A) 4 years

B) 5 years

C) 20 years

D) 3 years

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Tipper Co. is considering a 10-year project that is estimated to cost $700,000 and has no residual value. Tipper seeks to earn an average rate of return of 15% on all capital projects. Determine the necessary average annual income (using straight-line depreciation) that must be achieved on this project for it to be acceptable to Tipper Co.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each phrase that follows with the term (a-f) it describes. -A formal means of analyzing long-range investment decisions A)Capital rationing B)Annuity C)Capital investment analysis D)Internal rate of return method E)Payback period F)Accounting rate of return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following qualitative considerations may influence capital investment analysis except the investment proposal's impact on

A) manufacturing productivity

B) manufacturing sunk cost

C) manufacturing flexibility

D) market opportunities

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

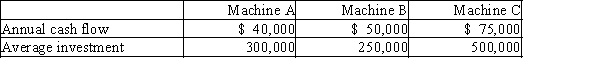

The production department is proposing the purchase of an automatic insertion machine. It has identified three machines and has asked the accountant to analyze them to determine which one has the best cash payback.

A) Machine A

B) Machine C

C) Machine B

D) Machines B and C have the same preferred payback period.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Methods that ignore present value in capital investment analysis include the internal rate of return method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The management of Idaho Corporation is considering the purchase of a new machine costing $430,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The net present value for this investment is

The net present value for this investment is

A) $16,400

B) $25,200

C) $(99,600)

D) $(126,800)

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A company is planning to purchase a machine that will cost $24,000, have a 6-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total operating income generated over the life of the machine is estimated to be $12,000. The machine will generate net cash inflows of $6,000 per year. The payback period for the machine is 12 years.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

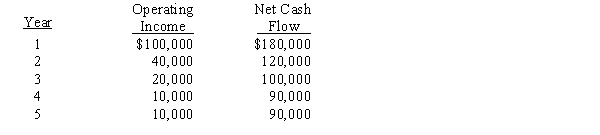

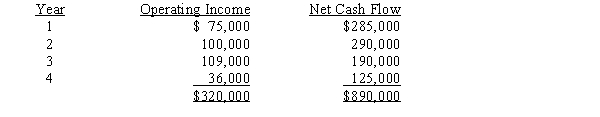

Sunrise Inc. is considering a capital investment proposal that costs $227,500 and has an estimated life of 4 years and no residual value. The estimated net cash flows are as follows:  The minimum desired rate of return for net present value analysis is 10%. The factors for the present value of $1 at the compound interest rate of 10% for 1, 2, 3, and 4 years are 0.909, 0.826, 0.751, and 0.683, respectively. Determine the net present value. Round interim answers to the nearest dollar.

The minimum desired rate of return for net present value analysis is 10%. The factors for the present value of $1 at the compound interest rate of 10% for 1, 2, 3, and 4 years are 0.909, 0.826, 0.751, and 0.683, respectively. Determine the net present value. Round interim answers to the nearest dollar.

Correct Answer

verified

Correct Answer

verified

Essay

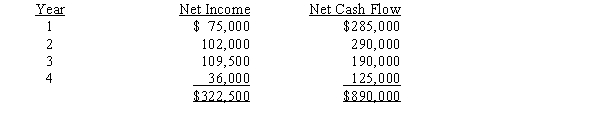

BAM Co. is evaluating a project requiring a capital expenditure of $806,250. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:  The company's minimum desired rate of return is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.Determine (a) the average rate of return on investment and (b) the net present value.

The company's minimum desired rate of return is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.Determine (a) the average rate of return on investment and (b) the net present value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

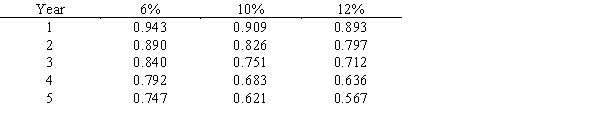

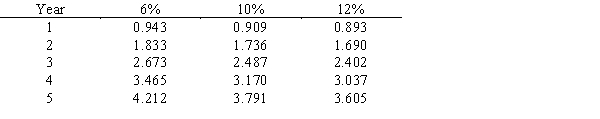

Following is a table for the present value of $1 at compound interest:  Following is a table for the present value of an annuity of $1 at compound interest:

Following is a table for the present value of an annuity of $1 at compound interest:

-Using the tables provided, the present value of $8,000 to be received 1 year from today, assuming an earnings rate of 12%, is

-Using the tables provided, the present value of $8,000 to be received 1 year from today, assuming an earnings rate of 12%, is

A) $7,544

B) $7,120

C) $7,272

D) $7,144

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

A $400,000 capital investment proposal has an estimated life of 4 years and no residual value. The estimated net cash flows are as follows:  The minimum desired rate of return for net present value analysis is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the net present value.

The minimum desired rate of return for net present value analysis is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the net present value.

Correct Answer

verified

Correct Answer

verified

True/False

The process by which management plans, evaluates, and controls investments in fixed assets is called capital investment analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In computing the present value of an investment in equipment, the present value of the residual value should be added to the cash inflows

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The methods of evaluating capital investment proposals can be grouped into two general categories referred to as (1) the average rate of return and (2) the cash payback methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume in analyzing alternative proposals that Proposal F has a useful life of 6 years and Proposal J has a useful life of 9 years. What is one widely used method to make the net present values of the proposals comparable?

A) Ignore the fact that Proposal F has a useful life of 6 years and treat it as if it has a useful life of 9 years.

B) Adjust the life of Proposal J to a time period that is equal to that of Proposal F by estimating a residual value at the end of year 6.

C) Ignore the useful lives of 6 and 9 years and find an average (7 1/2 years) .

D) Ignore the useful lives of 6 and 9 years and compute the average rate of return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A company is planning to purchase a machine that will cost $24,000, have a 6-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total operating income generated over the life of the machine is estimated to be $12,000. The machine will generate net cash inflows of $6,000 per year. The payback period for the machine is 4 years.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The expected period of time between the date of an investment and the recovery in cash of the amount invested is called the cash payback period.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:  The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the average rate of return on investment.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the average rate of return on investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brunette Company is contemplating investing in a new piece of manufacturing machinery. The amount to be invested is $180,000. The present value of the future cash flows generated by the project is $163,000. Should the company invest in this project?

A) yes, because the rate of return on the project exceeds the desired rate of return used to compute the present value of the future cash flows

B) no, because the rate of return on the project is less than the desired rate of return used to compute the present value of the future cash flows

C) no, because the net present value is $17,000

D) yes, because the rate of return on the project is equal to the desired rate of return used to compute the present value of the future cash flows

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 191

Related Exams