A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record accrued vacation privileges for its employees at the end of the year is

A) debit Vacation Pay Expense; credit Vacation Pay Payable

B) debit Vacation Pay Payable; credit Vacation Pay Expense

C) debit Salaries Expense; credit Cash

D) debit Salaries Expense; credit Salaries Payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Martin Services Company provides its employees vacation benefits and a defined contribution pension plan. Employees earned vacation pay of $39,500 for the period. The pension plan requires a contribution to the plan administrator equal to 9% of employee salaries. Salaries were $750,000 during the period. Provide the journal entries for (a) the vacation pay and (b) the pension benefit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martinez Co. borrowed $50,000 on March 1 of the current year by signing a 60-day, 9%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a

A) debit to Interest Payable for $750

B) debit to Interest Expense for $750

C) credit to Cash for $50,000

D) credit to Cash for $54,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the employer's payroll taxes?

A) SUTA tax

B) FUTA tax

C) social security tax

D) All of these choices

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

During the first year of operations, a company granted warranties on its products at an estimated cost of $8,500. The product warranty expense should be recorded in the years of the expenditures to repair the products covered by the warranty payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension plan that requires the employer to make annual pension contributions, with no promise to employees regarding future pension payments, is termed

A) funded

B) unfunded

C) defined benefit

D) defined contribution

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

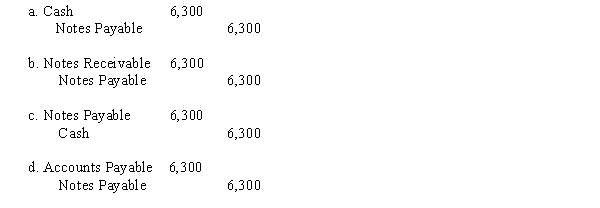

The journal entry to record the conversion of a $6,300 account payable to a note payable would be

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry used to record the issuance of a discounted note for the purpose of borrowing funds for the business is

A) debit Cash and Interest Expense; credit Notes Payable

B) debit Cash and Interest Payable; credit Notes Payable

C) debit Accounts Payable; credit Notes Payable

D) debit Notes Payable; credit Cash

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each payroll item that follows to the one item (a-f) that best describes its characteristics. -State unemployment compensation tax (SUTA)

A) Amount is limited, withheld from employee only

B) Amount is limited, withheld from employee and matched by employer

C) Amount is limited, paid by employer only

D) Amount is not limited, withheld from employee only

E) Amount is not limited, withheld from employee and matched by employer

F) Amount is not limited, paid by employer only

H) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An interest-beating note is a loan in which the lender deducts interest from the amount loaned before the money is advanced to the borrower.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each payroll item that follows to the one item (a-f) that best describes its characteristics. -Federal unemployment compensation tax (FUTA)

A) Amount is limited, withheld from employee only

B) Amount is limited, withheld from employee and matched by employer

C) Amount is limited, paid by employer only

D) Amount is not limited, withheld from employee only

E) Amount is not limited, withheld from employee and matched by employer

F) Amount is not limited, paid by employer only

H) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record partially funded pension rights for its salaried employees at the end of the year is

A) debit Salaries Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment taxes are paid by the employer and the employee.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is probable but amount is not estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use this information for Harris Company to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. -Assume that social security taxes are payable at a 6.0% rate, Medicare taxes are payable at a 1.5% rate with no maximum earnings, and federal and state unemployment compensation taxes total 4.6% on the first $7,000 of earnings. If an employee earns $2,500 for the current week and the employee's year-to-date earnings before this week were $6,800, what is the total payroll tax related to the current week?

A) $187.50

B) $196.70

C) $344.50

D) $9.20

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, when a $50,000, 90-day, 9% interest-bearing note payable matures, the total payment will be

A) $51,125

B) $54,500

C) $1,125

D) $4,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are

A) due and receivable within one year

B) due and to be paid out of current assets within one year

C) due, but not payable for more than one year

D) payable if a possible subsequent event occurs

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A current liability is a debt that is reasonably expected to be paid

A) between 6 and 18 months

B) out of currently recognized revenues

C) within one year

D) out of cash currently on hand

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

According to a summary of the payroll of Scotland Company, $450,000 was subject to the 6.0% social security tax and $500,000 was subject to the 1.5% Medicare tax. Federal income tax withheld was $98,000. Also, $15,000 was subject to state (4.2%) and federal (0.8%) unemployment taxes.? (a)Journalize the entry to record the accrual of payroll. (b)Journalize the entry to record the accrual of payroll taxes.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 201

Related Exams