A) Company Heidee has a lower times interest earned (TIE) ratio.

B) Company Heidee has a lower equity multiplier.

C) Company Heidee has more net income.

D) Company Heidee pays more in taxes.

E) Company Heidee has a lower ROE.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal, increasing the debt ratio will increase the ROA.

B) The use of debt financing will tend to lower the basic earning power ratio, other things held constant.

C) A firm that employs financial leverage will have a higher equity multiplier than an otherwise identical firm that has no debt in its capital structure.

D) If two firms have identical sales, interest rates paid, operating costs, and assets, but differ in the way they are financed, the firm with less debt will generally have the higher expected ROE.

E) Holding bonds is better than holding stock for investors because income from bonds is taxed on a more favorable basis than income from stock.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average, but its profit margin and debt ratio are both below the industry average. Which of the following statements is CORRECT?

A) Its total assets turnover must equal the industry average.

B) Its total assets turnover must be above the industry average.

C) Its return on assets must equal the industry average.

D) Its TIE ratio must be below the industry average.

E) Its total assets turnover must be below the industry average.

G) B) and E)

Correct Answer

verified

B

Correct Answer

verified

True/False

Significant variations in accounting methods among firms make meaningful ratio comparisons between firms more difficult than if all firms used similar accounting methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aziz Industries has sales of $100,000 and accounts receivable of $11,500, and it gives its customers 30 days to pay. The industry average DSO is 27 days, based on a 365-day year. If the company changes its credit and collection policy sufficiently to cause its DSO to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant?

A) $267.34

B) $281.41

C) $296.22

D) $311.81

E) $328.22

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

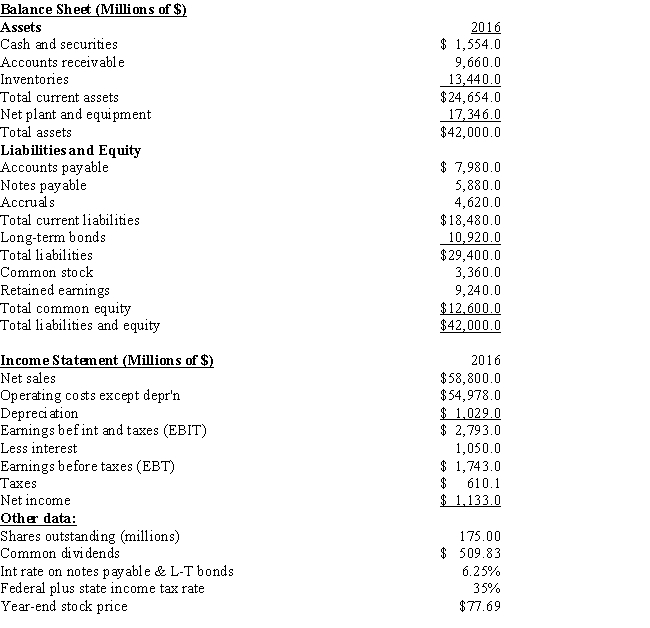

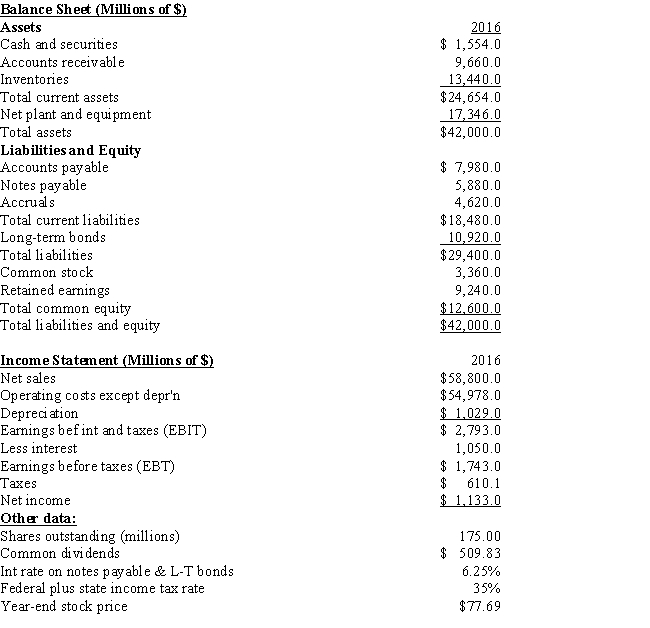

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's profit margin?

