B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business operated at 100% of capacity during its first month and incurred the following costs:  If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, what is the amount of the manufacturing margin that would be reported on the variable costing income statement?

If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, what is the amount of the manufacturing margin that would be reported on the variable costing income statement?

A) $104,000

B) $106,000

C) $140,000

D) not reported

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Presented below are the major categories or captions that would appear on an income statement prepared in the variable costing format: Contribution margin Fixed costs Income from operations Manufacturing margin Sales Variable cost of goods sold Variable selling and administrative expenses a Arrange the above captions in the proper order in accordance with the variable costing concept. b Which of the captions represents 1 the difference between sales and the total of all the variable costs and expenses and 2 the remaining amount of revenue available for fixed manufacturing costs, fixed expenses, and net income?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income under absorption costing will equal the amount of income under variable costing when units manufactured:

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On the variable costing income statement, variable selling and administrative expenses are deducted from manufacturing margin to yield contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management will use both variable and absorption costing in all of the following activities except:

A) controlling costs

B) product pricing

C) production planning

D) controlling inventory levels

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales totaled $800,000 for the year 80,000 units at $10.00 each and the planned sales totaled $799,500 78,000 units at $10.25 each, the effect of the quantity factor on the change in sales is:

A) $20,500 increase

B) $20,000 decrease

C) $20,500 decrease

D) $20,000 increase

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Essay

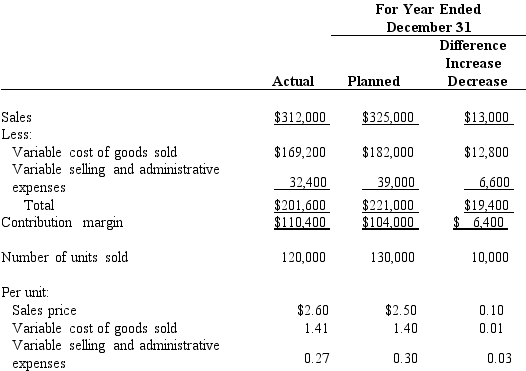

Based upon the following data taken from the records of Bruce Inc., prepare a contribution margin analysis report for the year ended December 31.

a.Absorption costing only

b.Variable costing only

c.Both absorption and variable costing

a.Absorption costing only

b.Variable costing only

c.Both absorption and variable costing

Correct Answer

verified

Correct Answer

verified

Essay

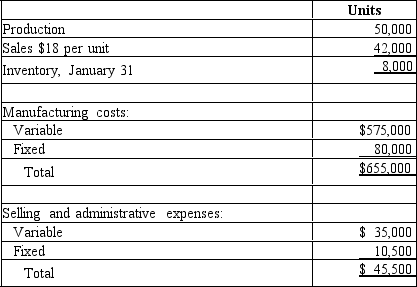

On January 1 of the current year, Townsend Co.commenced operations.It operated its plant at 100% of capacity during January.The following data summarized the results for January:

a Prepare an income statement using absorption costing.

b Prepare an income statement using variable costing.

a Prepare an income statement using absorption costing.

b Prepare an income statement using variable costing.

Correct Answer

verified

Correct Answer

verified

True/False

In variable costing, fixed costs do not become part of the cost of goods manufactured, but are considered an expense of the period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end equals the inventory at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable selling and administrative expenses totaled $120,000 for the year 80,000 units at $1.50 each and the planned variable selling and administrative expenses totaled $136,500 78,000 units at $1.75 each, the effect of the unit cost factor on the change in contribution margin is:

A) $19,500 decrease

B) $19,500 increase

C) $20,000 decrease

D) $20,000 increase

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under absorption costing, which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable and fixed factory overhead cost

D) variable and fixed selling and administrative expenses

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In evaluating the performance of salespersons, the salesperson with the highest level of sales should be evaluated as the best performer.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

A business operated at 100% of capacity during its first month and incurred the following costs:  If 75 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

If 75 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

A) $5,625

B) $5,250

C) $5,760

D) $6,210

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edna's Chocolates had planned to sell chocolate covered strawberries for $3.00 each.Due to various factors, the actual price was $2.75.Edna's was able to sell 1,000 more strawberries than the anticipated 4,000.What is 1 the quantity factor and 2 the price factor for sales?

A) 1 $3,000, 2 $1,250

B) 1 $3,000, 2 $3,000

C) 1 $1,250, 2 $3,000

D) 1 $4,000 2 $3,000

F) A) and D)

Correct Answer

verified

A

Correct Answer

verified

True/False

Contribution margin reporting and analysis is appropriate only for manufacturing firms, not for service firms.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Fixed costs are $50 per unit and variable costs are $125 per unit.Production was 130,000 units, while sales were 125,000 units.Determine a whether variable costing income from operations is less than or greater than absorption costing income from operations, and b the difference in variable costing and absorption costing income from operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable cost of goods sold totaled $80,000 for the year 16,000 units at $5.00 each and the planned variable cost of goods sold totaled $86,250 15,000 units at $5.75 each, the effect of the quantity factor on the change in contribution margin is:

A) $5,000 decrease

B) $5,000 increase

C) $5,750 increase

D) $5,750 decrease

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of product manufactured exceeded the quantity sold, income from operations reported under absorption costing will be larger than income from operations reported under variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 160

Related Exams