A) operating: $108,000; investing: ($105,200) ; financing: ($60,000)

B) operating: $151,800; investing: ($84,200) ; financing: ($64,600)

C) operating: $122,200; investing: ($84,200) ; financing: ($35,000)

D) operating: $172,200; investing: ($109,200) ; financing: ($60,000)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

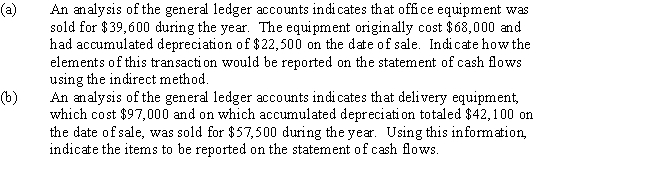

The following two scenarios are independent of one another.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be added to net income in calculating net cash flow from operating activities using the indirect method?

A) an increase in inventory

B) a decrease in accounts payable

C) preferred dividends declared and paid

D) a decrease in accounts receivable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A building with a book value of $54,000 is sold for $63,000 cash. Using the indirect method, this transaction should be shown on the statement of cash flows as follows:

A) an increase of $54,000 from investing activities

B) an increase of $63,000 from investing activities and a deduction from net income of $9,000

C) an increase of $9,000 from investing activities

D) an increase of $54,000 from investing activities and an addition to net income of $9,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A cash flow per share amount should be reported on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Increase in income taxes payable

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows prepared by the indirect method, the cash flows from operating activities section would include

A) receipts from the sale of investments

B) amortization of premium on bonds payable

C) payments for cash dividends

D) receipts from the issuance of common stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Cost of goods sold reported on the income statement was $155,000. The accounts payable balance increased $8,000, and the inventory balance increased by $21,000 over the year. Determine the amount of cash paid for merchandise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ten-year bond was issued at par for $250,000 cash. This transaction should be shown on a statement of cash flows under

A) investing activities

B) financing activities

C) noncash investing and financing activities

D) operating activities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last item on the statement of cash flows prior to the schedule of noncash investing and financing activities reports

A) the change in cash

B) cash at the end of the period

C) net cash flow from investing activities

D) net cash flow from financing activities

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question. -Exchange of land for common stock

A) Increase cash from operating activities

B) Decrease cash from operating activities

C) Increase cash from investing activities

D) Decrease cash from investing activities

E) Increase cash from financing activities

F) Decrease cash from financing activities

G) Noncash investing and financing activity

I) A) and G)

Correct Answer

verified

Correct Answer

verified

True/False

If land costing $145,000 was sold for $205,000, the $60,000 gain on the sale would be added to net income in the operating activities section of the statement of cash flows (prepared by the indirect method).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under GAAP, cash receipts from interest and dividends are classified as

A) financing activities

B) operating activities

C) investing activities

D) either financing or investing activities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flow per share is

A) required to be reported on the balance sheet

B) required to be reported on the income statement

C) required to be reported on the statement of cash flows

D) not required to be reported on any statement

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The net income reported on the income statement for the current year was $58,000. Depreciation recorded on fixed assets for the year was $24,000. In addition, equipment with an original cost of $130,000 and accumulated depreciation of $115,000 on the date of the sale, was sold for $20,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the cash flows from operating activities section of a statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from financing activities, as part of the statement of cash flows, would include any payments for dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales for the year were $600,000. Accounts receivable were $100,000 and $80,000 at the beginning and end of the year, respectively. Cash received from customers to be reported on the statement of cash flows using the direct method is

A) $700,000

B) $600,000

C) $580,000

D) $620,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is

A) all cash in the bank

B) cash from operations

C) cash from financing less cash used to purchase fixed assets to maintain productive capacity and cash used for dividends

D) cash flow from operations less cash used to purchase fixed assets to maintain productive capacity

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question. -Acquisition of treasury stock

A) Increase cash from operating activities

B) Decrease cash from operating activities

C) Increase cash from investing activities

D) Decrease cash from investing activities

E) Increase cash from financing activities

F) Decrease cash from financing activities

G) Noncash investing and financing activity

I) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows reports a firm's major sources of cash receipts and major uses of cash for a period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 195

Related Exams