-Refer to the data for Pettijohn Inc. What is the firm's profit margin?

A) 1.40%

B) 1.56%

C) 1.73%

D) 1.93%

E) 2.12%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cavendish Company recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. This action had no effect on the company's total assets or operating income. Which of the following effects would occur as a result of this action?

A) The company's debt ratio increased.

B) The company's current ratio increased.

C) The company's times interest earned ratio decreased.

D) The company's basic earning power ratio increased.

E) The company's equity multiplier increased.

G) None of the above

Correct Answer

verified

B

Correct Answer

verified

True/False

Suppose firms follow similar financing policies, face similar risks, have equal access to capital, and operate in competitive product and capital markets. Under these conditions, then firms that have high profit margins will tend to have high asset turnover ratios, and firms with low profit margins will tend to have low turnover ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's EPS?

-Refer to the data for Pettijohn Inc. What is the firm's EPS?

A) $5.84

B) $6.15

C) $6.47

D) $6.80

E) $7.14

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A decline in a firm's inventory turnover ratio suggests that it is managing its inventory more efficiently and also that its liquidity position is improving, i.e., it is becoming more liquid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harper Corp.'s sales last year were $395,000, and its year-end receivables were $42,500. Harper sells on terms that call for customers to pay 30 days after the purchase, but many delay payment beyond Day 30. On average, how many days late do customers pay? Base your answer on this equation: DSO − Allowed credit period = Average days late, and use a 365-day year when calculating the DSO.

A) 7.95

B) 8.37

C) 8.81

D) 9.27

E) 9.74

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding will decline.

B) If a security analyst saw that a firm's days' sales outstanding (DSO) was higher than the industry average and was also increasing and trending still higher, this would be interpreted as a sign of strength.

C) If a firm increases its sales while holding its accounts receivable constant, then, other things held constant, its days' sales outstanding (DSO) will increase.

D) There is no relationship between the days' sales outstanding (DSO) and the average collection period (ACP) . These ratios measure entirely different things.

E) A reduction in accounts receivable would have no effect on the current ratio, but it would lead to an increase in the quick ratio.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Determining whether a firm's financial position is improving or deteriorating requires analyzing more than the ratios for a given year. Trend analysis is one method of measuring changes in a firm's performance over time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which of the following actions would increase its quick ratio?

A) Issue new common stock and use the proceeds to acquire additional fixed assets.

B) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

C) Issue new common stock and use the proceeds to increase inventories.

D) Speed up the collection of receivables and use the cash generated to increase inventories.

E) Use some of its cash to purchase additional inventories.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonner Corp.'s sales last year were $415,000, and its year-end total assets were $355,000. The average firm in the industry has a total assets turnover ratio (TATO) of 2.4. Bonner's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales. By how much must the assets be reduced to bring the TATO to the industry average, holding sales constant?

A) $164,330

B) $172,979

C) $182,083

D) $191,188

E) $200,747

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Central Chemicals had sales of $205,000, assets of $127,500, a profit margin of 5.3%, and an equity multiplier of 1.2. The CFO believes that the company could reduce its assets by $21,000 without affecting either sales or costs. Had it reduced its assets in this amount, and had the debt-to-assets ratio, sales, and costs remained constant, by how much would the ROE have changed?

A) 1.81%

B) 2.02%

C) 2.22%

D) 2.44%

E) 2.68%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arshadi Corp.'s sales last year were $52,000, and its total assets were $22,000. What was its total assets turnover ratio (TATO) ?

A) 2.03

B) 2.13

C) 2.25

D) 2.36

E) 2.48

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which of the following actions would increase its current ratio?

A) Use cash to increase inventory holdings.

B) Reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment.

C) Use cash to repurchase some of the company's own stock.

D) Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.

E) Issue new stock and then use some of the proceeds to purchase additional inventory and hold the remainder as cash.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stewart Inc.'s latest EPS was $3.50, its book value per share was $22.75, it had 215,000 shares outstanding, and its debt-to-assets ratio was 46%. How much debt was outstanding?

A) $3,393,738

B) $3,572,356

C) $3,760,375

D) $3,958,289

E) $4,166,620

G) C) and E)

Correct Answer

verified

E

Correct Answer

verified

Showing 1 - 20 of 104

Related Exams