A) due and receivable within one year

B) due and to be paid out of current assets within one year

C) due, but not payable for more than one year

D) payable if a possible subsequent event occurs

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes are based on the employee's net pay.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The journal entry to record the cost of warranty repairs that were incurred during the current period, but related to sales made in prior years, includes a debit to Warranty Expense.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

According to a summary of the payroll of Sinclair Company, $545,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $10,000 was subject to state and federal unemployment taxes.(a)Calculate the employer's payroll taxes using the following rates: state unemployment tax, 5.4%; federal unemployment tax, 0.8%.(b)Journalize the entry to record the accrual of the employer's payroll taxes.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each payroll item that follows to the one item (a-f) that best describes its characteristics. -FICA - Medicare A)Amount is limited, withheld from employee only B)Amount is limited, withheld from employee and matched by employer C)Amount is limited, paid by employer only D)Amount is not limited, withheld from employee only E)Amount is not limited, withheld from employee and matched by employer F)Amount is not limited, paid by employer only

Correct Answer

verified

Correct Answer

verified

True/False

Interest expense is reported in the operating expense section of the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During the first year of operations, employees earned vacation pay of $35,000. The vacations will be taken during the second year. The vacation pay expense should be recorded in the second year as the vacations are taken by the employees.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

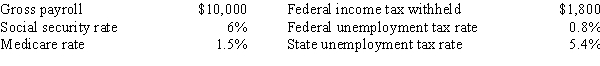

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. Use this information to answer the questions that follow.  -An aid in internal control over payrolls that indicates employee attendance is

-An aid in internal control over payrolls that indicates employee attendance is

A) time card

B) voucher system

C) special payroll bank account

D) fringe benefits

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Taxes deducted from an employee's earnings to finance social security and Medicare benefits are called FICA taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martinez Co. borrowed $50,000 on March 1 of the current year by signing a 60-day, 9%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a

A) debit to Interest Payable for $750

B) debit to Interest Expense for $750

C) credit to Cash for $50,000

D) credit to Cash for $54,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An employee's take-home pay is equal to gross pay less all voluntary deductions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment compensation taxes that are collected by the federal government are not paid directly to the unemployed but are allocated among the states for use in state programs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An interest-bearing note is a loan in which the lender deducts interest from the amount loaned before the money is advanced to the borrower.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar.

A) $700

B) $4,200

C) $307

D) $1,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All long-term liabilities eventually become current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On October 1, Ramos Co. signed a $90,000, 60-day discounted note at the bank. The discount rate was 6%, and the note was paid on November 30. (Assume a 360-day year is used for interest calculations.)(a)Journalize the entries for October 1 and November 30.(b)Assume that Ramos Co. signed a 6% interest-bearing note. Journalize the entries for October 1 and November 30.

Correct Answer

verified

Correct Answer

verified

Essay

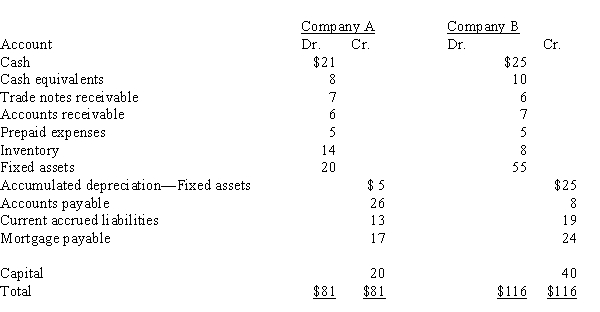

For Company A and Company B:

(a)Calculate the quick ratio for each company. Round ratios to two decimal places.(b)Comment on which one is more able to meet current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension plan that promises employees a fixed annual pension benefit, based on years of service and compensation, is called a(n)

A) defined contribution plan

B) defined benefit plan

C) unfunded plan

D) compensation plan

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following terms or phrases in (a-g) with the explanations in 1-8. Terms or phrases may be used more than once. -Measures the "instant" debt-paying ability of a company A)Current ratio B)Working capital C)Quick assets D)Quick ratio E)Record an accrual and disclose in the notes to the financial statements F)Disclose only in notes to financial statements G)No disclosure needed in notes to financial statements

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) all are correct

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 199

Related Exams