B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

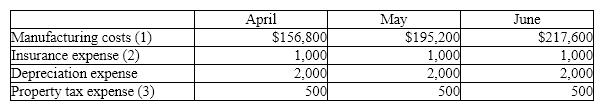

Finch Company began its operations on March 31 of the current year. Finch has the following projected costs:  (1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.

(2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the

quarter, (i.e., January, April, July, and October) .

(3) Property tax is paid once a year in November.

The cash payments expected for Finch Company in the month of April are

(1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.

(2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the

quarter, (i.e., January, April, July, and October) .

(3) Property tax is paid once a year in November.

The cash payments expected for Finch Company in the month of April are

A) $122,600

B) $120,600

C) $123,100

D) $121,100

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

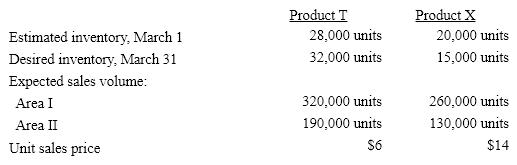

Based on the following production and sales data of Frixion Co. for March of the current year, prepare:

(a) a sales budget

(b) a production budget.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gilbert's expects its September sales to be 20% higher than its August sales of $150,000. Manufacturing costs were $100,000 in August and are expected to be $120,000 in September. All sales are on credit and are collected as follows: 30% in the month of the sale and 70% in the following month. Payments of manufacturing costs are as follows: 25% in the month of production and 75% in the following month. The beginning cash balance on September 1 is $7,500. The ending balance on September 30 would be

A) $61,500

B) $75,000

C) $72,300

D) $71,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For March, sales revenue is $1,000,000; sales commissions are 5% of sales; the sales manager's salary is $80,000; advertising expenses are $65,000; shipping expenses total 1% of sales; and miscellaneous selling expenses are $2,100 plus 1% of sales. Total selling expenses for the month of March are

A) $217,100

B) $205,000

C) $207,100

D) $142,100

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Production and sales estimates for April are as follows:  The number of units expected to be manufactured in April is

The number of units expected to be manufactured in April is

A) 11,000

B) 9,500

C) 12,000

D) 13,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

At the beginning of the period, the Cutting Department budgeted direct labor of $30,000 and supervisor salaries of $20,000 for 3,000 hours of production. The department actually completed 5,000 hours of production. Determine the budget for the department assuming that it uses flexible budgeting.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of January 1 of the current year, the Grackle Company had accounts receivables of $50,000. The sales for January, February, and March were as follows: $120,000, $140,000, and $150,000, respectively. Of each month's sales, 20% are for cash. Of the remaining 80% (the credit sales) , 60% are collected in the month of sale, with the remaining 40% collected in the following month. What is the total cash collected (both from accounts receivable and for cash sales) in the month of February?

A) $129,600

B) $62,400

C) $133,600

D) $91,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A series of budgets for varying rates of activity is termed a(n)

A) flexible budget

B) variable budget

C) master budget

D) activity budget

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Detailed supplemental schedules based on department responsibility are often prepared for major items in the operating expenses budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following budgets allow for adjustments in activity levels?

A) static budget

B) continuous budget

C) zero-based budget

D) flexible budget

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Production and sales estimates for June are as follows:  The budgeted total sales for June is

The budgeted total sales for June is

A) $225,000

B) $500,000

C) $525,000

D) $200,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Flexible budgeting requires all levels of management to start from zero and estimate sales, production, and other operating data as though operations were being started for the first time.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

The Ruff Jeans Company produces two different types of jeans, Simple Life, and Fancy Life. The company sales budget estimates that 350,000 of the Simple Life jeans and 200,000 of the Fancy Life jeans will be sold during the current year. The production budget requires 353,500 units of Simple Life and 196,000 Fancy Life be manufactured. The Simple Life jeans require 3 yards of denim material, a zipper, and 25 yards of thread. The Fancy Life jeans require 4.5 yards of denim material, a zipper, and 40 yards of thread. Each yard of denim material costs $3.25, the zipper costs $0.75 each, and the thread is $0.02 per yard. There is enough material to make 2,000 jeans of each type at the beginning of the year. The desired amount of materials left in ending inventory is to have enough to manufacture 3,500 jeans of each type. Prepare a direct materials purchases budget.

Correct Answer

verified

Correct Answer

verified

True/False

The sales budget is the starting point for preparation of the direct labor cost budget.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A formal written statement of management's plans for the future, expressed in financial terms, is called a budget.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The budgeted volume of production is normally computed as the sum of (1) the expected sales volume and (2) the desired ending inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The budgeted direct materials purchases is based on the sum of (1) the materials needed for production and (2) the desired ending materials inventory, less (3) the estimated beginning materials inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The financial budgets of a business include the cash budget, the budgeted income statement, and the budgeted balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Kid's World Industries has projected sales of 67,000 machines for the current year. The estimated January 1 inventory is 6,000 units, and the desired December 31 inventory is 15,000 units. What is the budgeted production (in units) for the year?

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 182

Related Exams