A) Accounts Receivable

B) Accounts Payable

C) Advertising Expense

D) Cash

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alpha sold $2,000 of services to Beta on credit.Beta promised to pay for it next month.Alpha will report a $2,000:

A) Accounts Receivable.

B) Account Payable.

C) increase in Cash, since Beta is sure to pay next month.

D) net loss.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not represent a financing activity?

A) Paying dividends to stockholders.

B) An investment of capital by the owners.

C) Borrowing money from a bank to purchase new equipment.

D) Buying supplies on account.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a company reports net income on the income statement,then the statement of cash flows will report the same amount as cash flows from operating activities for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Whackem-Smackem Software Company sold $11 million of computer games in its first year of operations.The company received payments of $7.5 million for these computer games.The company's income statement would report:

A) Accounts Receivable of $3.5 million.

B) expenses of $3.5 million.

C) Sales Revenue of $7.5 million.

D) Sales Revenue of $11 million.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost of doing business is referred to as a(n) ______ and it is necessary to earn ______.

A) revenue; assets

B) expense; revenue

C) liability; expenses

D) dividend; revenue

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Assets = Liabilities + Stockholders' Equity

B) Liabilities = Assets - Stockholders' Equity

C) Stockholders' Equity + Liabilities - Assets = 0

D) Assets = Liabilities - Stockholders' Equity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

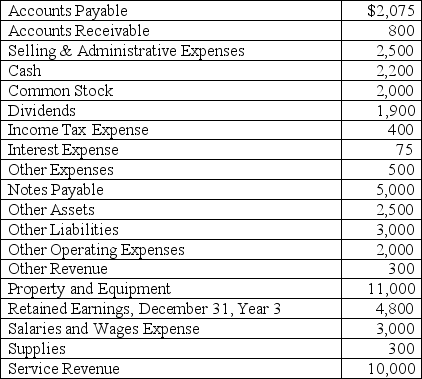

The following accounts are taken from the December 31, Year 4 financial statements of a company.

-Use the information above to answer the following question.What is the amount of total liabilities at the end of Year 4?

-Use the information above to answer the following question.What is the amount of total liabilities at the end of Year 4?

A) $7,075.

B) $10,075.

C) $9,075.

D) $12,975.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Managerial accounting reports prepared for internal use are used by the company's:

A) suppliers.

B) bank.

C) employees.

D) stockholders.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A stock that does not pay a dividend is an undesirable investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement reports:

A) the assets, liabilities, and stockholders' equity of a company.

B) cumulative earnings that have not been distributed to stockholders.

C) the amount of profit distributed to owners during the period.

D) the amount of revenues earned and expenses incurred during the period.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During its first year of operations,Widgets Incorporated reported Sales Revenue of $386,000 but collected only $303,000 from customers.At the end of the year,Accounts Receivable equal:

A) $689,000.

B) $386,000.

C) $303,000.

D) $83,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

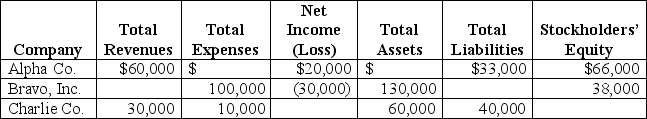

Essay

Each of the following independent companies is missing numerical data.

Required:

Use your knowledge of the financial statement equations and their interrelationships to fill in the missing amounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company earns net income,the company's Retained Earnings:

A) increase.

B) decrease.

C) are converted to cash.

D) are paid to stockholders.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the main goal of GAAP?

A) To help ensure that financial decisions are made in a professional and ethical manner.

B) To establish standards that help to prevent and detect fraudulent acts by management.

C) To ensure that the financial information produced by companies is useful to present and potential investors and other parties in making decisions.

D) To oversee the stock exchanges and financial reporting by public companies in the United States.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main goal of both U.S.GAAP and IFRS is to:

A) ensure that companies produce useful information for capital providers.

B) reduce the number of required financial statements.

C) prevent all fraud and ensure the amounts reported are precise to the penny.

D) ensure that companies become more profitable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

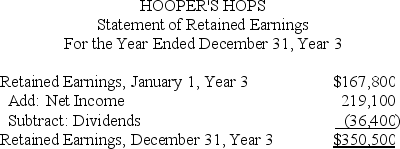

Which of the following statements about this statement of retained earnings is not correct?

A) Retained earnings of $350,500 will appear on the balance sheet as of December 31, Year 3.

B) The net income in the above statement came from the income statement for the year ending December 31, Year 3.

C) Dividends are shown in parentheses because they are distributions of earnings to the stockholders.

D) The ending retained earnings amount represents the amount of cash at the end of Year 3.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expressions of the accounting equation is correct?

A) Liabilities + Assets = Stockholder's Equity

B) Stockholder's Equity + Assets = Liabilities

C) Assets = Liabilities - Stockholder's Equity

D) Stockholder's Equity = Assets - Liabilities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Stockholders' equity is the difference between a company's assets and its liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement would report the amount of:

A) cash at the end of the year.

B) supplies used up during the current year.

C) dividends distributed to owners during the current year.

D) unpaid employee wages at the end of the year.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 211

Related Exams