B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

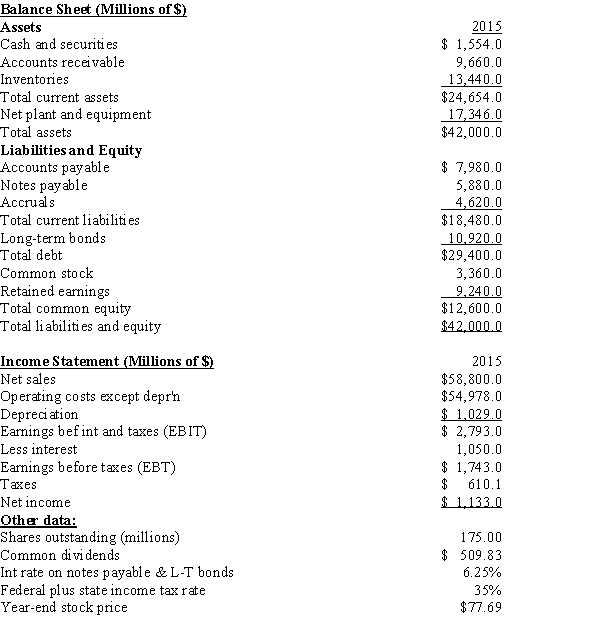

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's ROE?

-Refer to Exhibit 7.1.What is the firm's ROE?

A) 8.54%

B) 8.99%

C) 9.44%

D) 9.91%

E) 10.41%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lincoln Industries' current ratio is 0.5.Considered alone,which of the following actions would increase the company's current ratio?

A) Use cash to reduce long-term bonds outstanding.

B) Borrow using short-term notes payable and use the cash to increase inventories.

C) Use cash to reduce accruals.

D) Use cash to reduce accounts payable.

E) Use cash to reduce short-term notes payable.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose firms follow similar financing policies,face similar risks,have equal access to capital,and operate in competitive product and capital markets.Under these conditions,then firms that have high profit margins will tend to have high asset turnover ratios,and firms with low profit margins will tend to have low turnover ratios.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget,the current and quick ratios provide fast and easy-to-use measures of a firm's liquidity position.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonner Corp.'s sales last year were $415,000,and its year-end total assets were $355,000.The average firm in the industry has a total assets turnover ratio (TATO) of 2.4.Bonner's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales.By how much must the assets be reduced to bring the TATO to the industry average,holding sales constant?

A) $164,330

B) $172,979

C) $182,083

D) $191,188

E) $200,747

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Even though Firm A's current ratio exceeds that of Firm B,Firm B's quick ratio might exceed that of A.However,if A's quick ratio exceeds B's,then we can be certain that A's current ratio is also larger than that of B.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

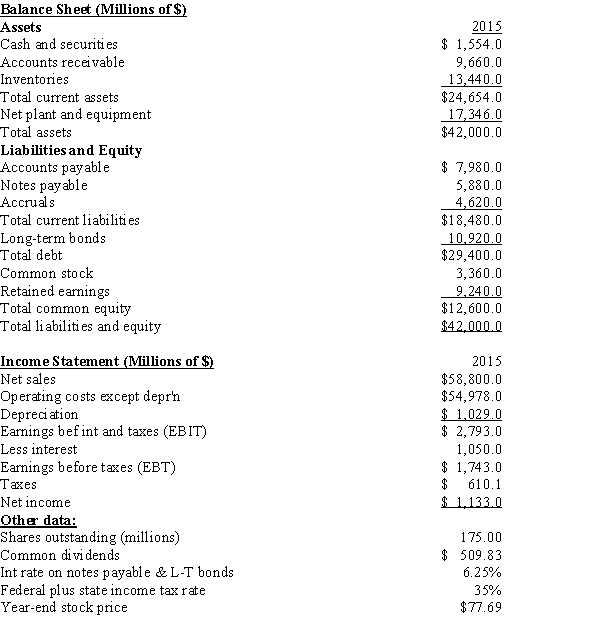

Exhibit 7.1

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -Refer to Exhibit 7.1.What is the firm's TIE?

-Refer to Exhibit 7.1.What is the firm's TIE?

A) 1.94

B) 2.15

C) 2.39

D) 2.66

E) 2.93

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The "apparent," but not the "true," financial position of a company whose sales are seasonal can differ dramatically,depending on the time of year when the financial statements are constructed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's new president wants to strengthen the company's financial position.Which of the following actions would make it financially stronger?

A) Increase inventories while holding sales and cost of goods sold constant.

B) Increase accounts receivable while holding sales constant.

C) Increase EBIT while holding sales constant.

D) Increase accounts payable while holding sales constant.

E) Increase notes payable while holding sales constant.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. Under these conditions, the ROE will decrease.

B) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. Under these conditions, the ROE will increase.

C) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. Without additional information, we cannot tell what will happen to the ROE.

D) The modified DuPont equation provides information about how operations affect the ROE, but the equation does not include the effects of debt on the ROE.

E) Other things held constant, an increase in the debt ratio will result in an increase in the profit margin on sales.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its current ratio?

A) Use cash to increase inventory holdings.

B) Reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment.

C) Use cash to repurchase some of the company's own stock.

D) Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.

E) Issue new stock and then use some of the proceeds to purchase additional inventory and hold the remainder as cash.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm finances with only debt and common equity,and if its equity multiplier is 3.0,then its debt ratio must be 0.667.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the coming year,Crane Inc.is considering two financial plans.Management expects sales to be $301,770,operating costs to be $266,545,assets to be $200,000,and its tax rate to be 35%.Under Plan A it would use 25% debt and 75% common equity.The interest rate on the debt would be 8.8%,but the TIE ratio would have to be kept at 4.00 or more.Under Plan B the maximum debt that met the TIE constraint would be employed.Assuming that sales,operating costs,assets,the interest rate,and the tax rate would all remain constant,by how much would the ROE change in response to the change in the capital structure?

A) 3.83%

B) 4.02%

C) 4.22%

D) 4.43%

E) 4.65%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cordelion Communications is considering issuing new common stock and using the proceeds to reduce its outstanding debt.The stock issue would have no effect on total assets,the interest rate Cordelion pays,EBIT,or the tax rate.Which of the following is likely to occur if the company goes ahead with the stock issue?

A) The times interest earned ratio will decrease.

B) The ROA will decline.

C) Taxable income will decrease.

D) The tax bill will increase.

E) Net income will decrease.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An increase in a firm's debt ratio, with no changes in its sales or operating costs, could be expected to lower the profit margin.

B) The ratio of long-term debt to total capital is more likely to experience seasonal fluctuations than is either the DSO or the inventory turnover ratio.

C) If two firms have the same ROA, the firm with the most debt can be expected to have the lower ROE.

D) An increase in the DSO, other things held constant, could be expected to increase the total assets turnover ratio.

E) An increase in the DSO, other things held constant, could be expected to increase the ROE.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Determining whether a firm's financial position is improving or deteriorating requires analyzing more than the ratios for a given year.Trend analysis is one method of measuring changes in a firm's performance over time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used similar accounting methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would,generally,indicate an improvement in a company's financial position,holding other things constant?

A) The total assets turnover decreases.

B) The TIE declines.

C) The DSO increases.

D) The EBITDA coverage ratio increases.

E) The current and quick ratios both decline.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams