A) $1,770.00

B) $1,858.50

C) $1,951.43

D) $2,049.00

E) $2,151.45

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The income statement shows the difference between a firm's income and its costs⎯i.e.,its profits⎯during a specified period of time.However,not all reported income comes in the form or cash,and reported costs likewise may not correctly reflect cash outlays.Therefore,there may be a substantial difference between a firm's reported profits and its actual cash flow for the same period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,Michelson Manufacturing reported $10,250 of sales,$3,500 of operating costs other than depreciation,and $1,250 of depreciation.The company had no amortization charges,it had $3,500 of bonds outstanding that carry a 6.5% interest rate,and its federal-plus-state income tax rate was 35%.This year's data are expected to remain unchanged except for one item,depreciation,which is expected to increase by $725.By how much will the depreciation change cause the firm's net after-tax income and its net cash flow to change? Note that the company uses the same depreciation calculations for tax and stockholder reporting purposes.

A) −$383.84; $206.68

B) −$404.04; $217.56

C) −$425.30; $229.01

D) −$447.69; $241.06

E) −$471.25; $253.75

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jessie's Bobcat Rentals' operations provided a negative net cash flow last year,yet the cash shown on its balance sheet increased.Which of the following statements could explain the increase in cash,assuming the company's financial statements were prepared under generally accepted accounting principles?

A) The company had high depreciation expenses.

B) The company repurchased some of its common stock.

C) The company dramatically increased its capital expenditures.

D) The company retired a large amount of its long-term debt.

E) The company sold some of its fixed assets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm reports a loss on its income statement, then the retained earnings account as shown on the balance sheet will be negative.

B) Since depreciation is a source of funds, the more depreciation a company has, the larger its retained earnings will be, other things held constant.

C) A firm can show a large amount of retained earnings on its balance sheet yet need to borrow cash to make required payments.

D) Common equity includes common stock and retained earnings, less accumulated depreciation.

E) The retained earnings account as shown on the balance sheet shows the amount of cash that is available for paying dividends.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In the statement of cash flows, a decrease in accounts receivable is reported as a use of cash.

B) Dividends do not show up in the statement of cash flows because dividends are considered to be a financing activity, not an operating activity.

C) In the statement of cash flows, a decrease in accounts payable is reported as a use of cash.

D) In the statement of cash flows, depreciation charges are reported as a use of cash.

E) In the statement of cash flows, a decrease in inventories is reported as a use of cash.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ullrich Printing Inc.paid out $21,750 of common dividends during the year.It ended the year with $187,500 of retained earnings versus the prior year's retained earnings of $132,250.How much net income did the firm earn during the year?

A) $77,000

B) $80,850

C) $84,893

D) $89,137

E) $93,594

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bae Inc.has the following income statement.How much net operating profit after taxes (NOPAT) does the firm have?

A) $370.60

B) $390.11

C) $410.64

D) $432.25

E) $455.00

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Depreciation and amortization are not cash charges, so neither of them has an effect on a firm's reported profits.

B) The more depreciation a firm reports, the higher its tax bill, other things held constant.

C) People sometimes talk about the firm's net cash flow, which is shown as the lowest entry on the income statement, hence it is often called "the bottom line."

D) Depreciation reduces a firm's cash balance, so an increase in depreciation would normally lead to a reduction in the firm's net cash flow.

E) Net cash flow (NCF) is often defined as follows:Net Cash Flow = Net Income + Depreciation and Amortization Charges.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In accounting,emphasis is placed on determining net income in accordance with generally accepted accounting principles.In finance,the primary emphasis is also on net income because that is what investors use to value the firm.However,a secondary financial consideration is cash flow,because cash is needed to operate the business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The retained earnings account on the balance sheet does not represent cash.Rather,it represents part of stockholders' claims against the firm's existing assets.This implies that retained earnings are in fact stockholders' reinvested earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Total net operating capital is equal to net fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Interest paid by a corporation is a tax deduction for the paying corporation,but dividends paid are not deductible.This treatment,other things held constant,tends to encourage the use of debt financing by corporations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The income statement for a given year is designed to give us an idea of how much the firm earned during that year.

B) The focal point of the income statement is the cash account, because that account cannot be manipulated by "accounting tricks."

C) The reported income of two otherwise identical firms cannot be manipulated by different accounting procedures provided the firms follow Generally Accepted Accounting Principles (GAAP) .

D) The reported income of two otherwise identical firms must be identical if the firms are publicly owned, provided they follow procedures that are permitted by the Securities and Exchange Commission (SEC) .

E) If a firm follows Generally Accepted Accounting Principles (GAAP) , then its reported net income will be identical to its reported net cash flow.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olivia Hardison,CFO of Impact United Athletic Designs,plans to have the company issue $500 million of new common stock and use the proceeds to pay off some of its outstanding bonds.Assume that the company,which does not pay any dividends,takes this action,and that total assets,operating income (EBIT) ,and its tax rate all remain constant.Which of the following would occur?

A) The company would have to pay less taxes.

B) The company's taxable income would fall.

C) The company's interest expense would remain constant.

D) The company would have less common equity than before.

E) The company's net income would increase.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The primary reason the annual report is important in finance is that it is used by investors when they form expectations about the firm's future earnings and dividends,and the riskiness of those cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

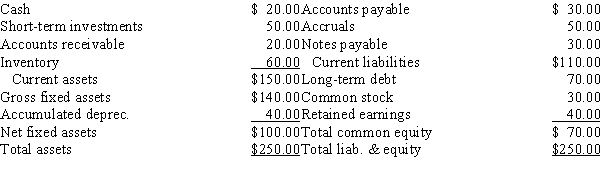

Zumbahlen Inc.has the following balance sheet.How much total operating capital does the firm have?

A) $114.00

B) $120.00

C) $126.00

D) $132.30

E) $138.92

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HHH Inc.reported $12,500 of sales and $7,025 of operating costs (including depreciation) .The company had $18,750 of investor-supplied operating assets (or capital) ,the weighted average cost of that capital (the WACC) was 9.5%,and the federal-plus-state income tax rate was 40%.What was HHH's Economic Value Added (EVA) ,i.e.,how much value did management add to stockholders' wealth during the year?

A) $1,357.13

B) $1,428.56

C) $1,503.75

D) $1,578.94

E) $1,657.88

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barnes' Brothers has the following data for the year ending 12/31/2015: Net income = $600; Net operating profit after taxes (NOPAT) = $700; Total assets = $2,500; Short-term investments = $200; Stockholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,100.Barnes' weighted average cost of capital is 10%.What is its economic value added (EVA) ?

A) $399.11

B) $420.11

C) $442.23

D) $465.50

E) $490.00

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

To estimate the cash flow from operations,depreciation must be added back to net income because it is a non-cash charge that has been deducted from revenue.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 76

Related Exams