A) The United States has a more equal distribution of income than other developed countries such as Japan and Germany.

B) The statement "a rising tide lifts all boats" illustrates how economic growth reduces the number of people with income levels below the poverty line.

C) The economic life cycle explains why people base spending decisions on transitory income.

D) The libertarian political philosophy follows the maximin criterion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poverty is correlated with

A) race.

B) age.

C) family composition.

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the doctrine of liberalism,principles of justice are the result of

A) fair agreement and bargain.

B) command-and-control policies.

C) domination of the powerful by the weak.

D) workers owning the factors of production.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility refers to the

A) government's attempt to distribute monetary assistance to areas most in need.

B) ability of families to freely relocate to find good jobs.

C) movement of people among income classes.

D) movement of resources from one country to another.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following does not explain why data on income distribution and the poverty rate give an incomplete picture of inequality?

A) in-kind transfers

B) economic life cycle

C) transitory income

D) All of the above contribute to an incomplete picture of inequality.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that income is subject to increasing marginal utility.From a utilitarian perspective,

A) some income redistribution from rich to poor would increase social welfare.

B) some income redistribution from poor to rich would increase social welfare.

C) any income redistribution would probably reduce social welfare.

D) any income redistribution would probably increase social welfare.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert Nozick criticizes Rawls' concept of justice by using an example of

A) minimum wage laws.

B) the grade distribution in an economics class.

C) a leaky bucket.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The founders of utilitarianism include

A) a.C.Pigou and John Maynard Keynes.

B) Jeremy Bentham and John Stuart Mill.

C) Augustin Cournot and Jean B.Say.

D) A.Kondratieff and Thomas Malthus.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to explain why young children in developing countries often work?

A) Their parents want them to gain valuable work experience.

B) Their parents do not view education as important.

C) Their families are poor.

D) Their families' religious practices encourage child labor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Measurements of income inequality usually do not include in-kind transfers.

B) Measurements of income inequality use lifetime incomes rather than annual incomes.

C) Measurements of income inequality would be more meaningful if they reflected permanent rather than current income.

D) Poverty is long-term problem for relatively few families.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The elderly represent the largest demographic group in poverty.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

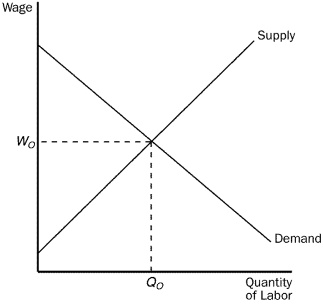

Figure 20-3

-Refer to Figure 20-3.If the government imposes a minimum wage above Wₒ,it is likely to

-Refer to Figure 20-3.If the government imposes a minimum wage above Wₒ,it is likely to

A) increase employment to a level above Qₒ.

B) reduce employment to a level below Qₒ.

C) provide more income to the working poor than they collectively received before the minimum wage was set.

D) have no effect on employment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"The government should choose policies deemed to be just,as evaluated by an impartial observer behind a 'veil of ignorance.'" This statement is most closely associated with which political philosophy?

A) liberalism

B) utilitarianism

C) libertarianism

D) welfarism

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Welfare programs may encourage illegitimate births.

B) The decline in welfare benefits since the 1970s has been associated with a decline in the percentage of children living with a single parent.

C) Welfare programs may reduce incentives for people to work.

D) A negative income tax program uses tax revenues collected from high-income families to provide cash subsidies to low-income families.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on U.S.income data from 2003,approximately what percent of all income did the bottom fifth of all families receive?

A) 48 percent

B) 21 percent

C) 10 percent

D) 4 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2003,the poverty rate in the United States was 12.5 percent.This means that 12.5 percent

A) of the population had a total family income that fell below the poverty line.

B) of the population had a total family income that was above the poverty line.

C) of the population had individual adjusted gross income below the poverty rate.

D) of children were poor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of an in-kind transfer in comparison to a cash payment?

A) In-kind transfers cost less to administer than cash transfers.

B) In-kind transfers restrict the use of the benefit; thus, recipients receive necessities such as food and health care.

C) In-kind transfers are more efficient than cash transfers.

D) In-kind transfers give the recipient more utility than cash transfers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The measured poverty rate may not reflect the true extent of economic deprivation because it does not include some forms of government assistance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A disadvantage of a minimum-wage law is that it may benefit unskilled workers who are not low-income workers.

B) A disadvantage of a negative income tax program is that a poor person who chooses not to work many hours would receive a cash benefit.

C) A disadvantage of an Earned Income Tax Credit (EITC) is that a person who is unable to work due to a disability does not benefit from the program.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line reflects an annual income equal to approximately

A) five times the cost of providing an adequate diet.

B) four times the cost of providing an adequate diet.

C) three times the cost of providing an adequate diet.

D) two times the cost of providing an adequate diet.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 247

Related Exams