B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The production budgets are used to prepare which of the following budgets?

A) operating expenses

B) direct materials purchases, direct labor cost, and factory overhead cost

C) sales in dollars

D) sales in units

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the beginning of the period, the Cutting Department budgeted direct labor of $155,000, direct materials of $165,000, and fixed factory overhead of $15,000 for 9,000 hours of production. The department actually completed 10,000 hours of production. What is the appropriate total budget for the department, assuming it uses flexible budgeting?

A) $416,000

B) $370,556

C) $368,889

D) $335,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of January 1 of the current year, the Grackle Company had accounts receivables of $50,000. The sales for January, February, and March were as follows: $120,000, $140,000, and $150,000, respectively. Of each month's sales, 20% are for cash. Of the remaining 80% (the credit sales) , 60% are collected in the month of sale, with the remaining 40% collected in the following month. What is the total cash collected (both from accounts receivable and cash sales) in the month of March?

A) $74,800

B) $146,800

C) $102,000

D) $116,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The Tough Jeans Company produces two different styles of jeans, Working Life and Social Life. The company sales budget estimates that 400,000 of the Working Life jeans and 250,000 of the Social Life jeans will be sold during the year. The company begins with 9,000 pairs of Working Life and 18,000 pairs of Social Life. The company desires ending inventory of 7,500 of Working Life and 10,000 Social Life. Prepare a production budget for the year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

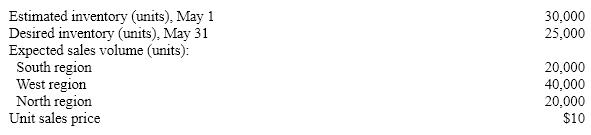

Based on the following production and sales estimates for May, determine the number of units expected to be manufactured in May.

A) 85,000

B) 80,000

C) 75,000

D) 105,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In preparing flexible budgets, the first step is to identify the fixed and variable components of the various costs and expenses being budgeted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

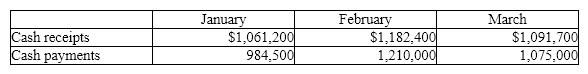

A company is preparing its cash budget. Its cash balance on January 1 is $290,000 and it has a minimum cash requirement of $340,000. The following data has been provided:  What is the amount of the deficiency or excess cash (after considering the minimum cash balance required) for January?

What is the amount of the deficiency or excess cash (after considering the minimum cash balance required) for January?

A) excess of $26,700

B) deficiency of $136,700

C) excess of $356,700

D) excess of $60,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

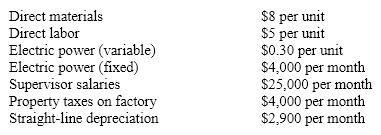

Rodger's Cabinet Manufacturers uses flexible budgets that are based on the following manufacturing data for the month of July:  Prepare a flexible budget for Rodger's based on production of 10,000, 15,000, and 20,000 units.

Prepare a flexible budget for Rodger's based on production of 10,000, 15,000, and 20,000 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Next year's sales forecast shows that 20,000 units of Product A and 22,000 units of Product B are going to be sold for prices of $10 and $12 per unit, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2,500 units. The desired ending inventory of B is 3,000 units. Total budgeted sales of both products for the year would be

A) $42,000

B) $200,000

C) $264,000

D) $464,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The budget procedure that requires all levels of management to start from zero in estimating sales, production, and other operating data is called zero-based budgeting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cardinal Company had a finished goods inventory of 55,000 units on January 1. Its projected sales for the next four months were: January - 200,000 units; February - 180,000 units; March - 210,000 units; and April - 230,000 units. The Cardinal Company wishes to maintain a desired ending finished goods inventory of 20% of the following months sales. What is the budgeted units of inventory for March 31?

A) 46,000

B) 36,000

C) cannot be determined from the data given

D) 42,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tara Company's budget shows the following credit sales for the current year: September, $25,000; October, $36,000; November, $30,000; December, $32,000. Experience has shown that payment for credit sales is received as follows: 15% in the month of sale, 60% in the first month after sale, 20% in the second month after sale, and 5% is uncollectible. How much cash will Tara Company expect to collect in November as a result of current and past credit sales?

A) $19,700

B) $28,400

C) $30,000

D) $31,100

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heedy Company is trying to decide how many units of merchandise to produce each month. The company policy is to have 20% of the next month's sales in inventory at the end of each month. Projected sales for August, September, and October are 30,000 units, 20,000 units, and 40,000 units, respectively. How many units must be produced in September?

A) 24,000

B) 18,000

C) 28,000

D) 22,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage of static budgets is that they

A) are dependent on previous year's actual results

B) cannot be used by service companies

C) do not show possible changes in underlying activity levels

D) show the expected results of a responsibility center for several levels of activity

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cardinal Company had a finished goods inventory of 55,000 units on January 1. Its projected sales for the next four months were: January - 200,000 units; February - 180,000 units; March - 210,000 units; and April - 230,000 units. The Cardinal Company wishes to maintain a desired ending finished goods inventory of 20% of the following months sales. What is the budgeted units of production for January?

A) 236,000

B) 181,000

C) 200,000

D) 219,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The capital expenditures budget details future plans for acquisition of fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

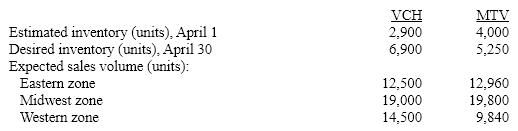

Diamond Company manufactures two models of cassette recorders, VCH and MTV. Based on the following production data for April, prepare a production budget.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

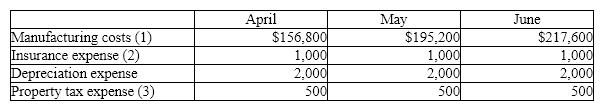

Finch Company began its operations on March 31 of the current year. Finch has the following projected costs:  (1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.

(2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the

quarter, (i.e., January, April, July, and October) .

(3) Property tax is paid once a year in November.

The cash payments expected for Finch Company in the month of May are

(1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.

(2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the

quarter, (i.e., January, April, July, and October) .

(3) Property tax is paid once a year in November.

The cash payments expected for Finch Company in the month of May are

A) $185,600

B) $149,900

C) $187,600

D) $189,100

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

At the beginning of the period, the Molding Department budgeted direct labor of $33,000 and supervisor salaries of $24,000 for 3,000 hours of production. The department actually completed 2,500 hours of production. Determine the budget for the department assuming that it uses flexible budgeting?

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 182

Related Exams