A) $10,000

B) $10,150

C) $10,900

D) $9,100

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the maker of a note fails to pay the debt on the due date, the note is said to be dishonored.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a note is received from a customer on account, it is recorded by debiting Notes Receivable and crediting Accounts Receivable.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When using the analysis of receivables method for estimating uncollectible receivables, the amount computed in the analysis is usually the amount that would be recorded in the end-of-period adjusting entry.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

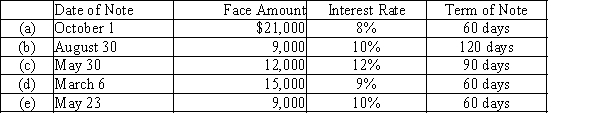

Determine the due date and the amount of interest due at maturity on the following notes:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts has a credit balance of $2,100 at the end of the year (before adjustment) , and an analysis of customers' accounts indicates uncollectible receivables of $19,700. Which of the following entries records the proper adjustment for bad debt expense?

A) debit Allowance for Doubtful Accounts, $17,600; credit Bad Debt Expense, $17,600

B) debit Allowance for Doubtful Accounts, $21,800; credit Bad Debt Expense, $21,800

C) debit Bad Debt Expense, $21,800; credit Allowance for Doubtful Accounts, $21,800

D) debit Bad Debt Expense, $17,600; credit Allowance for Doubtful Accounts, $17,600

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

On the basis of the following data related to assets due within one year for Webb Co., prepare a partial balance sheet in good form at December 31. Show total current assets.

Correct Answer

verified

Correct Answer

verified

Essay

At the end of the current year, Accounts Receivable has a balance of $550,000; Allowance for Doubtful Accounts has a credit balance of $5,500; and sales for the year total $2,500,000. An analysis of receivables estimates uncollectible receivables as $25,000. Determine (a) the amount of the adjusting entry for bad debt expense; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and (c) the net realizable value of accounts receivable.

Correct Answer

verified

Correct Answer

verified

True/False

No allowance account is used with the direct write-off method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The number of days' sales in receivables is an estimate of the length of time the accounts receivable have been outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The balance in Allowance for Doubtful Accounts at the end of the year includes the total of all accounts written off since the beginning of the year.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description to the appropriate term (a-h). -A note that is not paid when it is due A)Face amount B)Term C)Interest D)Maturity value E)Dishonored note F)Maker G)Notes receivable H)Interest rate

Correct Answer

verified

Correct Answer

verified

True/False

At the end of a period (before adjustment), Allowance for Doubtful Accounts has a credit balance of $5,000. The Accounts Receivable balance is analyzed by aging the accounts and the amount estimated to be uncollectible is $50,000. The amount to be recorded in the adjusting entry for the Bad Debt Expense is $45,000.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description to the appropriate term (a-h). -A formal, written instrument of credit that represents amounts due from customers A)Face amount B)Term C)Interest D)Maturity value E)Dishonored note F)Maker G)Notes receivable H)Interest rate

Correct Answer

verified

Correct Answer

verified

Short Answer

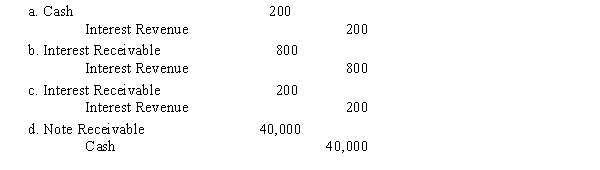

Harper Company lends Hewell Company $40,000 on March 1, accepting a four-month, 6% interest note. Harper Company prepares financial statements on March 31. What adjusting entry should be made before the financial statements can be prepared?

Correct Answer

verified

Correct Answer

verified

True/False

Receivables that are expected to be collected in cash in eighteen months or less are reported in the current asset section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two methods of accounting for uncollectible accounts are the

A) direct write-off method and the allowance method

B) allowance method and the accrual method

C) allowance method and the net realizable method

D) direct write-off method and the accrual method

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

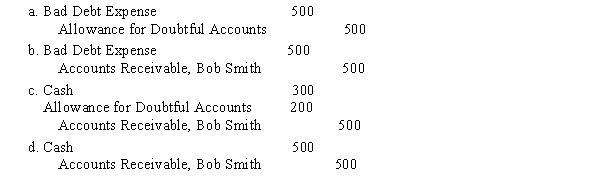

When a company uses the allowance method of accounting for uncollectible receivables, which entry would not be found in the general journal?

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description to the appropriate term (a-i). -A receivable created from selling merchandise or services on account A)Accounts receivable turnover B)Net realizable value C)Accounts receivable D)Aging report E)Receivables F)Direct write-off method G)Allowance for doubtful accounts H)Bad debt expense I)Factoring

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the direct write-off method of accounting for uncollectible accounts, Bad Debts Expense is debited

A) at the end of each accounting period

B) when a credit sale is past due

C) whenever a predetermined amount of credit sales have been made

D) when an account is determined to be worthless

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 210

Related Exams