A) 1.30

B) 1.50

C) 1.69

D) 2.83

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

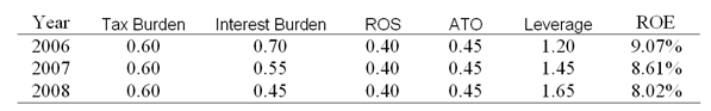

Look at the following table of data for Key Biscuit Company:  What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?

A) The firm began using more debt as a percentage of financing.

B) The firm began using less debt as a percentage of financing.

C) The compound leverage ratio was less than 1.

D) The operating ROA was declining.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a P/E ratio of 24 and a ROE of 12%. Its market-to-book-value ratio is ________.

A) 2.88

B) 2.00

C) 1.75

D) 0.69

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a tax burden of 0.7, a leverage ratio of 1.3, an interest burden of 0.8, and a return on sales ratio of 10%. The firm generates $2.28 in sales per dollar of assets. What is the firm's ROE?

A) 12.4%

B) 14.5%

C) 16.6%

D) 17.8%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benjamin Graham thought that the benefits from detailed analysis of a firm's financial statements had ________ over his long professional life.

A) increased greatly

B) increased slightly

C) remained constant

D) decreased

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

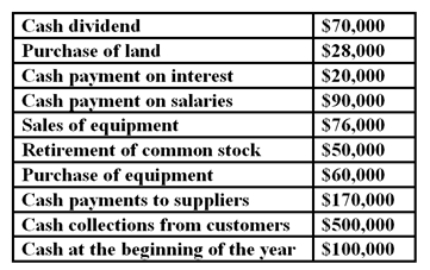

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.  What is the net cash provided by or used in investing activities of Haven Hardware?

What is the net cash provided by or used in investing activities of Haven Hardware?

A) ($12 000)

B) ($62 000)

C) $12 000

D) $164 000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic Value Added (EVA) is:

A) The difference between the return on assets and the opportunity cost of capital times the capital base

B) ROA x ROE

C) A measure of the firm's abnormal return

D) Largest for high-growth firms

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would result in a cash inflow under the heading 'Cash flow from investing' in the statement of cash flows?

A) Purchase of capital equipment

B) Payments to suppliers for inventory

C) Collections on receivables

D) Sale of production machinery

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The highest possible value for the interest burden ratio is ________ and this occurs when the firm ________.

A) 0; uses as much debt as possible

B) 1; uses debt to the point where ROA = interest cost of debt

C) 1; uses no interest bearing debt

D) -1; pays down its existing debts

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm has an ROA of 8%, a debt/equity ratio of 0.5, its ROE is ________.

A) 4%

B) 6%

C) 8%

D) 12%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a ROE of 20% and a market-to-book ratio of 2.38. Its P/E ratio is ________.

A) 8.40

B) 11.90

C) 17.62

D) 47.60

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following assets is most liquid?

A) Cash equivalents

B) Receivables

C) Inventories

D) Plant and equipment

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of decomposing ROE into a series of component ratios is called ________.

A) DuPont analysis

B) technical analysis

C) comparative analysis

D) liquidity analysis

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

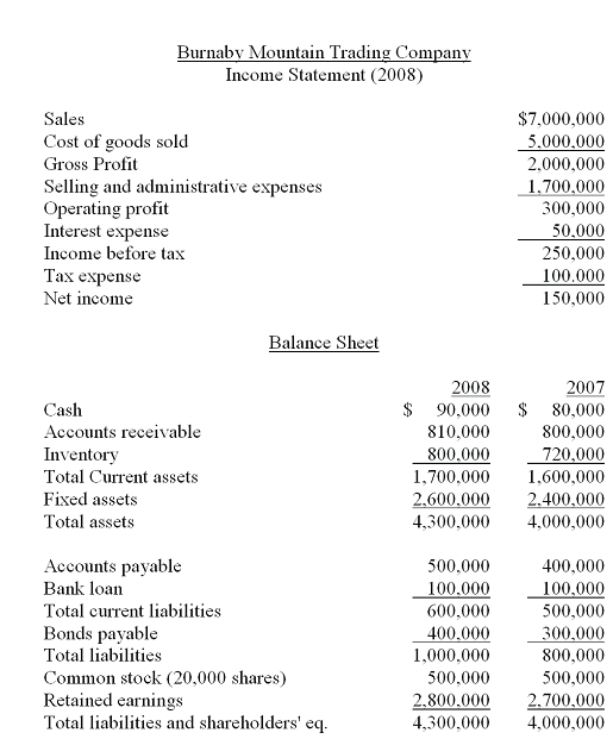

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the share market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's current ratio for 2008 is ________.

Note: The common shares are trading in the share market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's current ratio for 2008 is ________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating ROA can be found as the product of ________.

A) Return on sales x ATO

B) Tax burden x Interest burden

C) Interest burden x Leverage ratio

D) ROE x Dividend payout ratio

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 55 of 55

Related Exams