A) utilitarianism

B) liberalism

C) libertarianism

D) secularism

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the doctrine of liberalism, principles of justice are the result of

A) fair agreement and bargain.

B) command-and-control policies.

C) domination of the powerful by the weak.

D) workers owning the factors of production.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following explains the rise in income inequality in the United States from 1970 to 2011?

A) An increase in minimum wages.

B) An increase in the demand for skilled labor.

C) An increase in the demand for unskilled labor.

D) Reduced international trade with low-wage countries.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whether or not policymakers should try to make our society more egalitarian is largely a matter of

A) economic efficiency.

B) political philosophy.

C) egalitarian principles.

D) enhanced opportunity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Caroline earns more than John. Under a new tax system, some of the taxes paid by Caroline would go to John. A libertarian would

A) support the system because an extra dollar earned by Caroline would be worth less to her than an extra dollar given to John.

B) oppose the system if it redistributed income in the presence of equal opportunity.

C) oppose the system because an extra dollar earned by Caroline would be worth more to her than an extra dollar given to John.

D) support the system if it maximized the well-being of the poorest member of society.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line in the country of Abbyville is $15,000. The distribution of income for Abbyville is as follows: Number of Families Income

300 less than $15,000

500 between $15,000 and $20,000

900 between $20,000 and $25,000

600 between $25,000 and $30,000

200 over $30,000

300 less than $15,000

500 between $15,000 and $20,000

900 between $20,000 and $25,000

600 between $25,000 and $30,000

200 over $30,000

The poverty rate in Abbyville is

The poverty rate in Abbyville is

A) 12 percent.

B) 32 percent.

C) 50 percent.

D) 68 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In-kind transfers are transfers to the poor

A) in the form of goods and services rather than cash.

B) in the form of goods, services, and cash.

C) from private charitable organizations only.

D) from the federal government only.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study by economists Cox and Alm found that the 2006 after-tax income of the richest fifth of U.S. households is

A) equal to the after-tax income of the poorest fifth.

B) 7 times the after-tax income of the poorest fifth.

C) 14 times the after-tax income of the poorest fifth.

D) 21 times the after-tax income of the poorest fifth.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The distribution of income for Abbyville is as follows: Number of Families Income

300 less than $15,000

500 between $15,000 and $20,000

900 between $20,000 and $25,000

600 between $25,000 and $30,000

200 over $30,000

300 less than $15,000

500 between $15,000 and $20,000

900 between $20,000 and $25,000

600 between $25,000 and $30,000

200 over $30,000

If the poverty rate in Abbyville is 12 percent, what is the poverty line in Abbyville?

If the poverty rate in Abbyville is 12 percent, what is the poverty line in Abbyville?

A) $15,000.

B) $20,000.

C) $25,000.

D) $30,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Many measures of inequality are based on income, which may not reflect a person's standard of living.

B) Because many of the poorest families receive in-kind transfers, more families have lower standards of living when compared to poverty rates based on income.

C) Because people can borrow and save to smooth out life cycle changes in income, equality measures based only on income may not reflect a person's standard of living.

D) A person's standard of living depends more on her permanent income than her transitory income, so inequality measures based on current income may be misleading.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

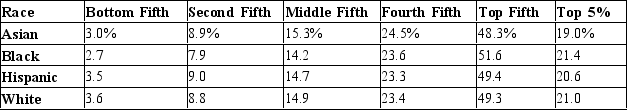

Table 20-12

Income Inequality in 2010 in the United States by Race

The values in the table reflect the percentages of pre-tax-and-transfer income.

-In comparison to the average poverty rate,

-In comparison to the average poverty rate,

A) children and the elderly are more likely to be poor.

B) children and the elderly are less likely to be poor.

C) children are more likely to be poor, but the elderly are less likely to be poor.

D) children are less likely to be poor, but the elderly are more likely to be poor.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An income distribution may not give an accurate picture of the standard of living for the poor because it does not include in-kind transfers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that young people often borrow and then repay the loans when they are older. These actions relate to which problem in measuring inequality?

A) in-kind transfers

B) the economic life cycle

C) a negative income tax

D) economic mobility

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Aniella believes that the demand for unskilled labor is relatively inelastic. Carmella believes that the demand for unskilled labor is relatively elastic. Which is an advocate of minimum-wage laws?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) Welfare is a broad term that includes a variety of government programs designed to help poor people.

B) Since the early 1970s, welfare benefits adjusted for inflation have increased, as has the percentage of children living with only one parent.

C) Critics of welfare programs argue that they can create incentives for unmarried women to have children.

D) Supporters argue that welfare doesn't cause the decline of twoparent families.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When we examine historical data on income inequality in the U.S., we see that the distribution of income gradually became

A) more equal between 1935 and 2011.

B) more equal between 1935 and 1973, but that trend reversed itself between 1973 and 2011.

C) more unequal between 1935 and 1973, but that trend reversed itself between 1973 and 2011.

D) more unequal between 1935 and 2011.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Approximately what fraction of total income in the US economy comes from labor earnings?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Less than three percent of families are categorized as poor for eight years or more.

B) In the United States, the grandson of a millionaire is much more likely to be rich than the grandson of an average-income person.

C) The majority of millionaires in the United States inherited their wealth.

D) Most workers have about the same income (adjusted for inflation) when they are young as when they are middle-aged.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The invisible hand of the marketplace acts to allocate resources efficiently, but it does not necessarily ensure that resources are allocated fairly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on data from 2011, the top fifth of all families received approximately what percent of all income in the United States?

A) 83 percent

B) 49 percent

C) 41 percent

D) 21 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 381 - 400 of 457

Related Exams