B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Megan Ross holds the following portfolio: What is the portfolio's beta?

A) 1.06

B) 1.17

C) 1.29

D) 1.42

E) 1.56

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If investors become more risk averse but rRF does not change, then the required rate of return on high-beta stocks will rise and the required return on low-beta stocks will decline, but the required return on an average-risk stock will not change.

B) An investor who holds just one stock will generally be exposed to more risk than an investor who holds a portfolio of stocks, assuming the stocks are all equally risky. Since the holder of the 1-stock portfolio is exposed to more risk, he or she can expect to earn a higher rate of return to compensate for the greater risk.

C) There is no reason to think that the slope of the yield curve would have any effect on the slope of the SML.

D) Assume that the required rate of return on the market, rM, is given and fixed at 10%. If the yield curve were upward sloping, then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

E) If Mutual Fund A held equal amounts of 100 stocks, each of which had a beta of 1.0, and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0, then the two mutual funds would both have betas of 1.0. Thus, they would be equally risky from an investor's standpoint, assuming the investor's only asset is one or the other of the mutual funds.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The $10.00 million mutual fund Henry manages has a beta of 1.05 and a 9.50% required return. The risk-free rate is 4.20%. Henry now receives another $5.00 million, which he invests in stocks with an average beta of 0.65. What is the required rate of return on the new portfolio? (Hint: You must first find the market risk premium, then find the new portfolio beta.)

A) 8.83%

B) 9.05%

C) 9.27%

D) 9.51%

E) 9.74%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charlie and Lucinda each have $50,000 invested in stock portfolios. Charlie's has a beta of 1.2, an expected return of 10.8%, and a standard deviation of 25%. Lucinda's has a beta of 0.8, an expected return of 9.2%, and a standard deviation that is also 25%. The correlation coefficient, r, between Charlie's and Lucinda's portfolios is zero. If Charlie and Lucinda marry and combine their portfolios, which of the following best describes their combined $100,000 portfolio?

A) The combined portfolio's beta will be equal to a simple weighted average of the betas of the two individual portfolios, 1.0; its expected return will be equal to a simple weighted average of the expected returns of the two individual portfolios, 10.0%; and its standard deviation will be less than the simple average of the two portfolios' standard deviations, 25%.

B) The combined portfolio's expected return will be greater than the simple weighted average of the expected returns of the two individual portfolios, 10.0%.

C) The combined portfolio's standard deviation will be greater than the simple average of the two portfolios' standard deviations, 25%.

D) The combined portfolio's standard deviation will be equal to a simple average of the two portfolios' standard deviations, 25%.

E) The combined portfolio's expected return will be less than the simple weighted average of the expected returns of the two individual portfolios, 10.0%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For a stock to be in equilibrium, two conditions are necessary: (1) The stock's market price must equal its intrinsic value as seen by the marginal investor and (2) the expected return as seen by the marginal investor must equal this investor's required return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul McLaren holds the following portfolio: Paul plans to sell Stock A and replace it with Stock E, which has a beta of 0.75. By how much will the portfolio beta change?

A) −0.190

B) −0.211

C) −0.234

D) −0.260

E) −0.286

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Assume that two investors each hold a portfolio, and that portfolio is their only asset. Investor A's portfolio has a beta of minus 2.0, while Investor B's portfolio has a beta of plus 2.0. Assuming that the unsystematic risks of the stocks in the two portfolios are the same, then the two investors face the same amount of risk. However, the holders of either portfolio could lower their risks, and by exactly the same amount, by adding some "normal" stocks with beta = 1.0.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the returns of two firms are negatively correlated, then one of them must have a negative beta.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In portfolio analysis, we often use ex post (historical) returns and standard deviations, despite the fact that we are really interested in ex ante (future) data.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin Ortner holds a $200,000 portfolio consisting of the following stocks: What is the portfolio's beta?

A) 0.938

B) 0.988

C) 1.037

D) 1.089

E) 1.143

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the required rate of return for Everest Expeditions Inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 1.00, and (5) its realized rate of return has averaged 15.0% over the last 5 years.

A) 10.29%

B) 10.83%

C) 11.40%

D) 12.00%

E) 12.60%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the Capital Asset Pricing Model, investors are primarily concerned with portfolio risk, not the risks of individual stocks held in isolation. Thus, the relevant risk of a stock is the stock's contribution to the riskiness of a well-diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

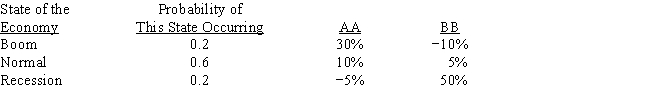

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational, risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE?

A) Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" or "expected future" beta.

B) The beta of an "average stock," or "the market," can change over time, sometimes drastically.

C) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

D) All of the statements above are true.

E) The fact that a security or project may not have a past history that can be used as the basis for calculating beta.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If you were restricted to investing in publicly traded common stocks, yet you wanted to minimize the riskiness of your portfolio as measured by its beta, then according to the CAPM theory you should invest an equal amount of money in each stock in the market. That is, if there were 10,000 traded stocks in the world, the least risky possible portfolio would include some shares of each one.

B) If you formed a portfolio that consisted of all stocks with betas less than 1.0, which is about half of all stocks, the portfolio would itself have a beta coefficient that is equal to the weighted average beta of the stocks in the portfolio, and that portfolio would have less risk than a portfolio that consisted of all stocks in the market.

C) Market risk can be eliminated by forming a large portfolio, and if some Treasury bonds are held in the portfolio, the portfolio can be made to be completely riskless.

D) A portfolio that consists of all stocks in the market would have a required return that is equal to the riskless rate.

E) If you add enough randomly selected stocks to a portfolio, you can completely eliminate all of the market risk from the portfolio.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

We would almost always find that the beta of a diversified portfolio is less stable over time than the beta of a single security.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In historical data, we see that investments with the highest average annual returns also tend to have the highest standard deviations of annual returns. This observation supports the notion that there is a positive correlation between risk and return. Which of the following answers correctly ranks investments from highest to lowest risk (and return) , where the security with the highest risk is shown first, the one with the lowest risk last?

A) Large-company stocks, small-company stocks, long-term corporate bonds, U.S. Treasury bills, long-term government bonds.

B) Small-company stocks, large-company stocks, long-term corporate bonds, long-term government bonds, U.S. Treasury bills.

C) U.S. Treasury bills, long-term government bonds, long-term corporate bonds, small-company stocks, large-company stocks.

D) Large-company stocks, small-company stocks, long-term corporate bonds, long-term government bonds, U.S. Treasury bills.

E) Small-company stocks, long-term corporate bonds, large-company stocks, long-term government bonds, U.S. Treasury bills.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freedman Flowers' stock has a 50% chance of producing a 25% return, a 30% chance of producing a 10% return, and a 20% chance of producing a −28% return. What is the firm's expected rate of return?

A) 9.41%

B) 9.65%

C) 9.90%

D) 10.15%

E) 10.40%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

We would generally find that the beta of a single security is more stable over time than the beta of a diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 146

Related Exams