B) False

Correct Answer

verified

Correct Answer

verified

True/False

The two cardinal rules that financial analysts should follow to avoid capital budgeting errors are: (1) in the NPV equation, the numerator should use income calculated in accordance with generally accepted accounting principles, and (2) all incremental cash flows should be considered when making accept/reject decisions.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A sunk cost is any cost that was expended in the past but can be recovered if the firm decides not to go forward with the project.

B) A sunk cost is a cost that was incurred and expensed in the past and cannot be recovered if the firm decides not to go forward with the project.

C) Sunk costs were formerly hard to deal with but now that the NPV method is widely used, it is possible to simply include sunk costs in the cash flows and then calculate the PV of the project.

D) A good example of a sunk cost is a situation where Home Depot opens a new store, and that leads to a decline in sales of one of the firm's existing stores.

E) A sunk cost is any cost that must be expended in order to complete a project and bring it into operation.

G) B) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

If an investment project would make use of land which the firm currently owns, the project should be charged with the opportunity cost of the land.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Estimating project cash flows is generally the most important, but also the most difficult, step in the capital budgeting process. Methodology, such as the use of NPV versus IRR, is important, but less so than obtaining a reasonably accurate estimate of projects' cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm that bases its capital budgeting decisions on either NPV or IRR will be more likely to accept a given project if it uses accelerated depreciation than if it uses straight-line depreciation, other things being equal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of variation, calculated as the standard deviation of expected returns divided by the expected return, is a standardized measure of the risk per unit of expected return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If debt is to be used to finance a project, then when cash flows for a project are estimated, interest payments should be included in the analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although it is extremely difficult to make accurate forecasts of the revenues that a project will generate, projects' initial outlays and subsequent costs can be forecasted with great accuracy. This is especially true for large product development projects.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

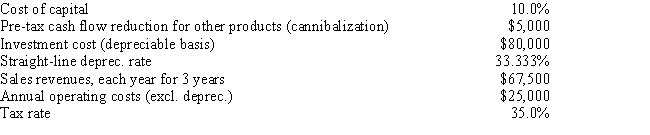

Weston Clothing Company is considering manufacturing a new style of shirt, whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other Weston's products and would reduce their pre-tax annual cash flows. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $3,636

B) $3,828

C) $4,019

D) $4,220

E) $4,431

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in net working capital should not be reflected in a capital budgeting cash flow analysis because capital budgeting relates to fixed assets, not working capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the NPV.

B) The existence of any type of "externality" will reduce the calculated NPV versus the NPV that would exist without the externality.

C) If one of the assets to be used by a potential project is already owned by the firm, and if that asset could be sold or leased to another firm if the new project were not undertaken, then the net after-tax proceeds that could be obtained should be charged as a cost to the project under consideration.

D) If one of the assets to be used by a potential project is already owned by the firm but is not being used, then any costs associated with that asset is a sunk cost and should be ignored.

E) In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to an upward bias in the NPV.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing risk. In evaluating this project, it would be reasonable for management to do which of the following?

A) Increase the estimated NPV of the project to reflect its greater risk.

B) Reject the project, since its acceptance would increase the firm's risk.

C) Ignore the risk differential if the project would amount to only a small fraction of the firm's total assets.

D) Increase the cost of capital used to evaluate the project to reflect its higher-than-average risk.

E) Increase the estimated IRR of the project to reflect its greater risk.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the total amount of depreciation that can be taken, assuming the asset is used for its full tax life, is greater.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

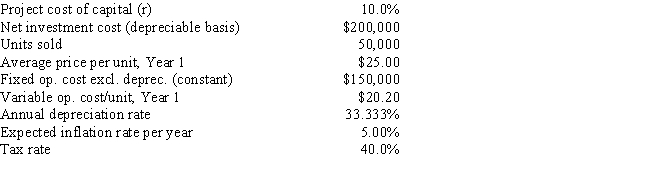

Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV?

A) $15,925

B) $16,764

C) $17,646

D) $18,528

E) $19,455

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product?

A) Revenues from an existing product would be lost as a result of customers switching to the new product.

B) Shipping and installation costs associated with a machine that would be used to produce the new product.

C) The cost of a study relating to the market for the new product that was completed last year. The results of this research were positive, and they led to the tentative decision to go ahead with the new product. The cost of the research was incurred and expensed for tax purposes last year.

D) It is learned that land the company owns and would use for the new project, if it is accepted, could be sold to another firm.

E) Using some of the firm's high-quality factory floor space that is currently unused to produce the proposed new product. This space could be used for other products if it is not used for the project under consideration.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Under current laws and regulations, corporations must use straight-line depreciation for all assets whose lives are 5 years or longer.

B) Corporations must use the same depreciation method (e.g., straight line or accelerated) for stockholder reporting and tax purposes.

C) Since depreciation is not a cash expense, it has no effect on cash flows and thus no effect on capital budgeting decisions.

D) Under accelerated depreciation, higher depreciation charges occur in the early years, and this reduces the early cash flows and thus lowers a project's projected NPV.

E) Using accelerated depreciation rather than straight line would normally have no effect on a project's total projected cash flows but it would affect the timing of the cash flows and thus the NPV.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Erickson Inc. is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%. What is the project's coefficient of variation?

A) 1.20

B) 1.26

C) 1.32

D) 1.39

E) 1.46

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

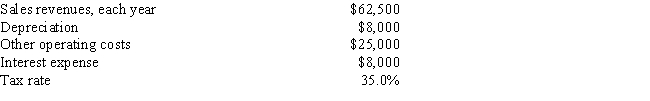

Taylor Inc., the company you work for, is considering a new project whose data are shown below. What is the project's Year 1 cash flow?

A) $25,816

B) $27,175

C) $28,534

D) $29,960

E) $31,458

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 78

Related Exams