A) $10,290

B) $2,710

C) $2,500

D) $2,290

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation issues bonds, it executes a contract with the bondholders, known as a bond debenture.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -The value of a bond stated on the bond certificate

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) A) and G)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of $5,000 to be received in four years at a market rate of interest of 6% compounded annually is $3,636.30.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Present entries to record the selected transactions described below. (a)Issued $2,750,000 of 10-year, 8% bonds at 97. (b)Amortized bond discount for a full year, using the straight-line method. (c)At the end of the third year, called bonds at 98. The bonds were carried at $2,692,250 at the time of the redemption.

Correct Answer

verified

Correct Answer

verified

True/False

If the amount of a bond premium on an issued 11%, four-year, $100,000 bond is $12,928, the semiannual straight-line amortization of the premium is $1,416.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at

A) a premium

B) their face value

C) their maturity value

D) a discount

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -Allows the bondholder to exchange bond for shares of stock

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A bond is simply a form of an interest-bearing note.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total premium related to the bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bonds payable should be reported on the balance sheet at face value plus or minus any unamortized premium or discount.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An equal stream of periodic payments is called an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An installment note payable for a principal amount of $94,000 at 6% interest requires Lawson Company to repay the principal and interest in equal annual payments of $22,315 beginning December 31, of the first year, for each of the next five years. After the final payment, the carrying amount on the note will be

A) $1,263

B) $21,053

C) $22,315

D) $0

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description below to the appropriate term (a-g) . -A measure of income earned by each share of common stock

A) EPS

B) Face value

C) Callable bond

D) Indenture

E) Term bond

F) Convertible bond

G) Serial bond

I) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bonds are issued at a premium, the stated interest rate is

A) higher than the market rate of interest

B) lower than the market rate of interest

C) too low to attract investors

D) adjusted to a higher rate of interest

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest expense recorded on an interest payment date is increased

A) only if the market rate of interest is less than the stated rate of interest on that date

B) by the amortization of premium on bonds payable

C) by the amortization of discount on bonds payable

D) only if the bonds were sold at face value

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An installment note is a debt that requires the borrower to make equal periodic payments to the lender for the term of the note.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $300,000 bond was redeemed at 104 when the carrying value of the bond was $316,000. The entry to record the redemption would include a

A) loss on bond redemption of $3,000

B) gain on bond redemption of $3,000

C) gain on bond redemption of $4,000

D) loss on bond redemption of $4,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses on the redemption of bonds are reported as Other income or Other expense on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

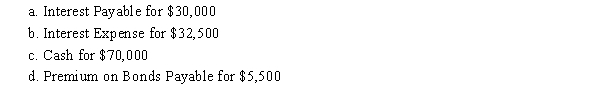

On the first day of the fiscal year, Lisbon Co. issued $1,000,000 of 10-year, 7% bonds for $1,050,000, with interest payable semiannually. Orange Inc. purchased the bonds on the issue date for the issue price. If Lisbon uses the straight-line method for amortizing the premium, the journal entry to record the first semiannual interest payment by Lisbon Co. would include a debit to

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 181

Related Exams