A) 1.15% decrease

B) 1.20% increase

C) 1.53% increase

D) 2.43% decrease

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond currently has a price of $1,050.The yield on the bond is 6.00%.If the yield increases 25 basis points,the price of the bond will go down to $1,030.The duration of this bond is ____ years.

A) 7.46

B) 8.08

C) 9.02

D) 10.11

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Convexity implies that duration predictions _______. I.underestimate the % increase in bond price when the yield falls II.underestimate the % decrease in bond price when the yield rises III.overestimates the % increase in bond price when the yield falls IV.overestimates the % decrease in bond price when the yield rises

A) I and III only

B) II and IV only

C) I and IV only

D) II and III only

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have an investment horizon of 6 years.You choose to hold a bond with a duration of 6 years and continue to match your investment horizon and duration throughout your holding period.Your realized rate of return will be the same as the promised yield on the bond if I.interest rates increase II.interest rates stay the same III.interest rates fall

A) I only

B) II only

C) I and II only

D) I, II and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All other things equal,which of the following has the longest duration?

A) A 30 year bond with a 10% coupon

B) A 20 year bond with a 9% coupon

C) A 20 year bond with a 7% coupon

D) A 10 year zero coupon bond

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Convexity of a bond is ___________.

A) the same as horizon analysis

B) the rate of change of the price-yield curve divided by bond price

C) a measure of bond duration

D) none of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When interest rates increase,the duration of a 20-year bond selling at a premium _________.

A) increases

B) decreases

C) remains the same

D) increases at first, then declines

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 20 year maturity corporate bond has a 6.5% coupon rate (the coupons are paid annually) .The bond currently sells for $925.50.A bond market analyst forecasts that in five years yield rates on these bonds will be at 7.0%.You believe that you will be able to reinvest the coupons earned over the next five years at a 6% rate of return.What is your expected annual compound rate of return if you plan on selling the bond in five years?

A) 7.37%

B) 7.56%

C) 8.12%

D) 8.54%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

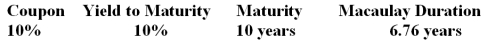

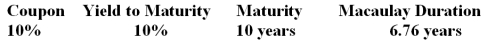

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:  -The modified duration for the Steel Pier bond is ______.

-The modified duration for the Steel Pier bond is ______.

A) 6.15 years

B) 5.95 years

C) 6.49 years

D) 9.09 years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:  -If the maturity of the bond was less than 10 years,the modified duration would be _____ compared to the original modified duration.

-If the maturity of the bond was less than 10 years,the modified duration would be _____ compared to the original modified duration.

A) larger

B) unchanged

C) smaller

D) There is not enough information to determine the direction of change

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a type of bond swap used in active portfolio management?

A) Inter-market spread swap

B) Substitution swap

C) Rate anticipation swap

D) Asset-liability swap

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banks and other financial institutions can best manage interest rate risk by _____________.

A) maximizing the duration of assets and minimizing the duration of liabilities

B) minimizing the duration of assets and maximizing the duration of liabilities

C) matching the durations of their assets and liabilities

D) matching the maturities of their assets and liabilities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The duration is independent of the coupon rate only for which one of the following?

A) Discount bonds

B) Premium bonds

C) Perpetuities

D) Short term bonds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the context of a bond portfolio,price risk and reinvestment rate risk exactly cancel out at a time horizon equal to ____.

A) the average bond maturity in the portfolio

B) the duration of the portfolio

C) the difference between the shortest duration and longest duration of the individual bonds in the portfolio

D) the average of the shortest duration and longest duration of the bonds in the portfolio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Target date immunization would primarily be of interest to _________.

A) banks

B) mutual funds

C) pension funds

D) individual investors

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio manager sells treasury bonds and buys corporate bonds because the spread between corporate and Treasury bond yields is higher than its historical average.This is an example of __________ swap.

A) a pure yield pick up

B) a rate anticipation

C) a substitution

D) an intermarket spread

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond has a maturity of 12 years,a duration of 9.5 years at a promised yield rate of 8%.What is the bond's modified duration?

A) 12 years

B) 11.1 years

C) 9.5 years

D) 8.8 years

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor who expects declining interest rates would maximize their capital gain by purchasing a bond that has a ___ coupon and a ___ term to maturity.

A) low; long

B) high; short

C) high; long

D) zero; long

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you choose a zero coupon bond with a maturity that matches your investment horizon which of the following statements is/are correct? I.You will have no interest rate risk on this bond. II.Absent default,you can be sure you will earn the promised yield rate. III.The duration of your bond is less than the time to your investment horizon.

A) I only

B) I and II only

C) II and III only

D) I, II and III

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investment returns a higher percentage of your money back sooner it will ______.

A) be less price volatile

B) have a higher credit rating

C) be less liquid

D) have a higher modified duration

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 85

Related Exams