B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating expense recorded from uncollectible receivables can be called all of the following except

A) accounts receivable

B) bad debt expense

C) doubtful accounts expense

D) uncollectible accounts expense

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The maturity value of a note receivable is always the same as its face value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Lowery Co. uses the direct write-off method of accounting for uncollectible accounts receivable. Lowery has a customer whose accounts receivable balance has been determined to likely be uncollectible. The entry to write off this account would be which of the following?

A) debit Allowance for Doubtful Accounts; credit Accounts Receivable

B) debit Sales; credit Accounts Receivable

C) debit Bad Debt Expense; credit Allowance for Doubtful Accounts

D) debit Bad Debt Expense; credit Accounts Receivable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

At the end of the current year, Accounts Receivable has a balance of $90,000; Allowance for Doubtful Accounts has a credit balance of $850; and sales for the year total $300,000. Bad debt expense is estimated at 2.5% of sales. Determine (a) the amount of the adjusting entry for uncollectible accounts; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and (c) the net realizable value of accounts receivable.

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables: Feb. 20 Received $1,000 from Andrew Warren and wrote off the remainder owed of $4,000 as uncollectible. May 10 Reinstated the account of Andrew Warren and received $4,000 cash in full payment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aging of a company's accounts receivable indicates that the estimate of uncollectible accounts totals $6,400. If Allowance for Doubtful Accounts has a $1,300 debit balance, the adjustment to record the bad debt expense for the period will require a

A) debit to Bad Debt Expense for $7,700

B) debit to Bad Debt Expense for $6,400

C) debit to Bad Debt expense for $5,100

D) credit to Allowance for Doubtful Accounts for $1,300

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

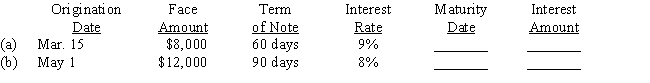

Determine the due date and amount of interest due at maturity on the following notes:

Correct Answer

verified

Correct Answer

verified

True/False

At the end of a period (before adjustment), Allowance for Doubtful Accounts has a debit balance of $500. Credit sales for the period total $800,000. If bad debt expense is estimated at 1% of credit sales, the amount of bad debt expense to be recorded in the adjusting entry is $8,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company accepts a note in settlement of a past due account, what is the effect on the accounting equation?

A) an increase in a liability and a decrease in an asset

B) an increase in an asset and a decrease in an asset

C) a decrease in an asset and a decrease in stockholders' equity (expense)

D) a decrease in a liability and an increase in stockholders' equity (revenue)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 60-day, 12% note for $7,000, dated April 15, is received from a customer on account. The face value of the note is

A) $6,860

B) $7,140

C) $7,840

D) $7,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Theta Company determines that a $6,300 account receivable from CorpCo is uncollectible and writes off the account using the direct write-off method on June 16. Journalize the entry to write off the account. You may omit posting references.

Correct Answer

verified

Correct Answer

verified

Essay

On the basis of the following data related to assets due within one year for Webb Co., prepare a partial balance sheet in good form at December 31. Show total current assets.

Correct Answer

verified

Correct Answer

verified

Essay

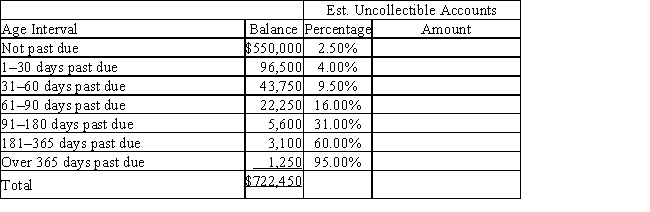

A partially completed aging of receivables schedule for Lindy Designs is shown below.

(a) Determine the amount estimated to be uncollectible by completing the aging of receivables schedule. Round calculations to the nearest dollar.  (b) If the Allowance for Doubtful Accounts has a credit balance of $9,700, record the adjusting entry for the bad debt expense for the year.

(c) If the Allowance for Doubtful Accounts has a debit balance of $9,700, record the adjusting entry for the bad debt expense for the year.

(b) If the Allowance for Doubtful Accounts has a credit balance of $9,700, record the adjusting entry for the bad debt expense for the year.

(c) If the Allowance for Doubtful Accounts has a debit balance of $9,700, record the adjusting entry for the bad debt expense for the year.

Correct Answer

verified

Correct Answer

verified

True/False

Both Accounts Receivable and Notes Receivable represent claims that are expected to be collected in cash.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The following journal entries would be used in one of the two methods of accounting for uncollectible receivables. Identify each.

(a)  (b)

(b)

Correct Answer

verified

Correct Answer

verified

True/False

Of the two methods of accounting for uncollectible receivables, the allowance method provides in advance for uncollectible receivables.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts has a credit balance of $500 at the end of the year (before adjustment) , and bad debt expense is estimated at 3% of credit sales. If credit sales are $300,000, the amount of the adjusting entry to record the estimated uncollectible accounts receivable is

A) $8,500

B) $9,500

C) $9,000

D) Cannot be determined

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

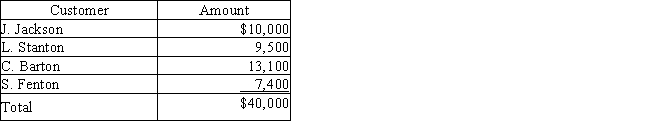

Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:

Required: (a) Journalize the write-offs for the current year under the direct write-off method.

(b) Journalize the write-offs for the current year under the allowance method. Also, joumalize the adjusting entry for uncollectible receivables assuming the company made of credit sales during the year and the industry average for uncollectible receivables is of credit sales.

(c) How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Required: (a) Journalize the write-offs for the current year under the direct write-off method.

(b) Journalize the write-offs for the current year under the allowance method. Also, joumalize the adjusting entry for uncollectible receivables assuming the company made of credit sales during the year and the industry average for uncollectible receivables is of credit sales.

(c) How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the direct write-off method of accounting for uncollectible receivables is used, what general ledger account is credited to write off a customer's account as uncollectible?

A) Bad Debt Expense

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) Interest Expense

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 186

Related Exams