A) variable

B) controllable

C) price

D) volume

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data relate to direct labor costs for the current period: Standard costs 9,000 hours at $5.50 Actual costs 8,500 hours at $5.75 The direct labor rate variance is

A) $2,250 unfavorable

B) $2,125 unfavorable

C) $2,250 favorable

D) $2,125 favorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

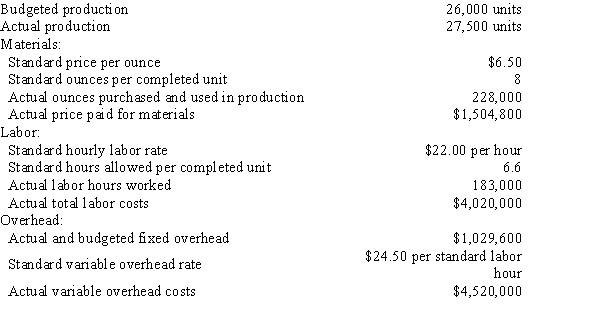

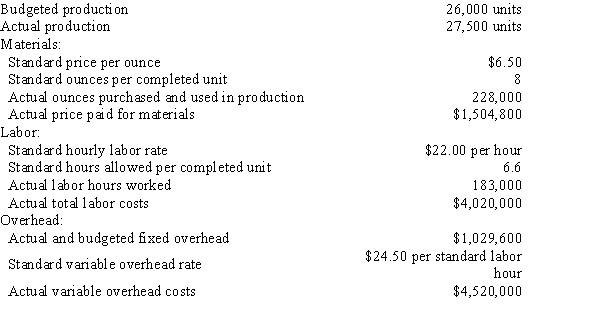

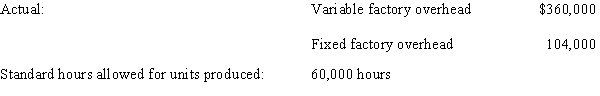

The following data are given for Harry Company:  Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.)

-The direct labor rate variance is

Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.)

-The direct labor rate variance is

A) $5,490 unfavorable

B) $5,490 favorable

C) $33,000 favorable

D) $33,000 unfavorable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Standard and actual costs for direct labor for the manufacture of 300 units of product were as follows: Actual costs 125 hours at $54 Standard costs 131 hours at $53 Determine the direct labor (a) time variance, (b) rate variance, and (c) total cost variance.

Correct Answer

verified

Correct Answer

verified

True/False

The principle of exceptions allows managers to focus on correcting variances between standard costs and actual costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The volume variance measures the use of fixed factory overhead resources.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Using the following information, prepare a factory overhead cost budget for Andover Company where the total factory overhead cost is $75,500 at normal capacity (100%). Include capacity at 75%, 90%, 100%, and 110%. Total variable cost is $6.25 per unit and total fixed costs are $38,000. The information is for the month ending August 31. (Hint: Determine units produced at normal capacity.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

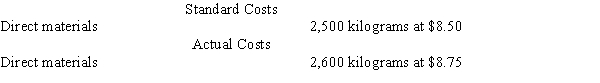

The standard costs and actual costs for direct materials for the manufacture of 2,500 actual units of product are as follows:  The direct materials quantity variance is

The direct materials quantity variance is

A) $875 favorable

B) $850 unfavorable

C) $850 favorable

D) $875 unfavorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

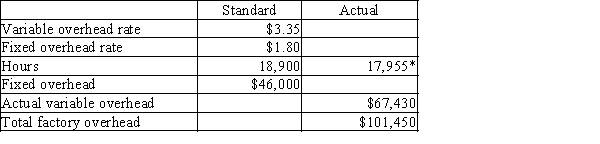

Multiple Choice

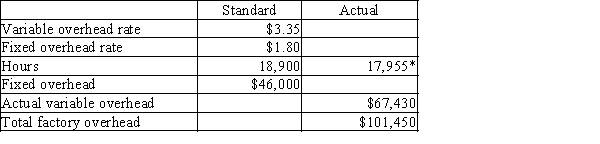

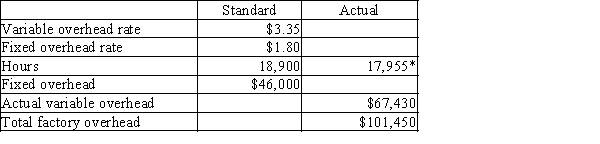

*Actual hours are equal to standard hours for units produced.

-The variable factory overhead controllable variance is

*Actual hours are equal to standard hours for units produced.

-The variable factory overhead controllable variance is

A) $8,981.75 favorable

B) $7,280.75 unfavorable

C) $8,981.75 unfavorable

D) $7,280.75 favorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data are given for Harry Company:  Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.)

-The direct labor time variance is

Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.)

-The direct labor time variance is

A) $6,000 favorable

B) $6,000 unfavorable

C) $33,000 unfavorable

D) $33,000 favorable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

*Actual hours are equal to standard hours for units produced.

-The total factory overhead cost variance is

*Actual hours are equal to standard hours for units produced.

-The total factory overhead cost variance is

A) $4,866.75 unfavorable

B) $4,866.75 favorable

C) $8,981.75 favorable

D) $8,981.75 unfavorable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following formulas and phrases with the term (a-e) it describes. -(Actual Price - Standard Price) × Actual Quantity

A) Direct materials price variance

B) Direct labor rate variance

C) Direct labor time variance

D) Direct materials quantity variance

E) Budgeted variable factory overhead

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Standards are performance goals used to evaluate and control operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

*Actual hours are equal to standard hours for units produced.

-Planned sales are 10,000 units at $7.00 per unit. Actual sales are 11,000 units at $6.50 per unit. Which of the following statements is not true?

*Actual hours are equal to standard hours for units produced.

-Planned sales are 10,000 units at $7.00 per unit. Actual sales are 11,000 units at $6.50 per unit. Which of the following statements is not true?

A) The revenue price variance is unfavorable.

B) The revenue volume variance is favorable.

C) The total revenue variance is unfavorable.

D) The revenue volume variance is $7,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accounting systems that use standards for product costs are called standard cost systems.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the wage rate paid per hour differs from the standard wage rate per hour for direct labor, the variance is a _____ variance.

A) variable

B) rate

C) quantity

D) volume

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following conditions normally would not indicate that standard costs should be revised?

A) The Engineering Department has revised product specifications in responding to customer suggestions.

B) The company has signed a new union contract that increases the factory wages on average by $3.50 an hour.

C) Actual costs differed from standard costs for the preceding week.

D) The average price of raw materials increased from $4.68 per pound to $4.82 per pound.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard factory overhead rate is $7.50 per machine hour ($6.20 for variable factory overhead and $1.30 for fixed factory overhead) based on 100% of normal capacity of 80,000 machine hours. The standard cost and the actual cost of factory overhead for the production of 15,000 units during August were as follows:

-Favorable volume variances may be harmful when

-Favorable volume variances may be harmful when

A) machine repairs cause work stoppages

B) supervisors fail to maintain an even flow of work

C) production in excess of normal capacity cannot be sold

D) all of these choices

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard costs and actual costs for direct labor in the manufacture of 2,500 units of product are as follows:  The direct labor time variance is

The direct labor time variance is

A) $1,180 favorable

B) $1,140 unfavorable

C) $1,180 unfavorable

D) $1,140 favorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

At the end of the fiscal year, the variances from standard are usually transferred to the finished goods account.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 172

Related Exams