B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although short-term interest rates have historically averaged less than long-term rates,the heavy use of short-term debt is considered to be an aggressive current asset financing strategy because of the inherent risks of using short-term financing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Inventory management is largely self-contained in the sense that very little coordination among the sales,purchasing,and production personnel is required for successful inventory management.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 16.1 Zorn Corporation is deciding whether to pursue a restricted or relaxed working capital investment policy. The firm's annual sales are expected to total $3,600,000, its fixed assets turnover ratio equals 4.0, and its debt and common equity are each 50% of total assets. EBIT is $150,000, the interest rate on the firm's debt is 10%, and the tax rate is 40%. If the company follows a restricted policy, its total assets turnover will be 2.5. Under a relaxed policy its total assets turnover will be 2.2. -Refer to Exhibit 15.1.If the firm adopts a restricted policy,how much lower would its interest expense be than under the relaxed policy?

A) $ 8,418

B) $ 8,861

C) $ 9,327

D) $ 9,818

E) $10,309

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

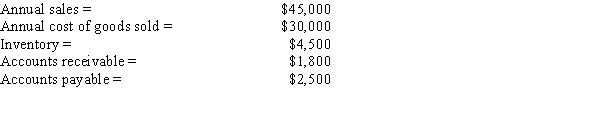

Desai Inc.has the following data,in thousands.Assuming a 365-day year,what is the firm's cash conversion cycle?

A) 28 days

B) 32 days

C) 35 days

D) 39 days

E) 43 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An informal line of credit and a revolving credit agreement are similar except that the line of credit creates a legal obligation for the bank and thus is a more reliable source of funds for the borrower than the revolving credit agreement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most consistent with efficient inventory management? The firm has a

A) below-average inventory turnover ratio.

B) low incidence of production schedule disruptions.

C) below-average total assets turnover ratio.

D) relatively high current ratio.

E) relatively low DSO.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data on Wentz Inc.for last year are shown below,along with the payables deferral period (PDP) for the firms against which it benchmarks.The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average.If this were done,by how much would payables increase? Use a 365-day year.

A) $ 764

B) $ 849

C) $ 943

D) $1,048

E) $1,164

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dyl Pickle Inc.had credit sales of $3,500,000 last year and its days sales outstanding was DSO = 35 days.What was its average receivables balance,based on a 365-day year?

A) $335,616

B) $352,397

C) $370,017

D) $388,518

E) $407,944

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate.

B) In managing a firm's accounts receivable, it is possible to increase credit sales per day yet still keep accounts receivable fairly steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently.

C) Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales.

D) Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

E) Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm buys on terms of 2/8,net 45 days,it does not take discounts,and it actually pays after 58 days.What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year.)

A) 14.34%

B) 15.10%

C) 15.89%

D) 16.69%

E) 17.52%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality payments are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A revolving credit agreement is a formal line of credit.The firm must generally pay a fee on the unused balance of the committed funds to compensate the bank for the commitment to extend those funds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Trade credit is provided only to relatively large, strong firms.

B) Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies.

C) Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than long-term debt.

D) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

E) Commercial paper is typically offered at a long-term maturity of at least five years.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

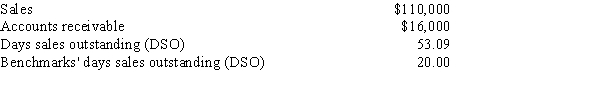

Data on Shick Inc.for 2013 are shown below,along with the days sales outstanding of the firms against which it benchmarks.The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average.If this were done,by how much would receivables decline? Use a 365-day year.

A) $ 8,078

B) $ 8,975

C) $ 9,973

D) $10,970

E) $12,067

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A conservative financing approach to working capital will result in permanent current assets and some seasonal current assets being financed using long-term securities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payments lags.

B) Depreciation.

C) Cumulative cash.

D) Repurchases of common stock.

E) Payment for plant construction.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Net working capital is defined as current assets divided by current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One of the effects of ceasing to take trade credit discounts is that the firm's accounts payable will rise,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 126

Related Exams