B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of stockholders' equity shows

A) only beginning and ending common stock and beginning and ending balance of retained earnings

B) only changes to common stock and ending retained earnings

C) only beginning balances of common stock and retained earnings, and the effects of net income (loss) on retained earnings

D) beginning and ending balance of common stock, retained earnings and all the changes that result from issuing stock, net income (loss) , dividends

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

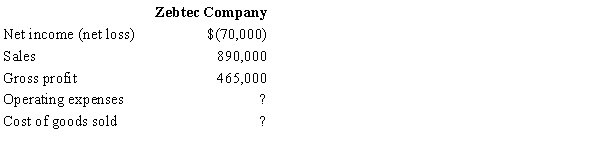

Find the missing amounts from the income statement data for Zebtec Company.

A) Operating expenses: $425,000; Cost of goods sold: $495,000

B) Operating expenses: $355,000; Cost of goods sold: $355,000

C) Operating expenses: $535,000; Cost of goods sold: $425,000

D) Operating expenses: $215,000; Cost of goods sold: $565,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A physical inventory at the end of June was $882,000. Estimated Returns Inventory is expected to increase to $16,500. What is Cerelat Co.'s income from operations for the year?

A) $136,000

B) $121,500

C) $105,000

D) $180,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

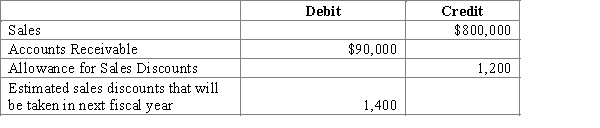

Surplus Galore uses the gross method of accounting for sales discounts. Selected data from its records for the year ended December 31 was as follows:  Journalize the adjusting entry for estimated sales discounts.

Journalize the adjusting entry for estimated sales discounts.

Correct Answer

verified

Correct Answer

verified

Short Answer

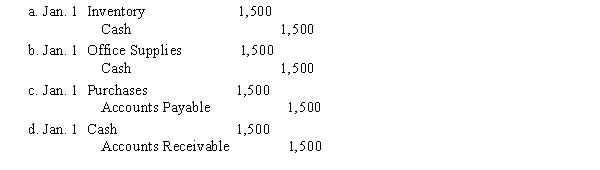

The journal entry to record the receipt of inventory purchased for cash in a perpetual inventory system would be

Correct Answer

verified

Correct Answer

verified

Essay

Prepare a statement of stockholders' equity for Fernandez Company. Additional common stock of $100,000 was issued during the year.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following items (a-h) with the appropriate definition below. -Informs the seller of the reasons for the return of merchandise or the request for a price allowance. A)Freight B)Delivery Expense C)Inventory D)Sales discount E)Purchases Returns and Allowances F)Debit memo G)Purchases discount H)Trade discount

Correct Answer

verified

Correct Answer

verified

Multiple Choice

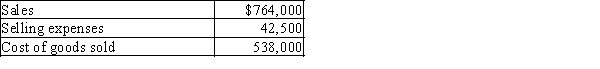

Calculate the gross profit for Jefferson Company based on the following:

A) $495,500

B) $183,500

C) $721,500

D) $226,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A retailer purchases merchandise with a catalog list price of $30,000. The retailer receives a 15% trade discount and has credit terms of 2/10, n/30. How much cash will be needed to pay this invoice within the discount period?

A) $30,000

B) $24,900

C) $29,400

D) $24,990

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the perpetual inventory system is used, the inventory sold is shown on the income statement as

A) cost of goods sold

B) purchases

C) purchases returns and allowances

D) net purchases

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following terms (a-h) with the correct definition below. -Inventory system that updates the inventory account for every purchase and sale transaction. A)Credit terms B)FOB destination C)FOB shipping point D)Periodic inventory system E)Perpetual inventory system F)Inventory shrinkage G)Single-step income statement H)Multiple-step income statement

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If title to merchandise purchases passes to the buyer when the goods are shipped from the seller, the terms are

A) n/30

B) FOB shipping point

C) FOB destination

D) consigned

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the correct amounts missing from the condensed income statement of Batavia, Inc.?

