B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

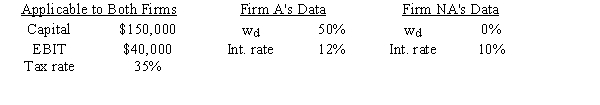

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical⎯they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e.,what is ROEA − ROENA?

A) 8.60%

B) 9.06%

C) 9.53%

D) 10.01%

E) 10.51%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for Firms A and B to have identical financial and operating leverage,yet for Firm A to have more risk as measured by the variability of EPS.This would occur if Firm A has more business risk than Firm B.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Senate Inc.is considering two alternative methods for producing playing cards.Method 1 involves using a machine with a fixed cost (mainly depreciation) of $12,000 and variable costs of $1.00 per deck of cards.Method 2 would use a less expensive machine with a fixed cost of only $5,000,but it would require a variable cost of $1.50 per deck.The sales price per deck would be the same under each method.At what unit output level would the two methods provide the same operating income (EBIT) ?

A) 12,600

B) 14,000

C) 15,400

D) 16,940

E) 18,634

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) As a rule, the optimal capital structure is found by determining the debt-equity mix that maximizes expected EPS.

B) The optimal capital structure simultaneously maximizes EPS and minimizes the WACC.

C) The optimal capital structure minimizes the cost of equity, which is a necessary condition for maximizing the stock price.

D) The optimal capital structure simultaneously minimizes the cost of debt, the cost of equity, and the WACC.

E) The optimal capital structure simultaneously maximizes the stock price and minimizes the WACC.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

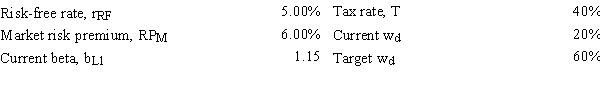

Dyson Inc.currently finances with 20.0% debt (i.e.,wd = 20%) ,but its new CFO is considering changing the capital structure so wd = 60.0% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 − wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity? (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.)

A) 4.05%

B) 4.50%

C) 4.95%

D) 5.45%

E) 5.99%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The Miller model begins with the Modigliani and Miller (MM)model without corporate taxes and then adds personal taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm is currently 100% equity financed.The CFO is considering a recapitalization plan under which the firm would issue long-term debt with an after-tax yield of 9% and use the proceeds to repurchase some of its common stock.The recapitalization would not change the company's total investor-supplied capital,the size of the firm (i.e.,total assets) ,and it would not affect the firm's return on investors' capital (ROIC) ,which is 15%.The CFO believes that this recapitalization would reduce the firm's WACC and increase its stock price.Which of the following would be likely to occur if the company goes ahead with the recapitalization plan?

A) The company's net income would increase.

B) The company's earnings per share would decline.

C) The company's cost of equity would increase.

D) The company's ROA would increase.

E) The company's ROE would decline.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's target capital structure should do which of the following?

A) Maximize the earnings per share (EPS) .

B) Minimize the cost of debt (rd) .

C) Obtain the highest possible bond rating.

D) Minimize the cost of equity (rs) .

E) Minimize the weighted average cost of capital (WACC) .

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm's business risk is determined solely by the financial characteristics of its industry.

B) The factors that affect a firm's business risk include industry characteristics and economic conditions, both of which are generally beyond the firm's control.

C) One of the benefits to a firm of being at or near its target capital structure is that this generally minimizes the risk of bankruptcy.

D) A firm's financial risk can be minimized by diversification.

E) The amount of debt in its capital structure can under no circumstances affect a company's EBIT and business risk.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,firms that use assets that can be sold easily (like trucks)tend to use more debt than firms whose assets are harder to sell (like those engaged in research and development).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller (MM)won Nobel Prizes for their work on capital structure theory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When a company increases its debt ratio, the costs of equity and debt both increase. Therefore, the WACC must also increase.

B) The capital structure that maximizes the stock price is generally the capital structure that also maximizes earnings per share.

C) All else equal, an increase in the corporate tax rate would tend to encourage companies to increase their debt ratios.

D) Since debt financing raises the firm's financial risk, increasing a company's debt ratio will always increase its WACC.

E) Since the cost of debt is generally fixed, increasing the debt ratio tends to stabilize net income.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

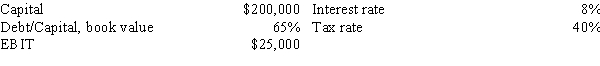

Confu Inc.expects to have the following data during the coming year.What is the firm's expected ROE?

A) 12.51%

B) 13.14%

C) 13.80%

D) 14.49%

E) 15.21%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's CFO is considering increasing the target debt ratio,which would also increase the company's interest expense.New bonds would be issued and the proceeds would be used to buy back shares of common stock.Neither total assets nor operating income would change,but expected earnings per share (EPS) would increase.Assuming the CFO's estimates are correct,which of the following statements is CORRECT?

A) Since the proposed plan increases the firm's financial risk, the stock price might fall even if EPS increases.

B) If the plan reduces the WACC, the stock price is likely to decline.

C) Since the plan is expected to increase EPS, this implies that net income is also expected to increase.

D) If the plan does increase the EPS, the stock price will automatically increase at the same rate.

E) Under the plan there will be more bonds outstanding, and that will increase their liquidity and thus lower the interest rate on the currently outstanding bonds.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle is considering investing in a new company that will produce high quality stereo speakers.The sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000.What sales volume would be required to break even,i.e.,to have EBIT = zero?

A) 28,880

B) 30,400

C) 32,000

D) 33,600

E) 35,280

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's capital structure does not affect its free cash flows as discussed in the text,because FCF reflects only operating cash flows,which are available to service debt,to pay dividends to stockholders,and for other purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southwest U's campus book store sells course packs for $15 each,the variable cost per pack is $9,fixed costs to produce the packs are $200,000,and expected annual sales are 50,000 packs.What are the pre-tax profits from sales of course packs?

A) $ 72,900

B) $ 81,000

C) $ 90,000

D) $100,000

E) $110,000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following events would be most likely to encourage a firm to increase the amount of debt in its capital structure?

A) Its sales are projected to become less stable in the future.

B) The bankruptcy laws are changed in a way that would make bankruptcy more costly to the firm and its stockholders.

C) Management believes that the firm's stock is currently overvalued.

D) The firm decides to automate its factory with specialized equipment and thus increase its use of operating leverage.

E) The corporate tax rate is increased.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Different borrowers have different risks of bankruptcy,and if a borrower goes bankrupt,its lenders will probably not get back the full amount of funds that they loaned.Therefore,lenders charge higher rates to borrowers judged to be more likely to go bankrupt.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 88

Related Exams