A) market risk

B) unique risk

C) unsystematic risk

D) none of these options (With a correlation of 1, no risk will be reduced.)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The portfolio with the lowest standard deviation for any risk premium is called the_______.

A) CAL portfolio

B) efficient frontier portfolio

C) global minimum variance portfolio

D) optimal risky portfolio

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following provides the best example of a systematic-risk event?

A) A strike by union workers hurts a firm's quarterly earnings.

B) Mad Cow disease in Montana hurts local ranchers and buyers of beef.

C) The Federal Reserve increases interest rates 50 basis points.

D) A senior executive at a firm embezzles $10 million and escapes to South America.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The part of a stock's return that is systematic is a function of which of the following variables? I. Volatility in excess returns of the stock market II. The sensitivity of the stock's returns to changes in the stock market III. The variance in the stock's returns that is unrelated to the overall stock market

A) I only

B) I and II only

C) II and III only

D) I, II, and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Market risk is also called ________ and ________.

A) systematic risk; diversifiable risk

B) systematic risk; nondiversifiable risk

C) unique risk; nondiversifiable risk

D) unique risk; diversifiable risk

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a stock portfolio and a bond portfolio have a zero correlation. This means that ________.

A) the returns on the stock and bond portfolios tend to move inversely

B) the returns on the stock and bond portfolios tend to vary independently of each other

C) the returns on the stock and bond portfolios tend to move together

D) the covariance of the stock and bond portfolios will be positive

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately how many securities does it take to diversify almost all of the unique risk from a portfolio?

A) 2

B) 6

C) 8

D) 20

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio of stocks fluctuates when the Treasury yields change. Since this risk cannot be eliminated through diversification, it is called ________.

A) firm-specific risk

B) systematic risk

C) unique risk

D) none of the options

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has a 50% chance of doubling your investment in 1 year and a 50% chance of losing half your money. What is the expected return on this investment project?

A) 0%

B) 25%

C) 50%

D) 75%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor does not diversify his portfolio and instead puts all of his money in one stock, the appropriate measure of security risk for that investor is the ________.

A) stock's standard deviation

B) variance of the market

C) stock's beta

D) covariance with the market index

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected return of a portfolio is 8.9%, and the risk-free rate is 3.5%. If the portfolio standard deviation is 12%, what is the reward-to-variability ratio of the portfolio?

A) 0

B) .45

C) .74

D) 1.35

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. The standard deviation of returns on the optimal risky portfolio is ________.

A) 25.5%

B) 22.3%

C) 21.4%

D) 20.7%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You find that the annual Sharpe ratio for stock A returns is equal to 1.8. For a 3-year holding period, the Sharpe ratio would equal ________.

A) 1.8

B) 2.48

C) 3.12

D) 5.49

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The optimal risky portfolio can be identified by finding: I. The minimum-variance point on the efficient frontier II. The maximum-return point on the efficient frontier and the minimum-variance point on the efficient frontier III. The tangency point of the capital market line and the efficient frontier IV. The line with the steepest slope that connects the risk-free rate to the efficient frontier

A) I and II only

B) II and III only

C) III and IV only

D) I and IV only

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

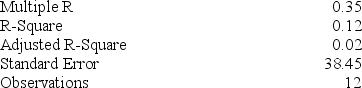

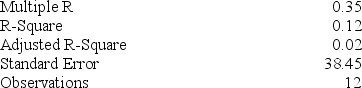

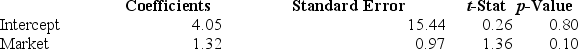

You run a regression for a stock's return on a market index and find the following Excel output:

The characteristic line for this stock is Rstock = ________ + ________ Rmarket.

The characteristic line for this stock is Rstock = ________ + ________ Rmarket.

A) .35; .12

B) 4.05; 1.32

C) 15.44; .97

D) .26; 1.36

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

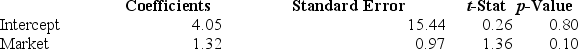

You run a regression for a stock's return on a market index and find the following Excel output:

The stock is ________ riskier than the typical stock.

The stock is ________ riskier than the typical stock.

A) 32%

B) 15.44%

C) 12%

D) 38%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

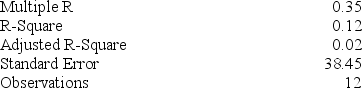

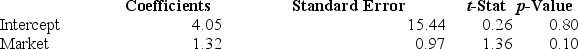

You run a regression for a stock's return on a market index and find the following Excel output:

________ % of the variance is explained by this regression.

________ % of the variance is explained by this regression.

A) 12

B) 35

C) 4.05

D) 80

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

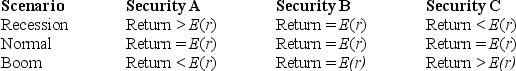

Based on the outcomes in the following table, choose which of the statements below is (are) correct?

I. The covariance of security A and security B is zero.

II. The correlation coefficient between securities A and C is negative.

III. The correlation coefficient between securities B and C is positive.

I. The covariance of security A and security B is zero.

II. The correlation coefficient between securities A and C is negative.

III. The correlation coefficient between securities B and C is positive.

A) I only

B) I and II only

C) II and III only

D) I, II, and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correlation coefficients will produce the most diversification benefits?

A) -.6

B) -.9

C) 0

D) .4

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To construct a riskless portfolio using two risky stocks, one would need to find two stocks with a correlation coefficient of ________.

A) -0.5

B) 0.0

C) 0.5

D) -1.0

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 89

Related Exams