A) 31 days

B) 34 days

C) 37 days

D) 41 days

E) 45 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Textbooks Inc. buys on terms of 2/15, net 50 days. It does not take discounts, and it typically pays on time, 50 days after the invoice date. Net purchases amount to $450,000 per year. On average, what is the dollar amount of costly trade credit (total credit − free credit) the firm receives during the year? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $43,151

B) $45,308

C) $47,574

D) $49,952

E) $52,450

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Noddings Inc. needs to raise more capital because its business is booming. The company purchases supplies on terms of 1/10 net 20, and it currently takes the discount. One way of getting the needed funds would be to forgo the discount, and the firm's owner believes she could delay payment to 40 days without adverse effects. What would be the effective annual percentage cost of funds raised by this action? (Assume a 365-day year.)

A) 10.59%

B) 11.15%

C) 11.74%

D) 12.36%

E) 13.01%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buchholz Corporation follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. The firm's annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its EBIT is $35,000; the interest rate on its debt is 10%; and its tax rate is 40%. With a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales. What is the difference in the projected ROEs between the restricted and relaxed policies?

A) 4.25%

B) 4.73%

C) 5.25%

D) 5.78%

E) 6.35%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Because money has time value, a cash sale is always more profitable than a credit sale.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On average, a firm collects checks totaling $250,000 per day. It takes the firm approximately 4 days from the day the checks were mailed until they result in usable cash for the firm. Assume that (1) a lockbox system could be employed which would reduce the cash conversion procedure to 2 1/2 days and (2) the firm could invest any additional cash generated at 6% after taxes. The lockbox system would be a good buy if it costs $25,000 annually.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have widely dispersed manufacturing facilities.

B) have a large marketable securities portfolio and cash to protect.

C) receive payments in the form of currency, such as fast food restaurants, rather than in the form of checks.

D) have customers who operate in many different parts of the country.

E) have suppliers who operate in many different parts of the country.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Dimon Products' sales are expected to be $5 million this year, with 90% on credit and 10% for cash. Sales are expected to grow at a stable, steady rate of 10% annually in the future. Dimon's accounts receivable balance will remain constant at the current level, because the 10% cash sales can be used to support the 10% growth rate, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality payments are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm busy on terms of 2/10 net 30, it should pay as early as possible during the discount period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive strategy because of the inherent risks associated with using short-term financing.

B) If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt.

C) Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased.

D) If a company follows a policy of "matching maturities," this means that it matches its use of short-term debt with its use of long-term debt.

E) Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When deciding whether or not to take a cash discount, the cost of borrowing from a bank or other source should be compared to the cost of trade credit to determine if the cash discount should be taken.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blueroot Inc. is considering a change in its financing policy. Currently, it uses maximum trade credit by not taking discounts on its purchases. The standard industry credit terms offered by all its suppliers are 2/10 net 30 days, and the firm pays on time. The new CFO is considering borrowing from its bank, using short-term notes payable, and then taking discounts. The firm wants to determine the effect of this policy change on its net income. Its net purchases are $11,760 per day, using a 365-day year. The interest rate on the notes payable is 10%, and the tax rate is 40%. If the firm implements the plan, what is the expected change in net income?

A) $32,964

B) $34,699

C) $36,526

D) $38,448

E) $40,370

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

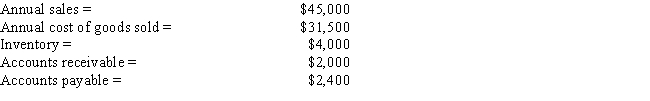

Marshall Inc. recently hired your consulting firm to improve the company's performance. It has been highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle?

A) 120.6 days

B) 126.9 days

C) 133.6 days

D) 140.6 days

E) 148.0 days

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

One of the advantages of short-term debt financing is that firms can obtain short-term credit more quickly than long-term credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Frosty Corporation has the following data, in thousands. Assuming a 365-day year, what is the firm's cash conversion cycle?

A) 25 days

B) 28 days

C) 31 days

D) 35 days

E) 38 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andrews Corporation buys on terms of 2/8, net 45 days, it does not take discounts, and it actually pays after 58 days. What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year.)

A) 14.34%

B) 15.10%

C) 15.89%

D) 16.69%

E) 17.52%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An informal line of credit and a revolving credit agreement are similar except that the line of credit creates a legal obligation for the bank and thus is a more reliable source of funds for the borrower.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will cause an increase in net working capital, other things held constant?

A) A cash dividend is declared and paid.

B) Merchandise is sold at a profit, but the sale is on credit.

C) Long-term bonds are retired with the proceeds of a preferred stock issue.

D) Missing inventory is written off against retained earnings.

E) Cash is used to buy marketable securities.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT commonly regarded as being a credit policy variable?

A) Collection policy.

B) Credit standards.

C) Cash discounts.

D) Payments deferral period.

E) Credit period.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 138

Related Exams