B) False

Correct Answer

verified

Correct Answer

verified

True/False

It is necessary for a company to use the same depreciation method for all of its depreciable assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expected useful life is

A) calculated when the asset is sold

B) estimated at the time that the asset is placed in service

C) determined each year that the depreciation calculation is made

D) none of these

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1, Michael Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years or 30,000 hours. Using straight-line depreciation, calculate depreciation expense for the second year.

A) $17,500

B) $30,000

C) $12,500

D) $40,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Identify the following as a fixed asset (FA), or intangible asset (IA), natural resource (NR), or none of these (N).(a)computer (b)patent (c)oil reserve (d)goodwill (e)U.S. Treasury note (f)land used for employee parking (g)gold mine

Correct Answer

verified

Correct Answer

verified

Essay

Williams Company acquired machinery on July 1, Year 1, at a cost of $130,000. The estimated useful life of the machinery was 10 years and the estimated residual value was $10,000. Williams uses the double-declining-balance method of depreciation. On October 1, Year 4, Williams sold the equipment for $75,000. (a) Record the journal entry for the depreciation on this machinery for Year 4.(b) Record the journal entry for the sale of the machinery.

Correct Answer

verified

11eb2346_58ae_41ed_aa27_0348fae69162_TB7934_00

Correct Answer

verified

Multiple Choice

Residual value is also known as all of the following except

A) scrap value

B) trade-in value

C) salvage value

D) net book value

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Revising depreciation estimates affects the amounts of depreciation expense recorded in past periods.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each account name to the financial statement section (a-i) in which it would appear. -Gain on Sale of Equipment A)Current Assets B)Fixed Assets C)Intangible Assets D)Current Liability E)Long-Term Liability F)Owners' Equity G)Revenues H)Operating Expenses I)Other Income/Expense

Correct Answer

verified

i

Correct Answer

verified

Multiple Choice

A fixed asset with a cost of $41,000 and accumulated depreciation of $36,500 is traded for a similar asset priced at $60,000. Assuming a trade-in allowance of $3,000, the recognized loss on the trade is

A) $3,000

B) $4,500

C) $500

D) $1,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The transfer to expense of the cost of intangible assets attributed to the passage of time or decline in usefulness is called amortization.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A machine costing $57,000 with a 6-year life and $54,000 depreciable cost was purchased January 1. Compute the yearly depreciation expense using straight-line depreciation.

A) $9,500

B) $9,000

C) $10,800

D) $11,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

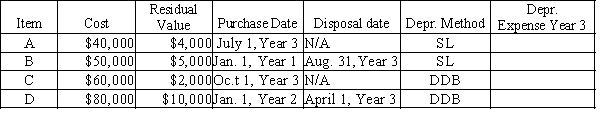

For each of the following fixed assets, determine the depreciation expense for Year 3:

Disposal date is N/A if asset is still in use.Method: SL = straight line; DDB = double declining balance

Assume the estimated life is 5 years for each asset.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be included in the acquisition cost of a piece of equipment?

A) transportation costs

B) installation costs

C) testing costs prior to placing the equipment into production

D) all of these

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a fixed asset with a book value of $10,000 is traded for a similar fixed asset, a trade-in allowance of $15,000 is granted by the seller, and the transaction is deemed to have commercial substance, the buyer would report a gain on exchange of fixed assets of $5,000.

B) False

Correct Answer

verified

True

Correct Answer

verified

Short Answer

Match each account name to the financial statement section (a-i) in which it would appear. -Land Improvements A)Current Assets B)Fixed Assets C)Intangible Assets D)Current Liability E)Long-Term Liability F)Owners' Equity G)Revenues H)Operating Expenses I)Other Income/Expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A fixed asset's estimated value at the time it is to be retired from service is called

A) book value

B) residual value

C) market value

D) carrying value

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the cost of land?

A) cost of paving a parking lot

B) brokerage commission

C) outdoor parking lot lighting attached to the land

D) fences on the land

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The double-declining-balance depreciation method calculates depreciation each year by taking twice the straight-line rate times the book value of the asset at the beginning of each year.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Classify each of the following costs associated with long-lived assets as one of the following: -Outdoor lighting at new business location A)Land improvements B)Buildings C)Land D)Machinery and equipment

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 243

Related Exams