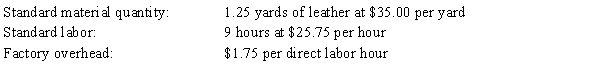

Essay

Compute the standard cost for one pair of boots, based on the following standards for each pair of boots:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A favorable cost variance occurs when

A) actual costs are more than standard costs

B) standard costs are more than actual costs

C) standard costs are less than actual costs

D) actual costs are the same as standard costs

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

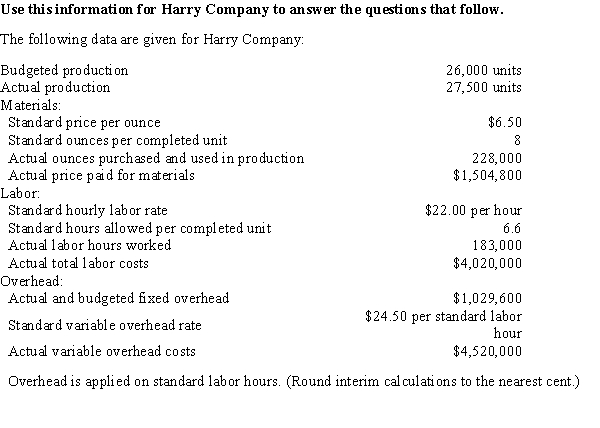

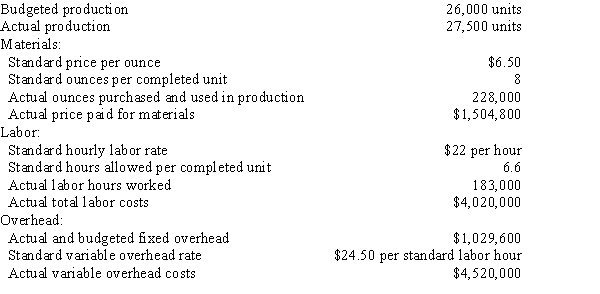

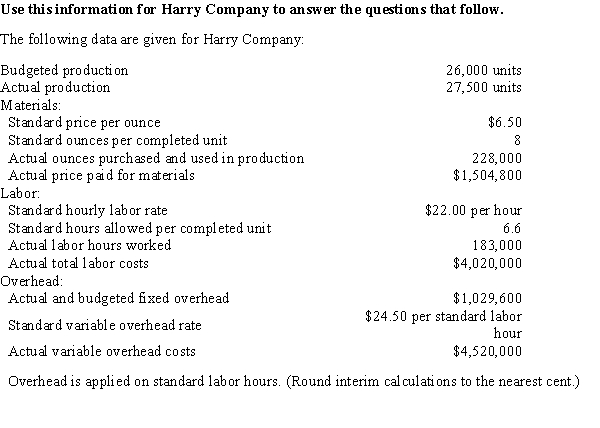

-Calculate the direct materials quantity variance.

-Calculate the direct materials quantity variance.

A) $4,512.50 unfavorable

B) $4,512.50 favorable

C) $4,750.00 unfavorable

D) $4,750.00 favorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A budget performance report compares actual results with the budgeted amounts and reports differences for possible investigation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In most businesses, cost standards are established principally by accountants.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following conditions normally would not indicate that standard costs should be revised?

A) The Engineering Department has revised product specifications in responding to customer suggestions.

B) The company has signed a new union contract that increases the factory wages on average by $3.50 an hour.

C) Actual costs differed from standard costs for the preceding week.

D) The average price of raw materials increased from $4.68 per pound to $4.82 per pound.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard costs are used in companies for a variety of reasons. Which of the following is not one of the benefits of using standard costs?

A) used to indicate where changes in technology and machinery need to be made

B) used to estimate cost of inventory

C) used to plan direct materials, direct labor, and variable factory overhead

D) used to control costs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Using the following information, prepare a factory overhead cost budget for Jacob Company where the total factory overhead cost is $206,500 at normal capacity (100%). Include capacity at 60%, 80%, 100%, and 120%. Total variable cost is $15.25 per unit, and total fixed costs are $54,000. The information is for the month ended October 31. (Hint: Determine units produced at normal capacity.)

Correct Answer

verified

Correct Answer

verified

True/False

A company should only use nonfinancial performance measures when financial measures cannot be calculated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use this information for Stringer Company to answer the questions that follow.

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

-The direct materials price variance is

Overhead is applied on standard labor hours.

-The direct materials price variance is

A) $0

B) $59,400 unfavorable

C) $59,400 favorable

D) $6,000 unfavorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-The direct labor rate variance is

-The direct labor rate variance is

A) $5,490 unfavorable

B) $5,490 favorable

C) $33,000 favorable

D) $33,000 unfavorable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 174

Related Exams