Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeted finished goods inventory and cost of goods sold for a manufacturing company for the year are as follows: January 1 finished goods, $765,000; December 31 finished goods, $640,000; and cost of goods sold, $2,560,000. The budgeted costs of goods manufactured is

A) $1,405,000

B) $2,560,000

C) $2,435,000

D) $3,965,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The production budget is the starting point for preparation of the direct labor cost budget.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

To meet projected annual sales, Bluegill Manufacturers, Inc. needs to produce 75,000 machines for the year. The estimated January 1 inventory is 7,000 units, and the desired December 31 inventory is 12,000 units. What are projected sales units for the year?

Correct Answer

verified

Correct Answer

verified

True/False

If Division Inc. expects to sell 200,000 units in the current year, desires ending inventory of 24,000 units, and has 22,000 units on hand as of the beginning of the year, the budgeted volume of production for the year is 198,000 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budget that summarizes future plans for the acquisition of fixed assets is

A) direct materials purchases budget

B) production budget

C) sales budget

D) capital expenditures budget

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The master budget of a small manufacturer would normally include all necessary component budgets except the budgeted balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Employees view budgeting more positively when goals are established for them by senior management.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Star Co. was organized on August 1 of the current year. Projected sales for the next three months are as follows:  The company expects to sell 50% of its merchandise for cash. Of the sales on account, 30% are expected to be collected in the month of the sale and the remainder in the following month.

Prepare a schedule indicating cash collections for August, September, and October.

The company expects to sell 50% of its merchandise for cash. Of the sales on account, 30% are expected to be collected in the month of the sale and the remainder in the following month.

Prepare a schedule indicating cash collections for August, September, and October.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeting process does not involve which of the following activities?

A) Specific goals are established.

B) Periodic comparison of actual results to goals.

C) Execution of plans to achieve goals.

D) Increase in sales by increasing marketing efforts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Production and sales estimates for June are as follows:  The number of units expected to be manufactured in June is

The number of units expected to be manufactured in June is

A) 11,000

B) 12,500

C) 15,500

D) 13,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

After the sales budget is prepared, the production budget is normally prepared next.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

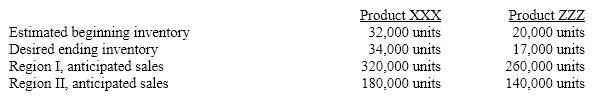

Below is budgeted production and sales information for Flushing Company for the month of December:  The unit selling price for product XXX is $5 and for product ZZZ is $15.

Budgeted production for product ZZZ during the month is:

The unit selling price for product XXX is $5 and for product ZZZ is $15.

Budgeted production for product ZZZ during the month is:

A) 403,000 units

B) 380,000 units

C) 397,000 units

D) 417,000 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When management seeks to achieve personal departmental objectives that may work to the detriment of the entire company, the manager is experiencing

A) budgetary slack

B) padding

C) goal conflict

D) cushions

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fashion Jeans, Inc. sells two lines of jeans-Simple Life and Fancy Life. Simple Life sells for $85, and Fancy Life sells for $100. The company sells all of its jeans on credit and estimates that 60% is collected in the month of the sale, 35% is collected in the following month, and the rest is considered to be uncollectible. The estimated sales for Simple are: January, 20,000 pairs of jeans; February, 27,500 pairs of jeans; and March, 25,000 pairs of jeans. The estimated sales for Fancy are: January, 18,000 pairs of jeans; February, 19,000 pairs of jeans; and March, 20,500 pairs of jeans. What are the expected cash receipts for the month of March?

A) $3,988,125

B) $2,505,000

C) $2,125,000

D) $4,175,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the expected sales volume for the current period is 9,000 units, the desired ending inventory is 200 units, and the beginning inventory is 300 units, the number of units set forth in the production budget, representing total production for the current period, is

A) 9,000

B) 8,900

C) 8,700

D) 9,100

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the expected sales volume for the current period is 8,000 units, the desired ending inventory is 1,400 units, and the beginning inventory is 1,200 units, the number of units set forth in the production budget, representing total production for the current period, is

A) 10,600

B) 8,200

C) 66,000

D) 6,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

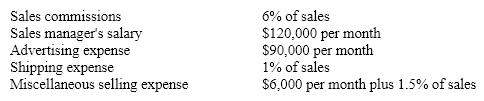

Short Answer

Prepare a monthly flexible selling expense budget for Cottonwood Company for sales volumes of $300,000, $350,000, and $400,000, based on the following data

Correct Answer

verified

Correct Answer

verified

True/False

The responsibility for coordinating the preparation of a master budget should be assigned to the CEO of a firm.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Sleep Tight manufactures comforters. The estimated inventories on January 1 for finished goods, work in process, and materials were $39,000, $33,000, and $27,000, respectively. The desired inventories on December 31 for finished goods, work in process, and materials were $42,000, $35,000, and $21,000, respectively. Direct material purchases were $575,000, direct labor was $212,000 for the year, and factory overhead was $156,000. Prepare a cost of goods sold budget for Sleep Tight, Inc.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 182

Related Exams