A) The Capital Market Line (CML) is a curved line that connects the risk-free rate and the market portfolio.

B) The slope of the CML is ( M - rRF) /bM.

C) All portfolios that lie on the CML to the right of M are inefficient.

D) All portfolios that lie on the CML to the left of M are inefficient.

E) The slope of the CML is ( M - rRF) / M..

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A stock with a beta equal to -1.0 has zero systematic (or market) risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

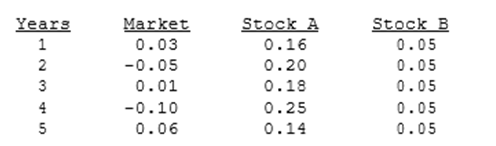

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B. Which of the possible answers best describes the historical betas for A and B?

A) .

B) .

C) .

D) .

E) .

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Y-axis intercept of the SML indicates the return on an individual asset when the realized return on an average (b = 1) stock is zero.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

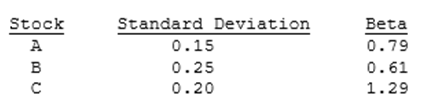

You have the following data on three stocks:  As a risk minimizer, you would choose Stock______ if it is to be held in isolation and Stock_________ if it is to be held as part of a well- diversified portfolio.

As a risk minimizer, you would choose Stock______ if it is to be held in isolation and Stock_________ if it is to be held as part of a well- diversified portfolio.

A) A; A.

B) A; B.

C) B; C.

D) C; A.

E) C; B.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In portfolio analysis, we often use ex post (historical) returns and standard deviations, despite the fact that we are interested in ex ante (future) data.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a potential problem with beta and its estimation?

A) Sometimes a security or project does not have a past history which can be used as a basis for calculating beta.

B) Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the “true” or “expected future” beta.

C) The beta of “the market,” can change over time, sometimes drastically.

D) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

E) There is a wide confidence interval around a typical stock’s estimated beta.

G) A) and B)

Correct Answer

verified

C

Correct Answer

verified

True/False

Arbitrage pricing theory is based on the premise that more than one factor affects stock returns, and the factors are specified to be (1) market returns, (2) dividend yields, and (3) changes in inflation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The slope of the SML is determined by the value of beta.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The typical R2 for a stock is about 0.3 and the typical R2 for a portfolio is also about 0.3.

B) The typical R2 for a stock is about 0.94 and the typical R2 for a portfolio is about 0.6.

C) The typical R2 for a stock is about 0.3 and the typical R2 for a large portfolio is about 0.94.

D) The typical R2 for a stock is about 0.94 and the typical R2 for a portfolio is also about 0.94.

E) The typical R2 for a stock is about 0.6 and the typical R2 for a portfolio is also about 0.6.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The SML relates required returns to firms' systematic (or market) risk. The slope and intercept of this line can be influenced by managerial actions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

We will almost always find that the beta of a diversified portfolio is less stable over time than the beta of a single security.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

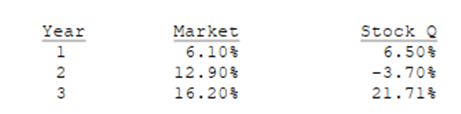

You are given the following returns on "the market" and Stock Q during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.)

A)

B)

C)

D)

E)

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for a firm to have a positive beta, even if the correlation between its returns and those of another firm are negative.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is a multi-period model which takes account of differences in securities' maturities, and it can be used to determine the required rate of return for any given level of systematic risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If investors are risk averse and hold only one stock, we can conclude that the required rate of return on a stock whose standard deviation is 0.21 will be greater than the required return on a stock whose standard deviation is 0.10. However, if stocks are held in portfolios, it is possible that the required return could be higher on the low standard deviation stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a diversified portfolio consisting of a $5,000 investment in each of 20 different common stocks. The portfolio beta is equal to 1.12. You have decided to sell a lead mining stock (b = 1.00) at $5,000 net and use the proceeds to buy a like amount of a steel company stock (b = 2.00) . What is the new beta of the portfolio?

A) 1.1139

B) 1.1700

C) 1.2311

D) 1.2927

E) 1.3573

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of Selleck & Company against those of the market and found that the slope of your line was negative, the CAPM would indicate that the required rate of return on Selleck's stock should be less than the risk-free rate for a well-diversified investor, assuming that the observed relationship is expected to continue in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the returns of two firms are negatively correlated, then one of them must have a negative beta.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A's beta is 1.5 and Stock B's beta is 0.5. Which of the following statements must be true about these securities? (Assume market equilibrium.)

A) When held in isolation, Stock A has greater risk than Stock B.

B) Stock B must be a more desirable addition to a portfolio than Stock A.

C) Stock A must be a more desirable addition to a portfolio than Stock B.

D) The expected return on Stock A should be greater than that on Stock B.

E) The expected return on Stock B should be greater than that on Stock A.

G) D) and E)

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 25

Related Exams