A) 34.0

B) 37.4

C) 41.2

D) 45.3

E) 49.8

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most consistent with efficient inventory management? The firm has a

A) low incidence of production schedule disruptions.

B) below average total assets turnover ratio.

C) relatively high current ratio.

D) relatively low DSO.

E) below average inventory turnover ratio.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Net working capital, defined as current assets minus the sum of payables and accruals, is equal to the current ratio minus the quick ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive current operating asset financing strategy because of the inherent risks of using short-term financing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The overriding goal of inventory management is to ensure that the firm never suffers a stock-out, i.e., never runs out of an inventory item.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardwig Inc. Hardwig Inc. is considering whether to pursue a restricted or relaxed current asset investment policy. The firm's annual sales are expected to total $3,600,000, its fixed assets turnover ratio equals 4.0, and its debt and common equity are each 50% of total assets. EBIT is $150,000, the interest rate on the firm's debt is 10%, and the tax rate is 40%. If the company follows a restricted policy, its total assets turnover will be 2.5. Under a relaxed policy its total assets turnover will be 2.2. -Refer to the data for Hardwig Inc. If the firm adopts a restricted policy, how much lower would its interest expense be than under the relaxed policy?

A) $8,418

B) $8,861

C) $9,327

D) $9,818

E) $10,309

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sells on terms of 2/10 net 30 days, and its DSO is 28 days, then the fact that the 28-day DSO is less than the 30-day credit period tells us that the credit department is functioning efficiently and there are no past-due accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a zero-growth firm, it is possible to increase the percentage of sales that are made on credit and still keep accounts receivable at their current level, provided the firm can shorten the length of its collection period sufficiently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, which of the following would tend to reduce the cash conversion cycle?

A) Place larger orders for raw materials to take advantage of price breaks.

B) Take all cash discounts that are offered.

C) Continue to take all cash discounts that are offered and pay on the net date.

D) Offer longer payment terms to customers.

E) Carry a constant amount of receivables as sales decline.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardwig Inc. Hardwig Inc. is considering whether to pursue a restricted or relaxed current asset investment policy. The firm's annual sales are expected to total $3,600,000, its fixed assets turnover ratio equals 4.0, and its debt and common equity are each 50% of total assets. EBIT is $150,000, the interest rate on the firm's debt is 10%, and the tax rate is 40%. If the company follows a restricted policy, its total assets turnover will be 2.5. Under a relaxed policy its total assets turnover will be 2.2. -Refer to the data for Hardwig, Inc. What's the difference in the projected ROEs under the restricted and relaxed policies?

A) 1.20%

B) 1.50%

C) 1.80%

D) 2.16%

E) 2.59%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A revolving credit agreement is a formal line of credit. The firm must generally pay a fee on the unused balance of the committed funds to compensate the bank for the commitment to extend those funds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanders Enterprises arranged a revolving credit agreement of $9,000,000 with a group of banks. The firm paid an annual commitment fee of 0.5% of the unused balance of the loan commitment. On the used portion of the revolver, it paid 1.5% above prime for the funds actually borrowed on a simple interest basis. The prime rate was 3.25% during the year. If the firm borrowed $6,000,000 immediately after the agreement was signed and repaid the loan at the end of one year, what was the total dollar annual cost of the revolver?

A) $285,000

B) $300,000

C) $315,000

D) $330,750

E) $347,288

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A conservative financing policy is one where the firm finances part of its fixed assets with short-term capital and all of its net working capital with short-term funds.

B) If a company receives trade credit under terms of 2/10 net 30, this implies that the company has 10 days of free trade credit.

C) One cannot tell if a firm uses a current asset financing policy that matches maturities, is conservative, or is aggressive without an examination of its cash budget.

D) If a firm has a relatively aggressive current asset financing policy vis-á-vis other firms in its industry, then its current ratio will probably be relatively high.

E) Accruals are an expensive but commonly used way to finance working capital.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms generally choose to finance temporary current operating assets with short-term debt because

A) short-term interest rates have traditionally been more stable than long-term interest rates.

B) a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term.

C) the yield curve is normally downward sloping.

D) short-term debt has a higher cost than equity capital.

E) matching the maturities of assets and liabilities reduces risk under some circumstances, and also because short-term debt is often less expensive than long-term capital.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The longer its customers normally hold inventory, the longer the credit period supplier firms normally offer. Still, suppliers have some flexibility in the credit terms they offer. If a supplier lengthens the credit period offered, this will shorten the customer's cash conversion cycle but lengthen the supplier firm's own CCC.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Safety Window and Door Co. buys on terms of 2/15, net 60 days. It does not take discounts, and it typically pays on time, 60 days after the invoice date. Net purchases amount to $450,000 per year. On average, how much "free" trade credit does the firm receive during the year? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $18,493

B) $19,418

C) $20,389

D) $21,408

E) $22,479

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Depreciation.

B) Cumulative cash.

C) Repurchases of common stock.

D) Payment for plant construction.

E) Payments lags.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As a rule, managers should try to always use the free component of trade credit but should use the costly component only if the cost of this credit is lower than the cost of credit from other sources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

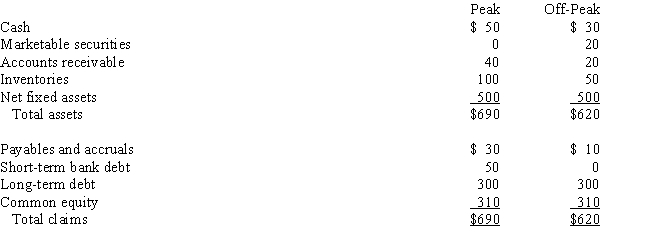

Summary balance sheet data for Greener Gardens Co. is shown below (in thousands of dollars) . The company is in a highly seasonal business, and the data show its assets and liabilities at peak and off-peak seasons: From this data we may conclude that

A) Greener Gardens' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

B) Greener Gardens follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital.

C) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

D) Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Greener Gardens' current asset financing policy calls for exactly matching asset and liability maturities.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 138

Related Exams