A) $10,521

B) $11,075

C) $11,658

D) $12,271

E) $12,885

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV?

A) $15,925

B) $16,764

C) $17,646

D) $18,528

E) $19,455

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

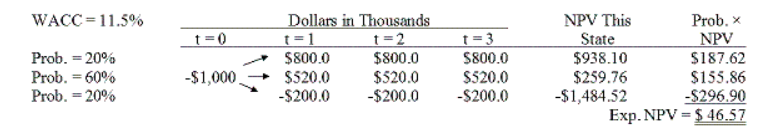

Brandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios. The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. How much is the option to abandon worth to the firm?

A) $55.08

B) $57.98

C) $61.03

D) $64.08

E) $67.29

G) D) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Puckett Inc. risk-adjusts its WACC to account for project risk. It uses a risk-adjusted project cost of capital of 8% for below-average risk projects, 10% for average-risk projects, and 12% for above-average risk projects. Which of the following independent projects should Puckett accept, assuming that the company uses the NPV method when choosing projects?

A) project b, which has below-average risk and an irr = 8.5%.

B) project c, which has above-average risk and an irr = 11%.

C) without information about the projects' npvs we cannot determine which project(s) should be accepted.

D) all of these projects should be accepted.

E) project a, which has average risk and an irr = 9%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because of differences in the expected returns on different investments, the standard deviation is not always an adequate measure of risk. However, the coefficient of variation adjusts for differences in expected returns and thus allows investors to make better comparisons of investments' stand-alone risk.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Although it is extremely difficult to make accurate forecasts of the revenues that a project will generate, projects' initial outlays and subsequent costs can be forecasted with great accuracy. This is especially true for large product development projects.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) in a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the npv.

B) the existence of any type of "externality" will reduce the calculated npv versus the npv that would exist without the externality.

C) if one of the assets to be used by a potential project is already owned by the firm, and if that asset could be sold or leased to another firm if the new project were not undertaken, then the net after-tax proceeds that could be obtained should be charged as a cost to the project under consideration.

D) if one of the assets to be used by a potential project is already owned by the firm but is not being used, then any costs associated with that asset is a sunk cost and should be ignored.

E) in a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to an upward bias in the npv.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sylvester Media is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required. What is the difference in the expected NPV if the inflation adjustment is made vs. if it is not made?

A) $13,286

B) $13,985

C) $14,721

D) $15,457

E) $16,230

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A firm that bases its capital budgeting decisions on either NPV or IRR will be more likely to accept a given project if it uses accelerated depreciation than if it uses straight-line depreciation, other things being equal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Garden-Grow Products is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.)

A) $23,852

B) $25,045

C) $26,297

D) $27,612

E) $28,993

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

DeVault Services recently hired you as a consultant to help with its capital budgeting process. The company is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

A) $15,740

B) $16,569

C) $17,441

D) $18,359

E) $19,325

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Erickson Inc. is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%. What is the project's coefficient of variation?

A) 1.20

B) 1.26

C) 1.32

D) 1.39

E) 1.46

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wansley Enterprises is considering a new project. The company has a beta of 1.0, and its sales and profits are positively correlated with the overall economy. The company estimates that the proposed new project would have a higher standard deviation and coefficient of variation than an average company project. Also, the new project's sales would be countercyclical in the sense that they would be high when the overall economy is down and low when the overall economy is strong. On the basis of this information, which of the following statements is CORRECT?

A) the proposed new project would increase the firm's corporate risk.

B) the proposed new project would increase the firm's market risk.

C) the proposed new project would not affect the firm's risk at all.

D) the proposed new project would have less stand-alone risk than the firm's typical project.

E) the proposed new project would have more stand-alone risk than the firm's typical project.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of variation, calculated as the standard deviation of expected returns divided by the expected return, is a standardized measure of the risk per unit of expected return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To increase productive capacity, a company is considering a proposed new plant. Which of the following statements is CORRECT?

A) since depreciation is a non-cash expense, the firm does not need to deal with depreciation when calculating the operating cash flows.

B) when estimating the project's operating cash flows, it is important to include both opportunity costs and sunk costs, but the firm should ignore the cash flow effects of externalities since they are accounted for in the discounting process.

C) capital budgeting decisions should be based on before-tax cash flows.

D) the cost of capital used to discount cash flows in a capital budgeting analysis should be calculated on a before-tax basis.

E) in calculating the project's operating cash flows, the firm should not deduct financing costs such as interest expense, because financing costs are accounted for by discounting at the cost of capital. if interest were deducted when estimating cash flows, this would, in effect, "double count" it.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McPherson Company must purchase a new milling machine. The purchase price is $50,000, including installation. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $8,878

B) $9,345

C) $9,837

D) $10,355

E) $10,900

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In your first job with TBL Inc. your task is to consider a new project whose data are shown below. What is the project's Year 1 cash flow?

A) $8,903

B) $9,179

C) $9,463

D) $9,746

E) $10,039

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitestone Products is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 cash flow?

A) $11,904

B) $12,531

C) $13,190

D) $13,850

E) $14,542

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax life, after which it will be worthless, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's Year 1 cash flow?

A) $28,115

B) $28,836

C) $29,575

D) $30,333

E) $31,092

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

We can identify the cash costs and cash inflows to a company that will result from a project. These could be called "direct inflows and outflows," and the net difference is the direct net cash flow. If there are other costs and benefits that do not flow from or to the firm, but to other parties, these are called externalities, and they need not be considered as a part of the capital budgeting analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 78

Related Exams