A) Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive strategy because of the inherent risks associated with using short-term financing.

B) If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt.

C) Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased.

D) If a company follows a policy of "matching maturities," this means that it matches its use of short-term debt with its use of long-term debt.

E) Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

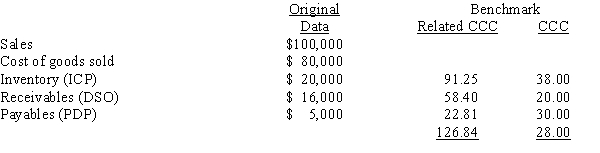

Fontana Painting had the following data for the most recent year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold.Fontana finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased?

A) 1,901

B) 2,092

C) 2,301

D) 2,531

E) 2,784

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pascarella Inc.is revising its payables policy.It has annual sales of $50,735,000,an average inventory level of $15,012,000,and average accounts receivable of $10,008,000.The firm's cost of goods sold is 85% of sales.The company makes all purchases on credit and has always paid on the 30th day.However,it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day.The CFO also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000.What will be the net change in the cash conversion cycle,assuming a 365-day year?

A) −26.6 days

B) −29.5 days

C) −32.8 days

D) −36.4 days

E) −40.5 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Famous Farm's payables deferral period (PDP) is 50 days (on a 365-day basis) ,accounts payable are $100 million,and its balance sheet shows inventory of $125 million.What is the inventory turnover ratio?

A) 4.73

B) 5.26

C) 5.84

D) 6.42

E) 7.07

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm busy on terms of 2/10 net 30,it should pay as early as possible during the discount period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The twin goals of inventory management are (1)to ensure that the inventories needed to sustain operations are available,but (2)to hold the costs of ordering and carrying inventories to the lowest possible level.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

If a profitable firm finds that it simply must "stretch" its accounts payable,then this suggests that it is undercapitalized,i.e.,that it needs more working capital to support its operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arnold Inc.purchases merchandise on terms of 2/10 net 30,and it always pays on the 30th day.The CFO calculates that the average amount of costly trade credit carried is $375,000.What is the firm's average accounts payable balance? (Assume a 365-day year.)

A) $458,160

B) $482,273

C) $507,656

D) $534,375

E) $562,500

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The average accounts receivable balance is a function of both the volume of credit sales and the days sales outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Determining a firm's optimal investment in working capital and deciding how that investment should be financed are critical to working capital management.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Shorter-term cash budgets⎯say a daily cash budget for the next month⎯are generally used for actual cash control while longer-term cash budgets⎯say monthly cash budgets for the next year⎯are generally used for planning purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blueroot Inc.is considering a change in its financing policy.Currently,it uses maximum trade credit by not taking discounts on its purchases.The standard industry credit terms offered by all its suppliers are 2/10 net 30 days,and the firm pays on time.The new CFO is considering borrowing from its bank,using short-term notes payable,and then taking discounts.The firm wants to determine the effect of this policy change on its net income.Its net purchases are $11,760 per day,using a 365-day year.The interest rate on the notes payable is 10%,and the tax rate is 40%.If the firm implements the plan,what is the expected change in net income?

A) $32,964

B) $34,699

C) $36,526

D) $38,448

E) $40,370

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

"Stretching" accounts payable is a widely accepted,entirely ethical,and costless financing technique.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Albrecht Inc.is a no-growth firm whose sales fluctuate seasonally,causing total assets to vary from $320,000 to $410,000,but fixed assets remain constant at $260,000.If the firm follows a maturity matching (or moderate) working capital financing policy,what is the most likely total of long-term debt plus equity capital?

A) $260,642

B) $274,360

C) $288,800

D) $304,000

E) $320,000

G) B) and E)

Correct Answer

verified

E

Correct Answer

verified

True/False

If a firm's suppliers stop offering discounts,then its use of trade credit is more likely to increase than to decrease,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will cause an increase in net working capital,other things held constant?

A) A cash dividend is declared and paid.

B) Merchandise is sold at a profit, but the sale is on credit.

C) Long-term bonds are retired with the proceeds of a preferred stock issue.

D) Missing inventory is written off against retained earnings.

E) Cash is used to buy marketable securities.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Short-term marketable securities are held for two separate and distinct purposes: (1)to provide liquidity as a substitute for cash and (2)as a non-operating investment.Marketable securities held while awaiting reinvestment are not available for liquidity purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Firms hold cash balances in order to complete transactions (both routine and precautionary)that are necessary in business operations and as compensation to banks for providing loans and services.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marshall Inc.recently hired your consulting firm to improve the company's performance.It has been highly profitable but has been experiencing cash shortages due to its high growth rate.As one part of your analysis,you want to determine the firm's cash conversion cycle.Using the following information and a 365-day year,what is the firm's present cash conversion cycle?

A) 120.6 days

B) 126.9 days

C) 133.6 days

D) 140.6 days

E) 148.0 days

G) A) and E)

Correct Answer

verified

E

Correct Answer

verified

Showing 1 - 20 of 138

Related Exams