A) the risk-return tradeoff.

B) insurance.

C) diversification.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine that someone offers you $100 today or $200 in 10 years. You would prefer to take the $100 today if the interest rate is

A) 4 percent.

B) 6 percent.

C) 8 percent.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An index fund

A) holds only stocks and bonds that are indexed to inflation.

B) holds all the stocks in a given stock index.

C) guarantees a return that follows the index of leading economic indicators.

D) typically has a lower return than a managed fund.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you win a small lottery and you are given the following choice: You can receive (1) an immediate payment of $10,000 or (2) two annual payments, each in the amount of $5,200, with the first payment coming one year from now, and the second payment coming two years from now. You would choose to take the immediate payment of $10,000 if the interest rate is

A) 2 percent, but not if the interest rate is 1 percent.

B) 3 percent, but not if the interest rate is 2 percent.

C) 4 percent, but not if the interest rate is 3 percent.

D) 5 percent, but not if the interest rate is 4 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Because the statistic called the standard deviation measures the volatility of a variable, it is used to measure the return of a portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Abby buys health insurance because she knows that she has health risks that wouldn't be obvious to an insurance company. Brad buys home owners insurance and then is less careful to make sure he's put out his cigarettes. The example with Abby

A) and the example with Brad illustrate adverse selection.

B) and the example with Brad illustrate moral hazard.

C) illustrates adverse selection; the example with Brad illustrates moral hazard.

D) illustrates moral hazard; the example with Brad illustrates adverse selection.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When you were 10 years old, your grandparents put $500 into an account for you paying 7 percent interest. Now that you are 18 years old, your grandparents tell you that you can take the money out of the account. What is the balance to the nearest cent?

A) $1,200.00

B) $1,111.77

C) $983.58

D) $859.09

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest reduction in a portfolio's risk is achieved when the number of stocks in the portfolio is increased from

A) 80 to 100.

B) 40 to 80.

C) 10 to 20.

D) 1 to 10.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If more people think a corporation's stock is overvalued than think it is undervalued then there is a

A) surplus, so its price will rise.

B) surplus, so its price will fall.

C) shortage, so its price will rise.

D) shortage, so its price will fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Writing in the Wall Street Journal in 2009, economist Jeremy Siegel argued that, in the years leading up to the financial crisis of 2008-2009,

A) financial firms acted in too risky a fashion.

B) the Federal Reserves's efforts to rein in the risky behavior of certain financial firms were inadequate.

C) falling house prices "crashed the banks and the economy."

D) All of the above are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When the price of an asset rises above what appears to be its fundamental value, the market is said to be experiencing a speculative bubble.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given that Tamar is a risk-averse person, she might accept a bet with a 50 percent chance of losing $100 today if she had a 50 percent

A) chance of winning $120 in two years and the interest rate was 11%.

B) chance of winning $114 in two years and the interest rate was 7%.

C) chance of winning $110 in two years and the interest rate was 3%.

D) None of the above are correct; a risk averse person would not accept any of the above bets.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the 1982 recession, the U.S. and world economies entered into a long period

A) of high unemployment rates.

B) high inflation rates.

C) that has become known as the "Great Moderation."

D) that has become known as the "Great Recession."

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk of a portfolio

A) increases as the number of stocks in the portfolio increases.

B) is usually measured using a statistic called the standard diversification.

C) is positively related to the average return of the portfolio.

D) bears no relationship to the average return of the portfolio.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct way to compute the future value of $X that earns r percent interest for N years?

A) $X(1 + rN) N

B) $X(1 + r) N

C) $X(1 + rN)

D) $X(1 + r/N) N

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By diversifying, the risk of holding stock

A) can be eliminated. On average over the past two centuries stocks paid a higher average real return than bonds.

B) can be eliminated. On average over the past two centuries stocks paid a lower average real return than bonds.

C) can be reduced but not eliminated. On average over the past two centuries stocks paid a higher average real return than bonds.

D) can be reduced but not eliminated. On average over the past two centuries stocks paid a lower average real return than bonds.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following defines an annuity?

A) For a fee, an insurance company provides you with regular income until you die.

B) A surcharge is added to life-insurance premiums paid by persons in dangerous occupations.

C) Annuity is another name for stock funds managed by mutual fund managers.

D) Annuity is another name for any diversified portfolio.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

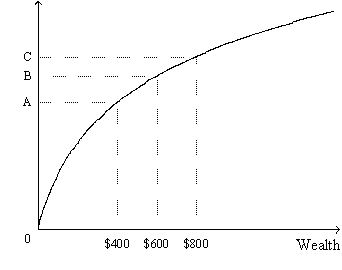

Figure 14-1. The figure shows a utility function.  -Refer to Figure 14-1. Let 0A represent the distance between the origin and point A; let AB represent the distance between point A and point B; etc. Which of the following ratios best represents the marginal utility per dollar when wealth increases from $400 to $600?

-Refer to Figure 14-1. Let 0A represent the distance between the origin and point A; let AB represent the distance between point A and point B; etc. Which of the following ratios best represents the marginal utility per dollar when wealth increases from $400 to $600?

A)

B)

C)

D)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In answering which of the following questions would you find it necessary to calculate a future value?

A) If Jill puts $5,000 today into a bank account that pays 3 percent interest, then how much will she have in the account after 2 years?

B) Should ABC Corporation buy a factory today for $2 million, knowing that the factory will yield the corporation $3 million after 5 years?

C) As the winner of a lottery, should Michael choose an immediate payment of $250,000 or should he choose annual payments of $30,000 for each of the next 10 years?

D) You would find it necessary to calculate a future value in order to answer all of these questions.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) There is a greater reduction in risk by increasing the number of stocks in a portfolio from 1 to 10, than by increasing it from 100 to 120 stocks.

B) The historical rate of return on stocks has been about 5 percentage points higher than the historical rate of return on bonds.

C) Stock in an industry that is very sensitive to economic conditions is likely to have a higher average return than stock in an industry that is not so sensitive to economic conditions.

D) If you had information about a corporation that no one else had, you could earn a very high rate of return. This contradicts the efficient market hypothesis.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 419

Related Exams