A) 8.72%

B) 9.08%

C) 9.44%

D) 9.82%

E) 10.22%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

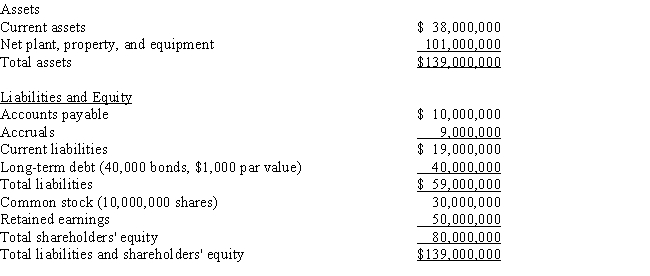

Collins Group

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to the data for the Collins Group. What is the best estimate of the after-tax cost of debt?

-Refer to the data for the Collins Group. What is the best estimate of the after-tax cost of debt?

A) 4.64%

B) 4.88%

C) 5.14%

D) 5.40%

E) 5.67%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The component costs of capital are market-determined variables in the sense that they are based on investors' required returns.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the assistant to the CFO of Johnstone Inc., you must estimate its cost of common equity. You have been provided with the following data: D0 = $0.80; P0 = $22.50; and gL = 8.00% (constant) . Based on the dividend growth model, what is the cost of common from reinvested earnings?

A) 10.69%

B) 11.25%

C) 11.84%

D) 12.43%

E) 13.05%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of debt is equal to one minus the marginal tax rate multiplied by the interest rate on new debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm J's earnings and stock price tend to move up and down with other firms in the S&P 500, while Firm F's earnings and stock price move counter cyclically with J and other S&P companies. Both J and F estimate their costs of equity using the CAPM, they have identical market values, their standard deviations of returns are identical, and they both finance only with common equity. Which of the following statements is CORRECT?

A) J and F should have identical WACCs because their risks as measured by the standard deviation of returns are identical.

B) If J and F merge, then the merged firm MW should have a WACC that is a simple average of J's and F's WACCs.

C) Without additional information, it is impossible to predict what the merged firm's WACC would be if J and F merged.

D) Since J and F move counter cyclically to one another, if they merged, the merged firm's WACC would be less than the simple average of the two firms' WACCs.

E) J should have the lower WACC because it is like most other companies, and investors like that fact.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

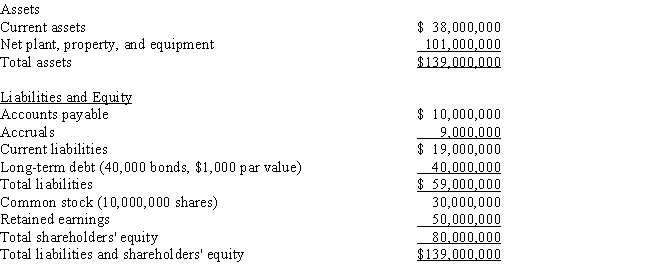

Collins Group

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to the data for the Collins Group. What is the best estimate of the firm's WACC?

-Refer to the data for the Collins Group. What is the best estimate of the firm's WACC?

A) 10.85%

B) 11.19%

C) 11.53%

D) 11.88%

E) 12.24%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Anderson Company has equal amounts of low-risk, average-risk, and high-risk projects. The firm's overall WACC is 12%. The CFO believes that this is the correct WACC for the company's average-risk projects, but that a lower rate should be used for lower-risk projects and a higher rate for higher-risk projects. The CEO disagrees, on the grounds that even though projects have different risks, the WACC used to evaluate each project should be the same because the company obtains capital for all projects from the same sources. If the CEO's position is accepted, what is likely to happen over time?

A) The company will take on too many low-risk projects and reject too many high-risk projects.

B) Things will generally even out over time, and, therefore, the firm's risk should remain constant over time.

C) The company's overall WACC should decrease over time because its stock price should be increasing.

D) The CEO's recommendation would maximize the firm's intrinsic value.

E) The company will take on too many high-risk projects and reject too many low-risk projects.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Granby Foods' (GF) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. The yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. The company has 10 million shares of stock, and the stock has a book value per share of $5.00. The current stock price is $20.00 per share, and stockholders' required rate of return, rs, is 12.25%. The company recently decided that its target capital structure should have 35% debt, with the balance being common equity. The tax rate is 40%. Calculate WACCs based on book, market, and target capital structures. What is the sum of these three WACCs?

A) 28.36%

B) 29.54%

C) 30.77%

D) 32.00%

E) 33.28%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: D1 = $1.45; P0 = $22.50; and gL = 6.50% (constant) . Based on the dividend growth approach, what is the cost of common from reinvested earnings?

A) 11.10%

B) 11.68%

C) 12.30%

D) 12.94%

E) 13.59%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal, an increase in a company's stock price will increase its marginal cost of reinvested earnings (not newly issued stock) , rs.

B) All else equal, an increase in a company's stock price will increase its marginal cost of new common equity, re.

C) Since the money is readily available, the after-tax cost of reinvested earnings (not newly issued stock) is usually much lower than the after-tax cost of debt.

D) If a company's tax rate increases but the YTM on its noncallable bonds remains the same, the after-tax cost of its debt will fall.

