A) interest rate management

B) immunization

C) convexity management

D) intermarket spread swap

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The duration of a portfolio of bonds can be calculated as ________.

A) the coupon weighted average of the durations of the individual bonds in the portfolio

B) the yield weighted average of the durations of the individual bonds in the portfolio

C) the value weighted average of the durations of the individual bonds in the portfolio

D) averages of the durations of the longest- and shortest-duration bonds in the portfolio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Market economists all predict a rise in interest rates. An astute bond manager wishing to maximize her capital gain might employ which strategy?

A) Switch from low-duration to high-duration bonds.

B) Switch from high-duration to low-duration bonds.

C) Switch from high-grade to low-grade bonds.

D) Switch from low-coupon to high-coupon bonds.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You find a 5-year AA Xerox bond priced to yield 6%. You find a similar-risk 5-year Canon bond priced to yield 6.5%. If you expect interest rates to rise, which of the following should you do?

A) Short the Canon bond, and buy the Xerox bond.

B) Buy the Canon bond, and short the Xerox bond.

C) Short both the Canon bond and the Xerox bond.

D) Buy both the Canon bond and the Xerox bond.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A forecast of bond returns based largely on a prediction of the yield curve at the end of the investment horizon is called a ________.

A) contingent immunization

B) dedication strategy

C) duration analysis

D) horizon analysis

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When interest rates increase, the duration of a 20-year bond selling at a premium ________.

A) increases

B) decreases

C) remains the same

D) increases at first and then declines

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a pure yield pickup swap, ________ bonds are exchanged for ________ bonds.

A) longer-duration; shorter-duration

B) shorter-duration; longer-duration

C) high-coupon; high-yield

D) low-yield; high-yield

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duration is a concept that is useful in assessing a bond's ________.

A) credit risk

B) liquidity risk

C) price volatility

D) convexity risk

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A zero-coupon bond is selling at a deep discount price of $430. It matures in 13 years. If the yield to maturity of the bond is 6.7%, what is the duration of the bond?

A) 6.7 years

B) 8 years

C) 10 years

D) 13 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Convexity implies that duration predictions: I. Underestimate the percentage increase in bond price when the yield falls. II. Underestimate the percentage decrease in bond price when the yield rises. III. Overestimate the percentage increase in bond price when the yield falls. IV. Overestimate the percentage decrease in bond price when the yield rises.

A) I and III only

B) II and IV only

C) I and IV only

D) II and III only

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is an important characteristic of the relationship between bond prices and yields.

A) Convexity

B) Concavity

C) Complexity

D) Linearity

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

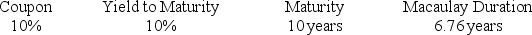

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

The modified duration for the Steel Pier bond is ________.

The modified duration for the Steel Pier bond is ________.

A) 6.15 years

B) 5.95 years

C) 6.49 years

D) 9.09 years

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because of convexity, when interest rates change, the actual bond price will ________ the bond price predicted by duration.

A) always be higher than

B) sometimes be higher than

C) always be lower than

D) sometimes be lower than

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of bond convexity, an increase in a bond's price when yield to maturity falls is ________ the price decrease resulting from an increase in yield of equal magnitude.

A) greater than

B) equivalent to

C) smaller than

D) The answer cannot be determined from the information given.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond portfolio manager notices a hump in the yield curve at the 5-year point. How might a bond manager take advantage of this event?

A) Buy the 5-year bonds, and short the surrounding maturity bonds.

B) Buy the 5-year bonds, and buy the surrounding maturity bonds.

C) Short the 5-year bonds, and short the surrounding maturity bonds.

D) Short the 5-year bonds, and buy the surrounding maturity bonds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 20-year maturity corporate bond has a 6.5% coupon rate (the coupons are paid annually) . The bond currently sells for $925.50. A bond market analyst forecasts that in 5 years yields on such bonds will be at 7%. You believe that you will be able to reinvest the coupons earned over the next 5 years at a 6% rate of return. What is your expected annual compound rate of return if you plan on selling the bond in 5 years?

A) 7.37%

B) 7.56%

C) 8.12%

D) 8.54%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ________ investment strategy takes market prices of securities as set fairly.

A) passive

B) active

C) interest rate focused

D) convex

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of cash flow matching and dedicated strategies include: I. Once the cash flows are matched, there is no need for rebalancing. II. Cash flow matching typically earns a higher rate of return than active bond portfolio management. III. Financial institutions' liabilities often exceed the maturity of available bonds, making cash matching even more desirable.

A) I only

B) II only

C) I and III only

D) I, II, and III

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have an investment that in today's dollars returns 15% of your investment in year 1, 12% in year 2, 9% in year 3, and the remainder in year 4. What is the duration of this investment?

A) 4 years

B) 3.5 years

C) 3.22 years

D) 2.95 years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond swap made in response to forecasts of interest rate changes is called ________.

A) a substitution swap

B) an intermarket spread swap

C) a rate anticipation swap

D) a pure yield pickup swap

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 90

Related Exams