A) an average tax rate of 22.5 percent when her income is $30,000.

B) an average tax rate of 22.0 percent when her income is $50,000.

C) a marginal tax rate of 10 percent when her income rises from $40,000 to $40,001.

D) a marginal tax rate of 50 percent when her income rises from $60,000 to $60,001.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stacy places a $20 value on a bottle of wine,and Andrea places a $17 value on it.The equilibrium price for a bottle of wine is $15.How much total consumer surplus do Stacy and Andrea get when each purchases a bottle of wine?

A) $1

B) $2

C) $5

D) $7

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The U.S.federal government collected a higher percentage of income in taxes in the early 1900s than in the early 2000s.

B) The U.S.federal government collects a higher percentage of income in taxes than many European countries,including France and Germany.

C) The U.S.federal government collects a lower percentage of income in taxes than many developing countries,including Mexico and India.

D) The U.S.federal government collects a similar percentage of income in taxes as Brazil and Japan.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tim earns income of $60,000 per year and pays $21,000 per year in taxes.Tim paid 20 percent in taxes on the first $30,000 he earned.What was the marginal tax rate on the second $30,000 he earned?

A) 20 percent

B) 30 percent

C) 50 percent

D) 70 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which tax system requires higher-income taxpayers to pay a higher percentage of their income in taxes?

A) A progressive tax

B) A proportional tax

C) A regressive tax

D) A lump-sum tax

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

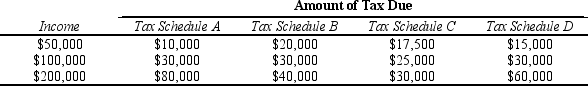

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedules are regressive?

-Refer to Table 12-14.Which tax schedules are regressive?

A) Tax Schedule A and Tax Schedule B

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule C and Tax Schedule D

D) None of the Tax Schedules are regressive.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical equity is not consistent with a regressive tax structure.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sales taxes generate nearly 50% of the tax revenue for state and local governments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about the percent of total income all levels of government in the U.S.take as taxes?

A) In 1902 the government collected about 7 percent of total income.In recent years,it collected about 30 percent of total income.

B) In 1902 the government collected about 30 percent of total income.In recent years,it collected about 7 percent of total income.

C) In 1902 the government collected about 7 percent of total income.In recent years,it collected about 7 percent of total income.

D) In 1902 the government collected about 30 percent of total income.In recent years,it collected about 30 percent of total income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments

A) use a mix of taxes and fees to generate revenue.

B) are required by federal mandate to levy income taxes.

C) are required to tax property at a standard rate set by the federal government.

D) cannot impose state excise taxes on products that are taxed by the federal government.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The claim that all citizens should make an "equal sacrifice" to support government programs is usually associated with

A) the ability-to-pay principle.

B) the benefits principle.

C) efficiency arguments.

D) regressive tax arguments.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 100 years,as the U.S.economy's income has grown,

A) tax rates have decreased,while tax revenues have increased.

B) tax rates have increased,while tax revenues have decreased.

C) both tax rates and tax revenues have increased.

D) both tax rates and tax revenues have decreased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake.Joan would be willing to purchase only one slice and would pay up to $6 for it.Jim would be willing to pay $9 for his first slice,$7 for his second slice,and $3 for his third slice.The current market price is $3 per slice. -Refer to Scenario 12-1.Assume that the government places a $4 tax on each slice of cheesecake and that the new equilibrium price is $7.What is Joan's consumer surplus from cheesecake?

A) zero

B) $2

C) $3

D) $6

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Income taxes and property taxes generate the highest tax revenue for state and local governments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about state income taxes is correct?

A) Some states do not tax income at all.

B) If states tax income,they must follow federal guidelines for designing the tax structure.

C) States are not allowed to have a higher marginal tax rate than the federal marginal tax rate.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket.In addition,suppose the price of a movie ticket is $5. -Refer to Scenario 12-2.Suppose the government levies a tax of $3 on a movie ticket and that,as a result,the price of a movie ticket increases to $8.What is total consumer surplus after the tax is imposed?

A) $0

B) $1

C) $2

D) $3

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A lump-sum tax minimizes deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses represent the

A) inefficiency that taxes create.

B) shift in benefit from producers to consumers.

C) part of consumer and producer surplus that is now revenue to the government.

D) loss in profit to producers when quantity demanded falls as a result of higher prices.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part of the deadweight loss from taxing labor earnings is that people

A) will work more.

B) will be reluctant to hire accountants to file their tax returns.

C) with low tax liabilities will universally be worse off than under some other tax policy.

D) will work less.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the rich pay more in taxes than the poor,the tax system must be progressive.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 397

Related Exams