A) Net income: $545,000; Gross profit: $740,000

B) Net income: $545,000; Gross profit: $545,000

C) Net income: $420,000; Gross profit: $740,000

D) Net income: $420,000; Gross profit: $545,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following items (a-h) with the appropriate definition below. -Account used to record inventory on hand under a perpetual inventory system. A)Freight B)Delivery Expense C)Inventory D)Sales discount E)Purchases Returns and Allowances F)Debit memo G)Purchases discount H)Trade discount

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If title to merchandise purchases passes to the buyer when the goods are delivered to the buyer, the terms are

A) consigned

B) n/30

C) FOB shipping point

D) FOB destination

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

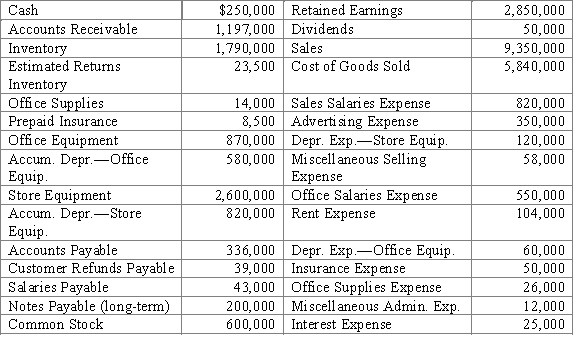

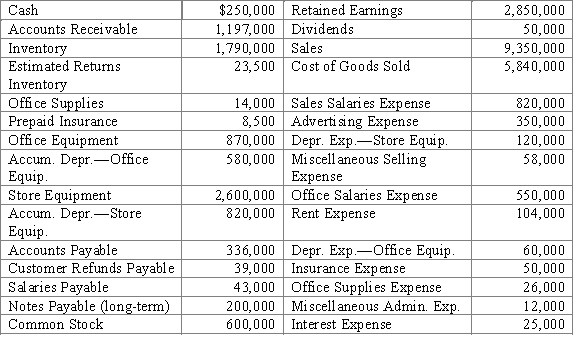

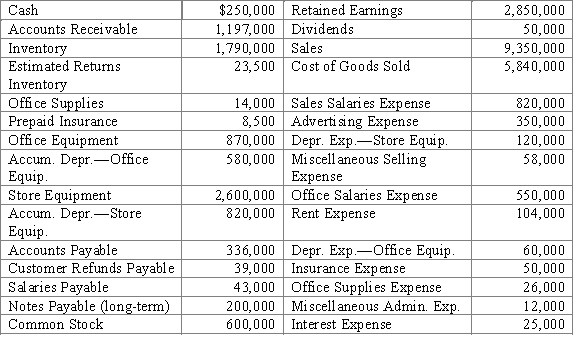

The following selected accounts and their current balances appear in the ledger of Fernandez Co. at the end of its fiscal year.  -What are total operating expenses for Fernandez Co.?

-What are total operating expenses for Fernandez Co.?

A) $2,175,000

B) $2,150,000

C) $3,510,000

D) $1,348,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following selected accounts and their current balances appear in the ledger of Fernandez Co. at the end of its fiscal year.  -What is Fernandez Company's income from operations for the year?

-What is Fernandez Company's income from operations for the year?

A) $1,335,000

B) $2,162,000

C) $3,510,000

D) $1,360,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If merchandise sells for $3,500, with terms of 3/15, n/45, and the cost of the inventory sold is $2,100, the amount charged to sales is

A) $3,395

B) $3,500

C) $2,037

D) $2,100

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following selected accounts and their current balances appear in the ledger of Fernandez Co. at the end of its fiscal year.  -What is Fernandez Company's ending retained earnings balance for the year?

-What is Fernandez Company's ending retained earnings balance for the year?

A) $4,135,000

B) $4,210,000

C) $3,510,000

D) $4,260,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 273

Related Exams