A) the life cycle.

B) permanent income.

C) transitory income.

D) in-kind transfers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of an in-kind transfer in comparison to a cash payment?

A) In-kind transfers cost less to administer than cash transfers.

B) In-kind transfers restrict the use of the benefit; thus, recipients receive necessities such as food and health care.

C) In-kind transfers are more efficient than cash transfers.

D) In-kind transfers give the recipient more utility than cash transfers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the four countries below, which has the highest degree of income inequality?

A) Germany

B) Turkey

C) South Africa

D) Mexico

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

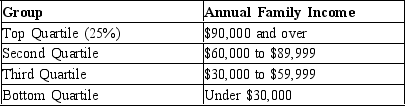

Table 20-1

The following table shows the distribution of income in Marysville.

-Refer to Table 20-1. If the poverty line were $23,021, what would be the poverty rate?

-Refer to Table 20-1. If the poverty line were $23,021, what would be the poverty rate?

A) less than 25%

B) between 25% and 50%

C) between 50% and 75%

D) There is insufficient information to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-6 Zooey is a single mother of two young children whose husband died in a tragic car accident. She earns $20,000 per year working as a cashier at a grocery store. The government uses a negative income tax system in which Taxes owed = (1/4 of income) - $15,000. -Refer to Scenario 20-6. How much does Zooey owe or receive from the government?

A) She receives $10,000.

B) She owes $10,000.

C) She receives $15,000.

D) She owes $5,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line in the country of Inequalia is $7,800. The distribution of income for Inequalia is as follows: Number of Families Income

200 less than $5,000

300 between $5,000 and $10,000

500 between $10,000 and $15,000

700 between $15,000 and $20,000

300 over $20,000

200 less than $5,000

300 between $5,000 and $10,000

500 between $10,000 and $15,000

700 between $15,000 and $20,000

300 over $20,000

The poverty rate in Inequalia is

The poverty rate in Inequalia is

A) 7.8 percent.

B) between 10 percent and 25 percent.

C) between 25 percent and 50 percent.

D) 39 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

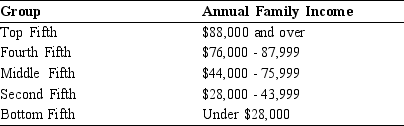

Table 20-3

The Distribution of Income in Edgerton

-Refer to Table 20-3. According to the table, what percent of families in Edgerton have income levels below $76,000?

-Refer to Table 20-3. According to the table, what percent of families in Edgerton have income levels below $76,000?

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The poverty line is

A) established by the federal government.

B) approximately equivalent to three times the cost of providing an adequate diet.

C) an absolute level of income below which a family is deemed to be in poverty.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Temporary Assistance for Needy Families program, most families

A) must have both parents in the home to qualify.

B) are female head-of-household families in which the father is absent.

C) have adult children with disabilities living at home.

D) are ineligible to receive assistance from other support programs.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Fewer than three percent of families are poor for eight or more years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following formulas is most representative of a negative income tax proposal?

A) Taxes Owed = (1/4 of Income) ![]() $2

$2

B) Taxes Owed = (1/2 of Income) ![]() 3/4

3/4

C) Taxes Owed = (1/2 of Income) + $10,000

D) Taxes Owed = (1/3 of Income) - $10,000

E) $2

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements illustrates diminishing marginal utility?

A) An extra dollar of income to a poor person provides that person with more additional utility than does an extra dollar to a rich person.

B) An extra dollar of income to a poor person provides that person with less additional utility than does an extra dollar to a rich person.

C) An extra dollar of income to a poor person provides that person with the same additional utility as does an extra dollar to a rich person.

D) An extra dollar of income to a poor person provides that person with the same total utility as does an extra dollar to a rich person.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A minimum wage law will result in less additional unemployment if labor demand is elastic rather than inelastic.

B) An in-kind transfer allows a person to use the benefit to purchase whatever they think they need most.

C) If a tax policy states that taxes owed equal 1/3 of income less $15,000, a person earning $25,000 per year would owe $6,666.67 in taxes.

D) Welfare reform enacted in 1996 limited the amount of time recipients could stay on welfare.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

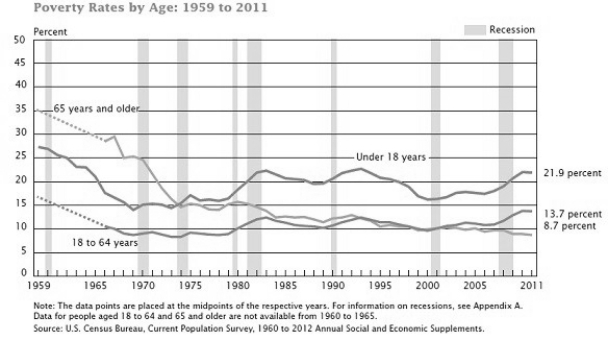

Figure 20-3  -Refer to Figure 20-3. Which of the following is consistent with the data reported in the figure?

-Refer to Figure 20-3. Which of the following is consistent with the data reported in the figure?

A) Policies to reduce elderly (65 years and older) poverty rates since 1959 seem to have been effective.

B) The age group suffering the highest poverty rate in recent years has been 18 to 64 year olds.

C) Policies to reduce youth (under 18 years) poverty rates since 1959 seem to have been effective.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The regular pattern of income variation over a person's life is called the .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liberals believe

A) that the government should choose just policies as evaluated by an impartial observer behind a "veil of ignorance."

B) in the assumption of diminishing marginal utility.

C) that everyone in society should have equal utility.

D) that the government should not redistribute income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Among all countries in the world, the United States has the most income inequality.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since 1970 the United States' income distribution has become more equal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medicaid and food stamps are

A) available only to the elderly.

B) forms of in-kind assistance.

C) forms of cash assistance.

D) transfer payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Critics argue that a disadvantage of minimum-wage laws is that they do not effectively target the working poor because many minimum-wage workers are the teenage children of middle-income families.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 457

Related Exams