A) shortage of 2,250 workers.

B) shortage of 4,500 workers.

C) surplus of 2,250 workers.

D) surplus of 4,500 workers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price floor is the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most labor economists believe that the supply of labor is

A) less elastic than the demand, and, therefore, firms bear most of the burden of the payroll tax.

B) less elastic than the demand, and, therefore, workers bear most of the burden of the payroll tax.

C) more elastic than the demand, and, therefore, workers bear most of the burden of the payroll tax.

D) more elastic than the demand, and, therefore, firms bear most of the burden of the payroll tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good, then the quantity of the good sold will

A) increase.

B) decrease.

C) not change.

D) All of the above are possible.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Rent control and the minimum wage are both examples of price ceilings.

B) Rent control is an example of a price ceiling, and the minimum wage is an example of a price floor.

C) Rent control is an example of a price floor, and the minimum wage is an example of a price ceiling.

D) Rent control and the minimum wage are both examples of price floors.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding, then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) the market will be less efficient than it would be without the price ceiling.

D) there will be no effect on the market price or quantity sold.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

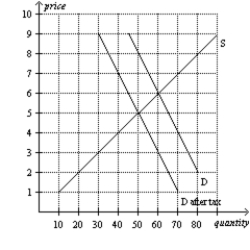

Figure 6-25  -Refer to Figure 6-25. The effective price that sellers receive after the tax is imposed is

-Refer to Figure 6-25. The effective price that sellers receive after the tax is imposed is

A) $5.

B) $6.

C) $7.

D) $8.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

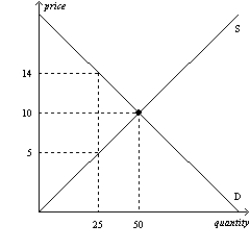

Figure 6-20  -Refer to Figure 6-20. Suppose a tax of $5 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed?

-Refer to Figure 6-20. Suppose a tax of $5 per unit is imposed on this market. How much will sellers receive per unit after the tax is imposed?

A) $5

B) between $5 and $10

C) between $10 and $14

D) $14

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

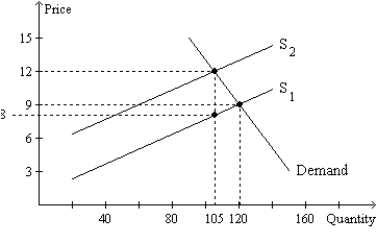

When OPEC raised the price of crude oil in the 1970s, it caused the

A) supply of gasoline to decrease.

B) quantity of gasoline demanded to decrease.

C) equilibrium price of gasoline to increase.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent-control laws dictate

A) the exact rent that landlords must charge tenants.

B) a maximum rent that landlords may charge tenants.

C) a minimum rent that landlords may charge tenants.

D) both a minimum rent and a maximum rent that landlords may charge tenants.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $1,000 tax per boat on sellers of boats, then the price paid by buyers of boats would

A) increase by more than $1,000.

B) increase by exactly $1,000.

C) increase by less than $1,000.

D) decrease by an indeterminate amount.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Advocates of the minimum wage admit that it has some adverse effects, but they believe that these effects are small and that a higher minimum wage makes the poor better off.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

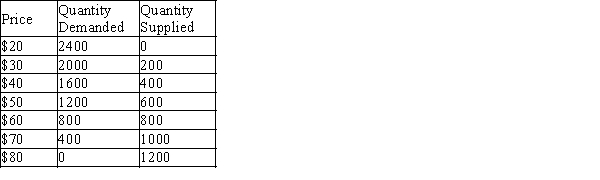

Table 6-1  -Refer to Table 6-1. Suppose the government imposes a price floor of $70 on this market. What will be the size of the surplus in this market?

-Refer to Table 6-1. Suppose the government imposes a price floor of $70 on this market. What will be the size of the surplus in this market?

A) 0 units

B) 400 units

C) 600 units

D) 1000 units

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To say that a price ceiling is binding is to say that the price ceiling

A) results in a surplus.

B) is set above the equilibrium price.

C) causes quantity demanded to exceed quantity supplied.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $1.50 tax levied on the buyers of pomegranate juice will shift the demand curve

A) upward by exactly $1.50.

B) upward by less than $1.50.

C) downward by exactly $1.50.

D) downward by less than $1.50.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-21  -Refer to Figure 6-21. How is the burden of the tax shared between buyers and sellers? Buyers bear

-Refer to Figure 6-21. How is the burden of the tax shared between buyers and sellers? Buyers bear

A) three-fourths of the burden, and sellers bear one-fourth of the burden.

B) two-thirds of the burden, and sellers bear one-third of the burden.

C) one-half of the burden, and sellers bear one-half of the burden.

D) one-fourth of the burden, and sellers bear three-fourths of the burden.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will decrease if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

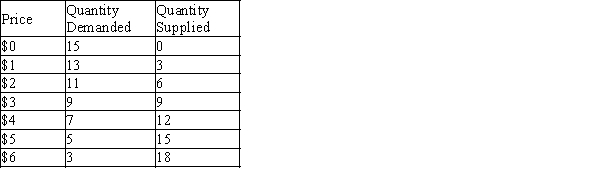

Table 6-4

The following table contains the demand schedule and supply schedule for a market for a particular good. Suppose sellers of the good successfully lobby Congress to impose a price floor $3 above the equilibrium price in this market.  -Refer to Table 6-4. Following the imposition of a price floor $3 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

-Refer to Table 6-4. Following the imposition of a price floor $3 above the equilibrium price, irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor. The resulting shortage is

A) 0 units.

B) 4 units.

C) 5 units.

D) 10 units.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In response to a shortage caused by the imposition of a binding price ceiling on a market,

A) price will no longer be the mechanism that rations scarce resources.

B) long lines of buyers may develop.

C) sellers could ration the good or service according to their own personal biases.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $0.25 tax per MP3 music file downloaded on buyers of MP3 music files, then the price received by sellers of MP3 music files would

A) decrease by more than $0.25.

B) decrease by exactly $0.25.

C) decrease by less than $0.25.

D) increase by an indeterminate amount.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 671

Related Exams