Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 32

True/False

The capital intensity ratio is the amount of assets required per dollar of sales and it has a major impact on a firm's capital requirements.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 33

True/False

Firms with high capital intensity ratios have found ways to lower this ratio permitting them to achieve a given level of growth with fewer assets and consequently less external capital. For example, just-in-time inventory systems, multiple shifts for labor, and outsourcing production are all feasible ways for firms to reduce their capital intensity ratios.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 34

Multiple Choice

Weber Interstate Paving Co. had $450 million of sales and $225 million of fixed assets last year, so its FA/Sales ratio was 50%. However, its fixed assets were used at only 65% of capacity. If the company had been able to sell off enough of its fixed assets at book value so that it was operating at full capacity, with sales held constant at $450 million, how much cash (in millions) would it have generated?

A) $74.81

B) $78.75

C) $82.69

D) $86.82

E) $91.16

F) A) and D)

G) C) and D)

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 35

Multiple Choice

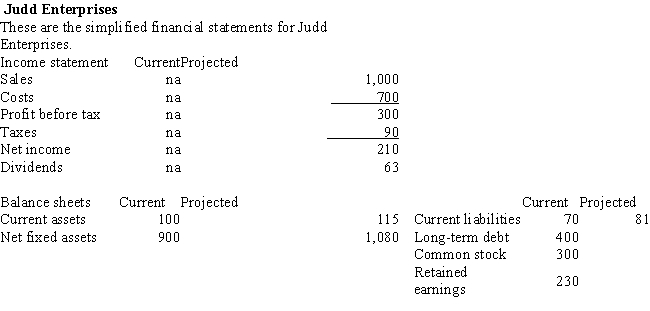

-Refer to the Judd Enterprises financial statements. If Judd does not plan on issuing new stock or additional long-term debt, then what is the additional net financing needed for the projected year?

-Refer to the Judd Enterprises financial statements. If Judd does not plan on issuing new stock or additional long-term debt, then what is the additional net financing needed for the projected year?

A) $30

B) $33

C) $37

D) $339

E) $396

F) C) and E)

G) A) and E)

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Question 36

Multiple Choice

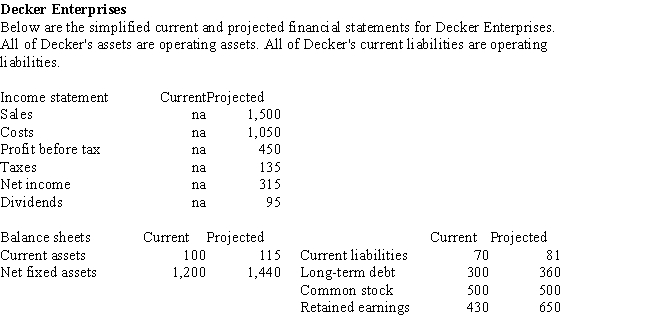

-Based on the projections, Decker will have

-Based on the projections, Decker will have

A) a financing surplus of $36

B) a financing deficit of $36

C) a financing surplus of $255

D) a financing deficit of $255

E) zero financing surplus or deficit

F) A) and B)

G) A) and C)

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 46 of 46

Related Exams