E) When calculating the cost of preferred stock, a company needs to adjust for taxes, because preferred stock dividends are deductible by the paying corporation.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Tierney Group has two divisions of equal size: an office furniture manufacturing division and a data processing division. Its CFO believes that stand-alone data processor companies typically have a WACC of 9%, while stand-alone furniture manufacturers typically have a 13% WACC. She also believes that the data processing and manufacturing divisions have the same risk as their typical peers. Consequently, she estimates that the composite, or corporate, WACC is 11%. A consultant has suggested using a 9% hurdle rate for the data processing division and a 13% hurdle rate for the manufacturing division. However, the CFO disagrees, and she has assigned an 11% WACC to all projects in both divisions. Which of the following statements is CORRECT?

A) The decision not to adjust for risk means, in effect, that it is favoring the data processing division. Therefore, that division is likely to become a larger part of the consolidated company over time.

B) The decision not to adjust for risk means that the company will accept too many projects in the manufacturing division and too few in the data processing division. This will lead to a reduction in the firm's intrinsic value over time.

C) The decision not to risk-adjust means that the company will accept too many projects in the data processing business and too few projects in the manufacturing business. This will lead to a reduction in its intrinsic value over time.

D) The decision not to risk-adjust means that the company will accept too many projects in the manufacturing business and too few projects in the data processing business. This may affect the firm's capital structure but it will not affect its intrinsic value.

E) While the decision to use just one WACC will result in its accepting more projects in the manufacturing division and fewer projects in its data processing division than if it followed the consultant's recommendation, this should not affect the firm's intrinsic value.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When estimating the cost of equity by use of the CAPM, three potential problems are (1) whether to use long-term or short-term rates for rRF, (2) whether or not the historical beta is the beta that investors use when evaluating the stock, and (3) how to measure the market risk premium, RPM. These problems leave us unsure of the true value of rs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

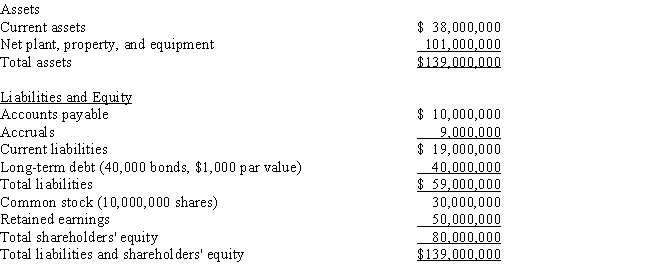

Collins Group

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to the data for the Collins Group. Which of the following is the best estimate for the weight of debt for use in calculating the firm's WACC?

-Refer to the data for the Collins Group. Which of the following is the best estimate for the weight of debt for use in calculating the firm's WACC?

A) 18.67%

B) 19.60%

C) 20.58%

D) 21.61%

E) 22.69%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The before-tax cost of debt, which is lower than the after-tax cost, is used as the component cost of debt for purposes of developing the firm's WACC.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the expected dividend growth rate is zero, then the cost of external equity capital raised by issuing new common stock (re) is equal to the cost of equity capital from retaining earnings (rs) divided by one minus the percentage flotation cost required to sell the new stock, (1 − F). If the expected growth rate is not zero, then the cost of external equity must be found using a different formula.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The dividend growth model is generally preferred by academics and financial executives over other models for estimating the cost of equity. This is because of the dividend growth model's logical appeal and also because accurate estimates for its key inputs, the dividend yield and the growth rate, are easy to obtain.

B) The bond-yield-plus-risk-premium approach to estimating the cost of equity may not always be accurate, but it has the advantage that its two key inputs, the firm's own cost of debt and its risk premium, can be found by using standardized and objective procedures.

C) Surveys indicate that the CAPM is the most widely used method for estimating the cost of equity. However, other methods are also used because CAPM estimates may be subject to error, and people like to use different methods as checks on one another. If all of the methods produce similar results, this increases the decision maker's confidence in the estimated cost of equity.

D) The dividend growth model model is preferred by academics and finance practitioners over other cost of capital models because it correctly recognizes that the expected return on a stock consists of a dividend yield plus an expected capital gains yield.

E) Although some methods used to estimate the cost of equity are subject to severe limitations, the CAPM is a simple, straightforward, and reliable model that consistently produces accurate cost of equity estimates. In particular, academics and corporate finance people generally agree that its key inputs⎯beta, the risk-free rate, and the market risk premium⎯can be estimated with little error.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

"Capital" is sometimes defined as funds supplied to a firm by investors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Avery Corporation's target capital structure is 35% debt, 10% preferred, and 55% common equity. The interest rate on new debt is 6.50%, the yield on the preferred is 6.00%, the cost of common from reinvested earnings is 11.25%, and the tax rate is 40%. The firm will not be issuing any new common stock. What is Avery's WACC?

A) 8.15%

B) 8.48%

C) 8.82%

D) 9.17%

E) 9.54%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The reason why reinvested earnings have a cost equal to rs is because investors think they can (i.e., expect to) earn rs on investments with the same risk as the firm's common stock, and if the firm does not think that it can earn rs on the earnings that it retains, it should distribute those earnings to its investors. Thus, the cost of reinvested earnings is based on the opportunity cost principle.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 92

Related Exams