A) $ 845.03

B) $ 889.51

C) $ 936.33

D) $ 983.14

E) $1,032.30

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much would $1,growing at 3.5% per year,be worth after 75 years?

A) $12.54

B) $13.20

C) $13.86

D) $14.55

E) $15.28

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers to lend you $100,000 at an 8.5% annual interest rate to start your new business.The terms require you to amortize the loan with 10 equal end-of-year payments.How much interest would you be paying in Year 2?

A) $7,531

B) $7,927

C) $8,323

D) $8,740

E) $9,177

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle has $375,000 and wants to retire.He expects to live for another 25 years,and he also expects to earn 7.5% on his invested funds.How much could he withdraw at the beginning of each of the next 25 years and end up with zero in the account?

A) $28,243.21

B) $29,729.70

C) $31,294.42

D) $32,859.14

E) $34,502.10

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Midway through the life of an amortized loan,the percentage of the payment that represents interest could be equal to,less than,or greater than to the percentage that represents repayment of principal.The proportions depend on the original life of the loan and the interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the discount (or interest)rate is positive,the present value of an expected series of payments will always exceed the future value of the same series.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle will sell you his bicycle shop for $250,000,with "seller financing," at a 6.0% nominal annual rate.The terms of the loan would require you to make 12 equal end-of-month payments per year for 4 years,and then make an additional final (balloon) payment of $50,000 at the end of the last month.What would your equal monthly payments be?

A) $4,029.37

B) $4,241.44

C) $4,464.67

D) $4,699.66

E) $4,947.01

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You just deposited $2,500 in a bank account that pays a 4.0% nominal interest rate,compounded quarterly.If you also add another $5,000 to the account one year (4 quarters) from now and another $7,500 to the account two years (8 quarters) from now,how much will be in the account three years (12 quarters) from now?

A) $15,234.08

B) $16,035.87

C) $16,837.67

D) $17,679.55

E) $18,563.53

G) B) and E)

Correct Answer

verified

B

Correct Answer

verified

True/False

Time lines cannot be constructed in situations where some of the cash flows occur annually but others occur quarterly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you are buying your first condo for $145,000,and you will make a $15,000 down payment.You have arranged to finance the remainder with a 30-year,monthly payment,amortized mortgage at a 6.5% nominal interest rate,with the first payment due in one month.What will your monthly payments be?

A) $741.57

B) $780.60

C) $821.69

D) $862.77

E) $905.91

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

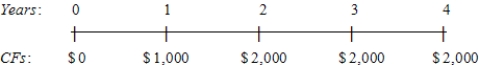

You sold a car and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 6.0%?

A) $5,987

B) $6,286

C) $6,600

D) $6,930

E) $7,277

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A time line is not meaningful unless all cash flows occur annually.

B) Time lines are not useful for visualizing complex problems prior to doing actual calculations.

C) Time lines can be constructed to deal with situations where some of the cash flows occur annually but others occur quarterly.

D) Time lines can only be constructed for annuities where the payments occur at the end of the periods, i.e., for ordinary annuities.

E) Time lines cannot be constructed where some of the payments constitute an annuity but others are unequal and thus are not part of the annuity.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a result of compounding,the effective annual rate on a bank deposit (or a loan)is always equal to or less than the nominal rate on the deposit (or loan).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods.

B) If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity.

C) The cash flows for an annuity due must all occur at the beginning of the periods.

D) The cash flows for an annuity may vary from period to period, but they must occur at regular intervals, such as once a year or once a month.

E) If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have a chance to buy an annuity that pays $550 at the beginning of each year for 3 years.You could earn 5.5% on your money in other investments with equal risk.What is the most you should pay for the annuity?

A) $1,412.84

B) $1,487.20

C) $1,565.48

D) $1,643.75

E) $1,725.94

G) B) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A time line is not meaningful unless all cash flows occur annually.

B) Time lines are not useful for visualizing complex problems prior to doing actual calculations.

C) Time lines cannot be constructed to deal with situations where some of the cash flows occur annually but others occur quarterly.

D) Time lines can only be constructed for annuities where the payments occur at the end of the periods, i.e., for ordinary annuities.

E) Time lines can be constructed where some of the payments constitute an annuity but others are unequal and thus are not part of the annuity.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following bank accounts has the highest effective annual return?

A) An account that pays 8% nominal interest with monthly compounding.

B) An account that pays 8% nominal interest with annual compounding.

C) An account that pays 7% nominal interest with daily (365-day) compounding.

D) An account that pays 7% nominal interest with monthly compounding.

E) An account that pays 8% nominal interest with daily (365-day) compounding.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Some of the cash flows shown on a time line can be in the form of annuity payments but none can be uneven amounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following investments would have the highest future value at the end of 10 years? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2,500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When a loan is amortized,a relatively low percentage of the payment goes to reduce the outstanding principal in the early years,and the principal repayment's percentage increases in the loan's later years.

B) False

Correct Answer

verified

True

Correct Answer

verified

Showing 1 - 20 of 163

Related Exams