A) The amount of annual interest paid to bondholders remains the same over the life of the bonds.

B) The amount of annual interest expense decreases as the bonds approach maturity.

C) The amount of annual interest paid to bondholders increases over the 15-year life of the bonds.

D) The carrying amount decreases from its amount at issuance date to $2,000,000 at maturity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The contract between bond issuer and bond purchaser

A) Contract rate

B) Effective rate

C) Bond discount

D) Bond premium

E) Bond

F) Bond indenture

G) Principal

I) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Premium on Bonds Payable

A) should be reported on the balance sheet as a deduction from the related bonds payable

B) should be allocated to the remaining periods for the life of the bonds by the straight-line method, if the results obtained by that method materially differ from the results that would be obtained by the effective interest rate method

C) would be added to the related bonds payable on the balance sheet

D) should be reported in the Paid-in capital section of the balance sheet

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When the effective interest rate method of amortization is used, the amount of interest expense for a given period is calculated by multiplying the face rate of interest by the bond's carrying value at the beginning of the given period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Premium on bonds payable may be amortized by the straight-line method if the results obtained by its use do not materially differ from the results obtained by use of the interest method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $900,000, and Premium on Bonds Payable has a balance of $10,000. If the issuing corporation redeems the bonds at 103, what is the amount of gain or loss on redemption?

A) $1,200 loss

B) $1,200 gain

C) $17,000 loss

D) $17,000 gain

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If $500,000 of 10-year bonds with interest payable semiannually are sold for $494,040 based on (1) the present value of $500,000 due in 20 periods at 5% plus (2) the present value of twenty $25,000 payments at 5%, the nominal or contract rate and the market rate of interest for the bonds are both 10%.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

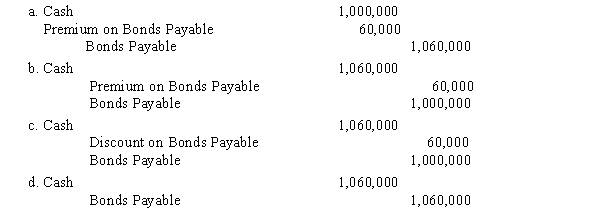

Bonds with a face amount of $1,000,000 are sold at 106. The journal entry to record the issuance is

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Elias Corporation issued 10% bonds with a face value of $50,000. The bonds are sold for $46,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, 10 years from now. Elias records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31 of the first year is

A) $5,000

B) $5,200

C) $5,800

D) $5,400

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freeman Corporation issues 2,000, 10-year, 8%, $1,000 bonds dated January 1 at 96. The journal entry to record the issuance will show a

A) debit to Cash for $2,000,000

B) credit to Discount on Bonds Payable for $80,000

C) credit to Bonds Payable for $1,920,000

D) debit to Cash for $1,920,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000 and Discount on Bonds Payable has a balance of $10,000. If the issuing corporation redeems the bonds at 97.5, what is the amount of gain or loss on redemption?

A) $10,000 loss

B) $25,000 loss

C) $25,000 gain

D) $15,000 gain

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Basil Corporation issues for cash $1,000,000 of 8%, 10-year bonds, interest payable annually, at a time when the market rate of interest is 7%. The straight-line method is adopted for the amortization of bond discount or premium. Which of the following statements is true?

A) The carrying amount increases from its amount at issuance date to $1,000,000 at maturity.

B) The carrying amount decreases from its amount at issuance date to $1,000,000 at maturity.

C) The amount of annual interest paid to bondholders increases over the 10-year life of the bonds.

D) The amount of annual interest expense decreases as the bonds approach maturity.

F) None of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The return required by the market on the day of issuance

A) Contract rate

B) Effective rate

C) Bond discount

D) Bond premium

E) Bond

F) Bond indenture

G) Principal

I) E) and G)

Correct Answer

verified

B

Correct Answer

verified

Essay

(a) Prepare the journal entry to issue $100,000 bonds that sold for $94,000. (b) Prepare the journal entry to issue $100,000 bonds that sold for $104,000.

Correct Answer

verified

Correct Answer

verified

True/False

The buyer determines how much to pay for bonds by computing the present value of future cash receipts using the contract rate of interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the corporation issuing the bonds has the right to redeem the bonds prior to maturity, the bonds are

A) convertible bonds

B) unsecured bonds

C) debenture bonds

D) callable bonds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On January 1, Yeargan Company obtained a $125,000, seven-year 5% installment note from Farmers Bank. The note requires annual payments of $21,602, with the first payment occurring on the last day of the fiscal year. The first payment consists of $6,250 interest and principal repayment of $15,352.Journalize the following entries: (a)Issued the installment notes for cash on January 1. (b)Paid the first annual payment on the note.

Correct Answer

verified

11eb12c7_e496_c5c7_87ae_634dfa2db573_TB2256_00

Correct Answer

verified

Essay

A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions:Year 1Apr. 1Issued the bonds for cash at their face amount.Oct. 1Paid the interest on the bonds.Year 3Oct. 1Called the bond issue at 104, the rate provided in the bond indenture. (Omit entry for payment of interest.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1 of the current year, Barton Corporation issued 10% bonds with a face value of $200,000. The bonds are sold for $191,000. The bonds pay interest semiannually on June 30 and December 31, and the maturity date is December 31, five years from now. Barton records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31 is

A) $10,900

B) $18,200

C) $21,800

D) $29,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of issuing bonds instead of common stock?

A) Tax savings result.

B) Income to common shareholders may increase.

C) Earnings per share on common stock may be lower.

D) Stockholder control is not affected.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 181

Related Exams