A) 16.05%

B) 16.90%

C) 17.74%

D) 18.63%

E) 19.56%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

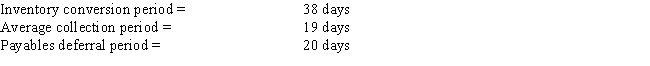

Fireside Inc. has the following data. What is the firm's cash conversion cycle?

A) 33 days

B) 37 days

C) 41 days

D) 45 days

E) 49 days

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The twin goals of inventory management are (1) to ensure that the inventories needed to sustain operations are available, but (2) to hold the costs of ordering and carrying inventories to the lowest possible level.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regular monthly cash budget will be misleading. The problem can be corrected by using a daily cash budget.

B) Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales.

C) If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60.

D) If a firm sells on terms of net 90, and if its sales are highly seasonal, with 80% of its sales in September, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August.

E) Depreciation is included in the estimate of cash flows (Cash flow = Net income = Depreciation) ; hence depreciation is set forth on a separate line in the cash budget.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For a firm that makes heavy use of net float, being able to forecast collections and disbursement check clearings is essential.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In managing a firm's accounts receivable, it is possible to increase credit sales per day yet still keep accounts receivable fairly steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently.

B) Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales.

C) Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

D) Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio.

E) A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A line of credit can be either a formal or an informal agreement between a borrower and a bank regarding the maximum amount of credit the bank will extend to the borrower during some future period, assuming the borrower maintains its financial strength.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fairweather Corporation purchases merchandise on terms of 2/15, net 40, and its gross purchases (i.e., purchases before taking off the discount) are $800,000 per year. What is the maximum dollar amount of costly trade credit the firm could get, assuming it abides by the supplier's credit terms? (Assume a 365-day year.)

A) $53,699

B) $56,384

C) $59,203

D) $62,163

E) $65,271

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit for a firm that buys on terms of 2/10 net 30 is lower (other things held constant) if the firm plans to pay in 40 days than in 30 days.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm constructing a new manufacturing plant and financing it with short-term loans, which are scheduled to be converted to first mortgage bonds when the plant is completed, would want to separate the construction loan from its current liabilities associated with working capital when calculating net working capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has a large percentage of accounts over 30 days old, this is proof positive that its receivables manager is not doing a good job.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monar Inc.'s CFO would like to decrease its cash conversion cycle by 10 days (based on a 365 day year) . The company carries average inventory of $750,000. Its annual sales are $10 million, its cost of goods sold is 75% of annual sales, and its average collection period is twice as long as its inventory conversion period. The firm buys on terms of net 30 days, and it pays on time. The CFO believes he can reduce the average inventory to $647,260 with no effect on sales. By how much must the firm also reduce its accounts receivable to meet its goal in the reduction of the cash conversion cycle?

A) $123,630

B) $130,137

C) $136,986

D) $143,836

E) $151,027

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Determining a firm's optimal investment in working capital and deciding how that investment should be financed are critical to working capital management.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

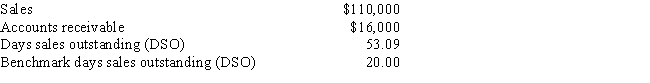

Data on Nathan Enterprises for the most recent year are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average. If this were done, by how much would receivables decline? Use a 365-day year.

A) $8,078

B) $8,975

C) $9,973

D) $10,970

E) $12,067

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is

A) used to identify inventory safety stocks.

B) used to slow down the collection of checks our firm writes.

C) used to speed up the collection of checks received.

D) used primarily by firms where currency is used frequently in transactions, such as fast food restaurants, and less frequently by firms that receive payments as checks.

E) used to protect cash, i.e., to keep it from being stolen.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Freeman Builders, Inc. buys on terms of 2/15, net 30. It does not take discounts, and it typically pays 60 days after the invoice date. Net purchases amount to $720,000 per year. What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 10.86%

B) 12.07%

C) 13.41%

D) 14.90%

E) 16.55%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

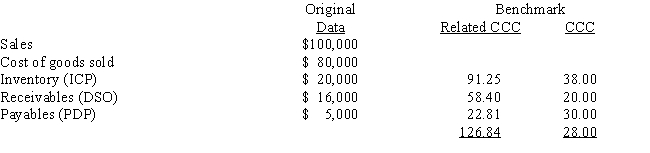

Multiple Choice

Fontana Painting had the following data for the most recent year (in millions) . The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold. Fontana finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased?

A) 1,901

B) 2,092

C) 2,301

D) 2,531

E) 2,784

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items should a company report directly in its monthly cash budget?

A) Cash proceeds from selling one of its divisions.

B) Accrued interest on zero coupon bonds that it issued.

C) New shares issued in a stock split.

D) New shares issued in a stock dividend.

E) Its monthly depreciation expense.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's suppliers stop offering cash discounts, then its use of trade credit is more likely to increase than to decrease, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget and the capital budget are handled separately, and although they are both important, they are developed completely independently of one another.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 138

Related Exams