Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) A negative income tax only applies to working people, so it encourages people to get full-time work.

B) Supporters advocate the use of the Earned Income Tax Credit as a way to help the working poor.

C) A negative income tax subsidizes the incomes of poor people.

D) An advantage of a negative income tax is that it is not based on the number of children, so it does not provide incentives for unmarried women to have children.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

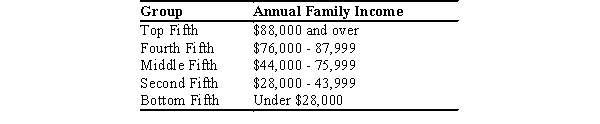

Table 20-3

The Distribution of Income in Edgerton  -Refer to Table 20-3. Where would the government in Edgerton set the poverty line to have a poverty rate of 40 percent?

-Refer to Table 20-3. Where would the government in Edgerton set the poverty line to have a poverty rate of 40 percent?

A) $28,000

B) $44,000

C) $76,000

D) $88,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) The poverty line is an absolute level of income set by the federal government below which a family is considered to be in poverty.

B) The poverty line is approximately equal to three times the cost of providing an adequate diet.

C) The poverty line is adjusted annually to reflect changes in price levels.

D) The poverty line is adjusted semiannually to reflect changes in fuel prices.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supporters of raising the minimum wage argue that minimum-wage laws are

A) a tax-free way to help the working poor. Businesses bear the burden of paying higher wages, not the government.

B) better than the Earned Income Tax Credit (EITC) in targeting the working poor. The EITC may benefit teenagers from middle-class families who work summer jobs at the minimum wage.

C) better than in-kind transfers such as food stamps in providing food rather than unhealthy items such as drugs or alcohol.

D) a way to increase employment of those likely to earn the minimum wage.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Of the following countries, which has the most equal distribution of income? United States, Brazil, Mexico, China, Japan, Germany, United Kingdom, Russia

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Equality of opportunities is more important than equality of incomes." This statement would be most likely attributed to which political philosophy?

A) utilitarianism

B) liberalism

C) libertarianism

D) welfarism

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of in-kind transfers?

A) food stamps

B) Medicaid

C) the Earned Income Tax Credit

D) housing vouchers

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family's ability to buy goods and services depends largely on its

A) permanent income, which is its normal, or average, income.

B) permanent income, which is the lowest annual income the family has received over a 10-year period.

C) transitory income, which is the measure of income used by the government to analyze the distribution of income and the poverty rate.

D) transitory income, which is its money income plus any in-kind transfers it receives.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to occur when the government enacts policies to make the distribution of income more equal?

A) a more efficient allocation of resources

B) a distortion of incentives

C) unchanged behavior

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poor families are eligible for financial assistance, without having to demonstrate any additional "need,"

A) under the current welfare system and under a negative income tax.

B) under the current welfare system but not under a negative income tax.

C) under a negative income tax but not under the current welfare system.

D) under neither the current welfare system nor under a negative income tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax provision that works much like a negative income tax is the

A) Earned Income Tax Credit (EITC) .

B) Temporary Assistance for Needy Families (TANF) .

C) deduction for charitable contributions.

D) mortgage interest rate deduction.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on data from 2011, the top fifth of all families received approximately what percent of all income in the United States?

A) 83 percent

B) 49 percent

C) 41 percent

D) 21 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income distribution in the United States shows that the income share of the top fifth of all families is

A) over 60 percent.

B) around 21 percent.

C) more than 12 times the income of the bottom fifth.

D) less than 10 times the income of the bottom fifth.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Two key elements of welfare reform are work requirements and limiting the time that recipients can receive benefits.

B) The Earned Income Tax Credit (EITC) is very similar to a negative income tax.

C) Minimum wage laws will likely increase unemployment.

D) The elderly are more likely to be poor than single mothers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marketplace allocates resources

A) fairly.

B) efficiently.

C) to those desiring them least.

D) both efficiently and equitably.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The philosopher John Rawls argued that

A) people would choose a more equal distribution of income if they had to determine an economic distribution system before knowing their place in it.

B) people would choose income inequality to allow the maximum use of their individual talents.

C) government has a role to ensure income equality to prevent social unrest.

D) people would choose equal opportunity because it is morally right.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose society consists of four individuals: Andy, Bill, Carl, and David. Andy has $20,000 of income, Bill has $40,000 of income, Carl has $60,000 of income, and David has $80,000 of income. A utilitarian would argue that

A) taking $1 from Bill and giving it to Carl would increase society's total utility.

B) taking $1 from Carl and giving it to Andy would increase society's total utility.

C) taking $1 from Carl and giving it to David would increase society's total utility.

D) taking $1 from Bill and giving it to David would increase society's total utility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of utilitarians is to

A) punish crimes and enforce voluntary agreements but not to redistribute income.

B) redistribute income until each person has equal earnings.

C) redistribute income until the marginal utility of the wealthiest person equals the total utility of the poorest person.

D) redistribute income based on the assumption of diminishing marginal utility.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a transitory change in income is the

A) annual cost of living adjustment to your salary.

B) increase in income that results from a job promotion linked to your education.

C) increase in income of California orange growers that results from an orange-killing frost in Florida.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 478

Related Exams