A) $37.52

B) $39.40

C) $41.37

D) $43.44

E) $45.61

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

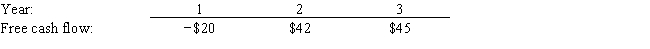

The free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions?

A) $586

B) $617

C) $648

D) $680

E) $714

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Judd Corporation has a weighted average cost of capital of 10.25%, and its value of operations is $57.50 million. Free cash flow is expected to grow at a constant rate of 6.00% per year. What is the expected year-end free cash flow, FCF1 in millions?

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is rs = 10.5%, and the expected constant growth rate is g = 6.4%. What is the stock's current price?

A) $17.39

B) $17.84

C) $18.29

D) $18.75

E) $19.22

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

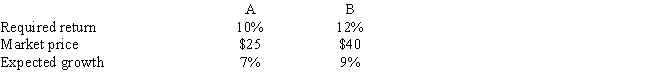

Stocks A and B have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) These two stocks must have the same dividend yield.

B) These two stocks should have the same expected return.

C) These two stocks must have the same expected capital gains yield.

D) These two stocks must have the same expected year-end dividend.

E) These two stocks should have the same price.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to the nonconstant growth model discussed in the textbook, the discount rate used to find the present value of the expected cash flows during the initial growth period is the same as the discount rate used to find the PVs of cash flows during the subsequent constant growth period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

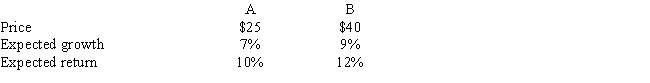

Stocks A and B have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) The two stocks could not be in equilibrium with the numbers given in the question.

B) A's expected dividend is $0.50.

C) B's expected dividend is $0.75.

D) A's expected dividend is $0.75 and B's expected dividend is $1.20.

E) The two stocks should have the same expected dividend.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Founders' shares are a type of classified stock where the shares are owned by the firm's founders, and they generally have more votes per share than the other classes of common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B have the same price and are in equilibrium, but Stock A has the higher required rate of return. Which of the following statements is CORRECT?

A) Stock B must have a higher dividend yield than Stock A.

B) Stock A must have a higher dividend yield than Stock B.

C) If Stock A has a higher dividend yield than Stock B, its expected capital gains yield must be lower than Stock B's.

D) Stock A must have both a higher dividend yield and a higher capital gains yield than Stock B.

E) If Stock A has a lower dividend yield than Stock B, its expected capital gains yield must be higher than Stock B's.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last dividend paid by Wilden Corporation was $1.55. The dividend growth rate is expected to be constant at 1.5% for 2 years, after which dividends are expected to grow at a rate of 8.0% forever. The firm's required return (rs) is 12.0%. What is the best estimate of the current stock price?

A) $37.05

B) $38.16

C) $39.30

D) $40.48

E) $41.70

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The required returns of Stocks X and Y are rX = 10% and rY = 12%. Which of the following statements is CORRECT?

A) If Stock Y and Stock X have the same dividend yield, then Stock Y must have a lower expected capital gains yield than Stock X.

B) If Stock X and Stock Y have the same current dividend and the same expected dividend growth rate, then Stock Y must sell for a higher price.

C) The stocks must sell for the same price.

D) Stock Y must have a higher dividend yield than Stock X.

E) If the market is in equilibrium, and if Stock Y has the lower expected dividend yield, then it must have the higher expected growth rate.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D0 = $1.75, g (which is constant) = 3.6%, and P0 = $32.00, what is the stock's expected total return for the coming year?

A) 8.37%

B) 8.59%

C) 8.81%

D) 9.03%

E) 9.27%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

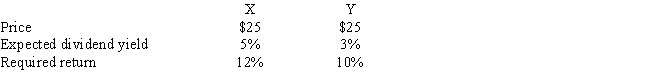

Stocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) Stock X pays a higher dividend per share than Stock Y.

B) One year from now, Stock X should have the higher price.

C) Stock Y has a lower expected growth rate than Stock X.

D) Stock Y has the higher expected capital gains yield.

E) Stock Y pays a higher dividend per share than Stock X.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The preferred stock of a given firm is generally less risky to investors than the same firm's common stock.

B) Corporations cannot buy the preferred stocks of other corporations.

C) Preferred dividends are not generally cumulative.

D) A big advantage of preferred stock is that dividends on preferred stocks are tax deductible by the issuing corporation.

E) Preferred stockholders have a priority over bondholders in the event of bankruptcy to the income, but not to the proceeds in a liquidation.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decker Tires' free cash flow was just FCF0 = $1.32. Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The WACC for this company 9.00%. Decker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding. What is the best estimate of the stock's current intrinsic price?

A) $31.59

B) $32.65

C) $33.75

D) $34.87

E) $35.99

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orwell Building Supplies' last dividend was $1.75. Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever. Its required return (rs) is 12%. What is the best estimate of the current stock price?

A) $41.58

B) $42.64

C) $43.71

D) $44.80

E) $45.92

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock is expected to pay a year-end dividend of $2.00, i.e., D1 = $2.00. The dividend is expected to decline at a rate of 5% a year forever (g = −5%) . If the company is in equilibrium and its expected and required rate of return is 15%, which of the following statements is CORRECT?

A) The company's dividend yield 5 years from now is expected to be 10%.

B) The constant growth model cannot be used because the growth rate is negative.

C) The company's expected capital gains yield is 5%.

D) The company's expected stock price at the beginning of next year is $9.50.

E) The company's current stock price is $20.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D1 = $1.25, g (which is constant) = 5.5%, and P0 = $44, what is the stock's expected total return for the coming year?

A) 7.54%

B) 7.73%

C) 7.93%

D) 8.13%

E) 8.34%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You, in analyzing a stock, find that its expected return exceeds its required return. This suggests that you think

A) the stock should be sold.

B) the stock is a good buy.

C) management is probably not trying to maximize the price per share.

D) dividends are not likely to be declared.

E) the stock is experiencing supernormal growth.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The free cash flow valuation model cannot be used unless a company doesn't pay dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 91

Related Exams